Nvidia’s $100B OpenAI deal still in limbo as CFO says no final agreement yet

Nvidia’s $100 billion partnership with OpenAI is still stuck in draft form. That’s the message chief financial officer Colette Kress delivered on stage at the UBS Global Technology and AI Conference in Arizona on Tuesday, confirming that the letter of intent announced in September hasn’t crossed the finish line.

“Nvidia’s agreement with ChatGPT parent OpenAI to invest up to $100 billion in the startup is still not finalized,” Reuters reported, citing Nvidia CFO Colette Kress.

Nvidia’s $100B Bet on OpenAI Hits a Pause: CFO Says Talks Are Ongoing

The update lands at a tense moment for the AI sector, which is watching each big-ticket deal for signs of strain, speculation, or circular relationships between chip suppliers and the startups that rely on them. Nvidia and OpenAI sit at the center of that debate, and Kress’ comments gave investors a more transparent window into where talks stand.

The deal outlined in the fall called for Nvidia to invest up to $100 billion in OpenAI as part of an effort to deliver 10 gigawatts of AI infrastructure. That amount of compute would be large enough to support a leap in OpenAI’s long-term superintelligence ambitions. The scale is staggering—10 GW is comparable to the electricity needed to power more than 8 million U.S. homes.

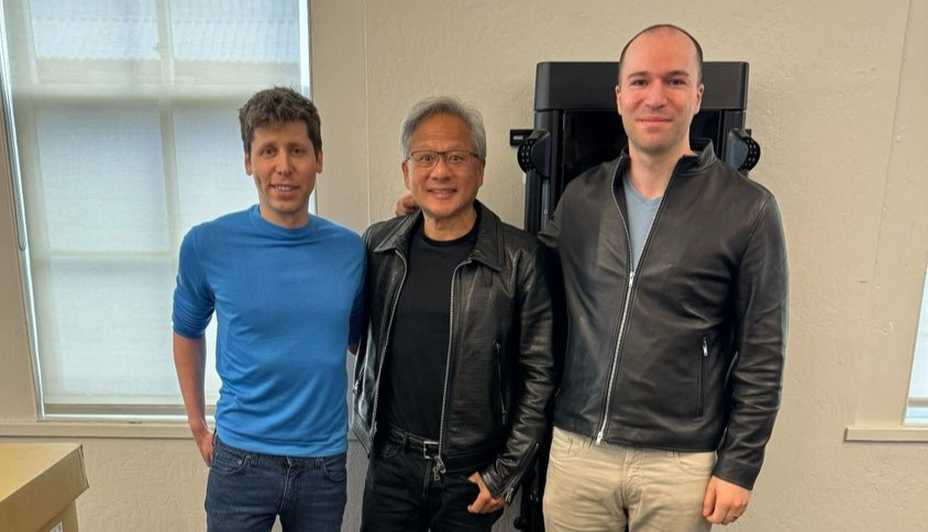

“NVIDIA and OpenAI have pushed each other for a decade, from the first DGX supercomputer to the breakthrough of ChatGPT,” said Jensen Huang, Nvidia’s founder and CEO. “This investment and infrastructure partnership mark the next leap forward — deploying 10 gigawatts to power the next era of intelligence,” the two companies said back in September.

“We still haven’t completed a definitive agreement, but we’re working with them,” Kress said, responding to questions about the partnership and its structure.

OpenAI has been one of Nvidia’s biggest customers since the launch of ChatGPT in late 2022, and demand has only intensified as the model line has grown and the company has pushed into new products. Nvidia already has $500 billion in bookings through 2026 for its current-generation chips, a figure that continues to draw attention for its size alone. Kress said none of the potential OpenAI supply from this pending agreement is included in that number. “That half a trillion doesn’t include any of the work that we’re doing right now on the next part of the agreement with OpenAI,” she added.

Nvidia shares climbed 2.6% following the remarks.

The chipmaker has kept its foot on the gas all year with a wave of deals involving AI startups, including equity investments in firms that buy Nvidia hardware at massive scale. That pattern has fed Wall Street’s growing debate over whether the sector is inflating itself, as the same dollars circulate between infrastructure suppliers and the companies building on top of them.

Last month, Nvidia said it would commit up to $10 billion to Anthropic, OpenAI’s closest rival in the race to build next-generation AI systems. Kress noted that arrangement, too, could push Nvidia’s bookings even higher.

For now, the industry is waiting to see whether Nvidia and OpenAI will finalize one of the largest agreements yet in the AI boom—and what it might signal about the next phase of the market’s momentum.