Top Startup and Tech Funding News – November 24, 2025

It’s Monday, November 24, 2025, and we’re back with the top startup and tech funding news stories across neobanking, AI financial automation, business rewards platforms, mortgage tech, wealth management infrastructure, asset-backed fintech, regtech, and D2C beauty. Momentum stretched across late-stage scale-ups and early-to-mid growth rounds, with capital flowing into companies building intelligent platforms that automate legacy workflows, unlock new financial access, and drive product innovation across both developed and emerging markets.

Revolut headlined the day with a landmark secondary share sale valuing the neobank at $75 billion, cementing its position as one of the world’s most valuable private tech companies. Model ML followed with a $75 million Series A to automate investment banking’s most manual workflows, while Pay.com.au raised A$53 million to accelerate its international expansion and scale its rewards-focused B2B payments infrastructure.

Workflow and trust infrastructure also gained traction. Tidalwave closed a $22 million Series A to reinvent mortgage approvals using agentic AI, Wealthy secured ₹130 crore to scale its advisory automation stack for Indian financial planners, and Barker launched with $3.5 million to transform asset-backed lending through insurer-guaranteed AI valuations. Meanwhile, STAMP and FinReach raised capital to streamline compliance and expand inclusive credit access, while FAE Beauty extended its omnichannel footprint with new funding in the D2C space.

Funding Highlights

- Revolut was valued at $75 billion in a secondary share sale led by global institutional investors.

- Model ML raised $75 million in Series A funding to automate investment banking workflows.

- Pay.com.au secured A$53 million (~$34 million USD) to scale its business rewards and payments platform.

- Tidalwave raised $22 million in Series A funding to accelerate AI mortgage automation.

- Wealthy raised ₹130 crore (~$15 million USD) in Series B funding to expand AI-driven wealth advisory tools.

- Barker secured $3.5 million in seed funding to enable insured AI valuations for asset-backed lending.

- FinReach raised ₹21.9 crore (~$2.6 million USD) in seed funding to expand collateral-free small business lending.

- STAMP raised $2 million in pre-seed capital to automate business compliance in Saudi Arabia.

- FAE Beauty raised ₹17 crore (~$2.1 million USD) to grow its inclusive, Gen Z–focused D2C cosmetics brand.

Investor Activity

Today’s financings drew participation from global multistage firms, fintech-focused venture investors, strategic corporate partners, and impact-focused early-stage backers. From neobanking and capital markets automation to AI-regulated lending and emerging-market compliance, the breadth of sectors and geographies reflects growing conviction in intelligent infrastructure, platform defensibility, and market modernization.

Taken together, today’s rounds underscore a decisive shift toward practical AI, digitally native financial tools, and trusted automation layers as 2025 enters its final sprint. Here’s the full breakdown of today’s funding stories.

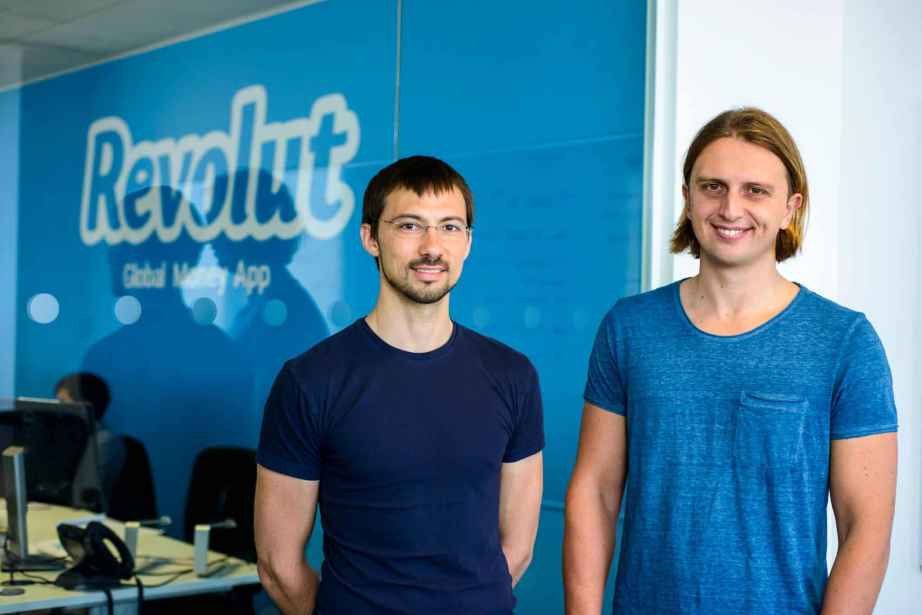

Revolut Hits $75B Valuation in Latest Funding Round Led by Coatue

Revolut, the London-based neobank, has completed a new funding round via a secondary share sale that values the company at an eye-popping $75 billion. The deal, co-led by global tech investors Coatue, Greenoaks, Dragoneer, and Fidelity, saw participation from Andreessen Horowitz, Franklin Templeton, and Nvidia’s NVentures, underscoring heavyweights’ confidence in Revolut’s growth.

Already serving over 65 million customers across Europe, the fintech super-app has been rapidly expanding into markets from India to Latin America. This valuation leap – roughly 66% higher than last year’s – cements Revolut’s status as one of the world’s most valuable private tech companies. The fresh capital will support Revolut’s push for new banking licenses, an expanded suite of offerings (from credit to mortgages), and continued global expansion as it aims to reach 100 million users by 2027.

Funding Details:

-

Startup: Revolut

-

Investors: Coatue, Greenoaks, Dragoneer, Fidelity (co-leads); with participation from Andreessen Horowitz, Franklin Templeton, Nvidia’s NVentures

-

Amount Raised: Not disclosed (valued at $75 billion)

-

Total Raised: ~$2.9 billion

-

Funding Stage: Secondary share sale (Late-stage)

-

Funding Date: November 24, 2025

Model ML Raises $75M in Series A Funding to Automate Investment Bankers’ Grunt Work

Model ML, a London-based AI startup targeting the finance industry, secured a hefty $75 million Series A round to scale its platform for automating investment bankers’ grunt work. Founded in 2023 by brothers Chaz and Arnie Englander, Model ML builds AI agents that can generate polished pitch decks, financial models, and due diligence reports in minutes — labor-intensive tasks that traditionally keep junior bankers burning the midnight oil.

The round was led by fintech-focused investment bank FT Partners with participation from Y Combinator, QED Investors, 13Books, Latitude, and LocalGlobe, and it comes only six months after Model ML’s initial seed raise. The new infusion will enable Model ML to expand into global financial hubs like New York and Hong Kong and to deepen its AI workflow automation capabilities. Banks and advisory firms are eager to adopt tools like this to save thousands of analyst hours while maintaining compliance and accuracy, signaling strong conviction in “AI for finance” as a burgeoning category.

Funding Details:

-

Startup: Model ML

-

Investors: FT Partners (lead); Y Combinator, QED Investors, 13Books, Latitude, LocalGlobe

-

Amount Raised: $75 million

-

Total Raised: $87 million (approximate)

-

Funding Stage: Series A

-

Funding Date: November 24, 2025

Pay.com.au Secures A$53M to Fuel Global Expansion of Business Rewards Platform

Pay.com.au, an Australian business payments and rewards platform, has finalized a A$53 million (~$34 million USD) funding round to accelerate its growth and international expansion plans. The raise was led by Morgans Corporate Limited and comprised A$25 million in new primary capital and A$28 million via secondary share sales, effectively doubling Pay.com.au’s valuation to about A$633 million. Backers in this round include Wilson Asset Management, Thorney Investment Group, and Ophir, among other investors. The Melbourne-based startup will use the fresh funds to drive local growth and launch into the U.S. market in partnership with American Express, all while further enhancing its end-to-end payments and loyalty platform. Pay.com.au enables small businesses to earn rewards on expenses like payroll and taxes – a value proposition that has helped it process over $10 billion in business spend since 2019. The new capital validates the company’s proven business model and will turbocharge its bid to become a global leader in business loyalty payments.

Funding Details:

-

Startup: Pay.com.au

-

Investors: Morgans Corporate (lead); Wilson Asset Management, Thorney Investment Group, Ophir Asset Management

-

Amount Raised: A$53 million (approximately $34 million USD)

-

Total Raised: ~A$75 million (~$48 million USD)

-

Funding Stage: Growth funding (Series B)

-

Funding Date: November 24, 2025

Tidalwave Raises $22M in Series A Funding for AI Mortgage Automation

Tidalwave, a New York-based startup using “agentic” AI to speed up home loan processing, raised $22 million in Series A financing to transform the notoriously slow mortgage approval process. The round was led by Permanent Capital, with participation from D.R. Horton – the largest U.S. homebuilder – and returning investor Engineering Capital, bringing Tidalwave’s total funding to $24 million.

Tidalwave’s platform deploys autonomous AI agents to handle end-to-end mortgage tasks such as income verification and underwriting, aiming to slash loan closing times that still average about 43 days in the industry. With the new funds, the company plans to accelerate adoption of its AI-powered system, targeting more than 200,000 loans annually (roughly 4% of U.S. mortgage originations projected for 2026). The infusion will fuel hiring and integrations as Tidalwave scales up with lenders, promising a radically faster, paperless mortgage experience that could save lenders and borrowers significant time and money.

Funding Details:

-

Startup: Tidalwave

-

Investors: Permanent Capital (lead); D.R. Horton, Inc.; Engineering Capital (follow-on)

-

Amount Raised: $22 million

-

Total Raised: $24 million

-

Funding Stage: Series A

-

Funding Date: November 24, 2025

Wealthy (Wealthy.in) Raises $15M in Series B Funding to Scale AI-Enabled Wealth Management

Wealthy, a Bengaluru-based wealth-tech startup, has raised ₹130 crore (about $15 million USD) in a Series B round to grow its AI-powered platform for mutual fund distributors and financial advisors. The funding was led by Bertelsmann India Investments, with participation from existing investor Alpha Wave (Alphawave) Global and new backer Shepherd’s Hill, along with several tech entrepreneurs. This round brings Wealthy’s total fundraising to roughly $30 million to date.

Founded in 2015 by Aditya Agarwal and Prashant Gupta, Wealthy provides digital tools and artificial intelligence solutions that help independent financial advisors serve clients more efficiently across India – including in over 1,000 smaller cities and towns beyond the major metros. Wealthy will use the fresh capital infusion to enhance its AI-driven advisory platform and expand its on-the-ground presence. By strengthening the tech that thousands of advisors use to manage investments (from mutual funds to insurance products), Wealthy aims to meet rising demand for organized financial planning and long-term wealth building among India’s growing investor base.

Funding Details:

-

Startup: Wealthy (Wealthy.in)

-

Investors: Bertelsmann India Investments (lead); Alpha Wave Global, Shepherd’s Hill, and several angel investors

-

Amount Raised: ₹130 crore (approx. $14.5 million)

-

Total Raised: ~$30 million

-

Funding Stage: Series B

-

Funding Date: November 24, 2025

Barker Secures $3.5M Seed Round to Scale AI-Warranted Asset Valuations in Lending

Barker, a New York City-based fintech, raised $3.5 million in seed funding to expand its AI platform that turns illiquid asset valuations into insurer-backed financial instruments for lending. The round, which was led by Walkabout VC, will help Barker further develop its “agentic” valuation system, which provides real-time appraisals for hard-to-value assets — from private jets and heavy equipment to art and even GPUs — backed by insurance guarantees.

Through a partnership with Munich Re’s aiSure program, Barker uniquely warrants its AI-generated valuations: if an asset ultimately sells for less than the algorithm predicted, an insurance policy covers the difference. This transforms subjective collateral appraisals into enforceable commitments, giving lenders greater confidence to extend credit against non-traditional assets. Barker plans to use the new capital to enter additional asset classes and deepen its partnerships with financial institutions, further establishing its platform as a “trust layer” for asset-based finance.

Funding Details:

-

Startup: Barker

-

Investors: Walkabout VC (lead)

-

Amount Raised: $3.5 million

-

Total Raised: $3.5 million (initial seed round)

-

Funding Stage: Seed

-

Funding Date: November 24, 2025

FinReach Raises $2.6M in Funding to Boost Collateral-Free Small Business Lending

FinReach, a Bengaluru-based fintech focused on expanding credit access, raised ₹21.9 crore (~$2.6 million USD) in fresh funding to scale its collateral-free lending platform for micro-entrepreneurs and small businesses. The round was led by Colossa Ventures, with participation from existing impact-focused investors including the Michael & Susan Dell Foundation, Omidyar Network Fund, and Caspian’s SME Impact Fund IV.

Founded in 2020, FinReach provides credit guarantee solutions and tech-driven risk assessment that enable lenders to extend loans to borrowers in India’s tier-III to tier-V regions who lack traditional collateral. So far, the startup has helped over 14,000 micro-entrepreneurs – including thousands of women-led businesses and smallholder farmers – obtain financing that would otherwise be out of reach. The new capital will be used to strengthen FinReach’s technology and risk analytics platform and expand its programs to more underserved communities, as the company works to unlock formal credit for those outside the economic mainstream.

Funding Details:

-

Startup: FinReach

-

Investors: Colossa Ventures (lead); Michael & Susan Dell Foundation, Omidyar Network, Caspian SME Impact Fund IV

-

Amount Raised: ₹21.9 crore (approximately $2.6 million)

-

Total Raised: Not disclosed

-

Funding Stage: Early-stage (Seed)

-

Funding Date: November 24, 2025

STAMP Raises $2M in Pre-Seed Funding for AI-Driven Compliance Platform in Saudi Arabia

STAMP, a Saudi Arabia-based regulatory technology (regtech) startup, announced it has raised $2 million in a pre-seed funding round to accelerate development of its AI-powered compliance and corporate operations platform. Founded in 2021 by entrepreneurs Muyasser Albar and Mohammed Zarei, Riyadh-headquartered STAMP specializes in simplifying the maze of government licensing, registration, and post-incorporation filings for businesses.

STAMP’s unified platform uses artificial intelligence to parse complex regulations, auto-fill and submit paperwork to authorities, and centralize all compliance documentation—offering companies a seamless way to manage obligations for KYC, business licensing, and corporate governance. This early backing, provided by undisclosed local investors, will help STAMP enhance its AI capabilities and expand its solution as Saudi Arabia’s startup ecosystem grows. By turning compliance into a continuous, automated process rather than a periodic headache, STAMP aims to set a new benchmark for regulatory tech in the region.

Funding Details:

-

Startup: STAMP

-

Investors: Undisclosed Saudi investors

-

Amount Raised: $2 million

-

Total Raised: $2 million (pre-seed round)

-

Funding Stage: Pre-seed

-

Funding Date: November 24, 2025

FAE Beauty Raises $2.1M in Funding to Expand D2C Cosmetics Brand

FAE Beauty, an Indian direct-to-consumer cosmetics startup, has raised ₹17 crore (~$2.1 million USD) in a fresh funding round to scale up its product lines and omnichannel presence. The round was led by Spring Marketing Capital, with participation from existing investor Titan Capital (Winners Fund), noted angel investor Arihant Patni, and other marquee angels. Short for “Free And Equal,” FAE Beauty is known for its inclusive makeup products and digital-first marketing strategy targeting Gen Z consumers across India.

With the new funds, the Mumbai-based brand plans to double down on product innovation by launching new categories, and strengthening its distribution both online and offline – expanding beyond e-commerce into quick-commerce platforms and retail outlets. The goal is to expand FAE’s footprint as an up-and-coming cosmetics label that resonates with young, diversity-minded customers.

Funding Details:

-

Startup: FAE Beauty

-

Investors: Spring Marketing Capital (lead); Titan Capital (Winners Fund), Arihant Patni, and other angel investors

-

Amount Raised: ₹17 crore (approximately $2.1 million)

-

Total Raised: Not disclosed

-

Funding Stage: Seed/Angel round

-

Funding Date: November 24, 2025

Tech Funding Summary Table

| Startup | Investors (Lead and notable investors) | Amount Raised | Total Raised | Funding Stage | Funding Date |

|---|---|---|---|---|---|

| Revolut | Coatue, Greenoaks, Dragoneer, Fidelity (co-leads); others: Nvidia NVentures, Andreessen Horowitz, Franklin Templeton | Not disclosed (valued at $75 B) | ~$2.9 billion | Secondary share sale | Nov 24, 2025 |

| Model ML | FT Partners (lead); Y Combinator, QED Investors, 13Books, Latitude, LocalGlobe | $75 million | $87 million | Series A | Nov 24, 2025 |

| Pay.com.au | Morgans Corporate (lead); Wilson Asset Mgmt, Thorney, Ophir | A$53 million (~$34 M USD) | ~A$75 M (~$48 M) | Growth round (Series B) | Nov 24, 2025 |

| Tidalwave | Permanent Capital (lead); D.R. Horton, Engineering Capital | $22 million | $24 million | Series A | Nov 24, 2025 |

| Wealthy | Bertelsmann India (lead); Alpha Wave (Alphawave) Global, Shepherd’s Hill, tech entrepreneurs | ₹130 crore (~$15 M) | ~$30 million | Series B | Nov 24, 2025 |

| Barker | Walkabout VC (lead) | $3.5 million | $3.5 million | Seed | Nov 24, 2025 |

| FinReach | Colossa Ventures (lead); Michael & Susan Dell Fdn, Omidyar Network, Caspian SME Fund IV | ₹21.9 crore (~$2.6 M) | Not disclosed | Seed/Early-stage | Nov 24, 2025 |

| STAMP | Undisclosed Saudi investors | $2 million | $2 million | Pre-seed | Nov 24, 2025 |

| FAE Beauty | Spring Marketing Capital (lead); Titan Capital, Arihant Patni, others | ₹17 crore (~$2.1 M) | Not disclosed | Seed | Nov 24, 2025 |