Top 10 Startup and Tech Funding News – November 19, 2025

It’s Wednesday, November 19, 2025, and we’re back with the top startup and tech funding news stories across AI infrastructure, consumer AI platforms, healthcare automation, fintech underwriting, cybersecurity, and life-science tools. The momentum today cut across both late-stage scale-ups and high-conviction seed rounds, with capital flowing toward companies building real operational systems, medically grounded intelligence engines, and next-generation defence-grade cybersecurity.

Function Health headlined the day with a landmark $298 million Series B that pushed the consumer health-intelligence company to a valuation near $2.5 billion. Suno followed with a $250 million round that cemented its position as one of the world’s fastest-growing AI music platforms, while Arbiter secured $52 million at a nearly $400 million valuation to rebuild the administrative spine of healthcare. On the infrastructure and tooling front, AlphaXiv closed a $7 million seed round to accelerate the conversion of AI research into production-grade deployment, and Kaaj raised $3.8 million to automate small-business credit analysis for lenders.

Life sciences and hard-tech funding also remained active. Hermes Biosciences added new seed capital to scale automated extracellular-vesicle isolation systems for diagnostics and therapeutics, while Modern Life secured $20 million to expand its AI-powered life-insurance advisory platform. In proptech, TULU extended its Series A to $37 million as the usage-economy trend continues to reshape residential IoT ecosystems. Rounding out the day, Ember raised $4.3 million to deepen its healthcare AI platform, and cybersecurity firm Doppel locked in a $70 million Series C to counter the surge of AI-powered social-engineering attacks targeting global enterprises.

Funding Highlights

-

Function Health raised $298 million in Series B financing at a valuation near $2.5 billion, accelerating its AI-powered medical intelligence platform.

-

Suno secured $250 million in Series C funding to expand its rapidly growing AI music ecosystem.

-

Arbiter raised $52 million in a high-profile seed round at about $400 million valuation to automate healthcare administration.

-

AlphaXiv closed a $7 million seed round to become the collaboration layer bridging AI research and production.

-

Kaaj raised $3.8 million to automate underwriting and small-business credit intelligence.

-

Modern Life secured $20 million in Series A funding to modernize life-insurance advisory with AI workflows.

-

TULU extended its Series A to $37 million to scale its global smart-access and usage-economy IoT platform.

-

Hermes Biosciences added seed funding to scale automated extracellular-vesicle isolation tech for precision medicine.

-

Ember raised $4.3 million to expand its healthcare-AI infrastructure.

-

Doppel closed $70 million in Series C funding at a valuation exceeding $600 million to counter AI-driven impersonation threats.

Investor Activity

Today’s financings included participation from many of the sector’s most influential technology and life-science investors — across early, mid-stage, and late-stage rounds. The presence of major multistage firms alongside healthcare specialists, fintech-focused funds, proptech investors and cybersecurity strategics underscores continued conviction in core infrastructure categories: AI-driven health platforms, enterprise underwriting engines, research-to-production tooling, high-risk defence-aligned cybersecurity and foundational biotech instrumentation. The seed-stage environment remained particularly strong, with climate, healthtech and deep-tech investors backing scientific and operational startups that form the backbone of next-generation innovation.

Taken together, today’s rounds signal a strong mid-November showing — where AI infrastructure, medical intelligence, cybersecurity readiness and enterprise modernisation continue to push toward 2026 with significant investor commitment. Here’s the full breakdown of today’s funding stories.

Function Health Raises $298M in Series B Funding at ~$2.5 B Valuation

Function Health, a direct-to-consumer health-tech platform that combines lab testing, wearable data and AI-driven insights, has secured nearly $298 million in Series B funding, lifting its valuation to around $2.5 billion. The Austin-based company is positioning itself at the intersection of preventive health and data-driven clinical-grade care. Rather than simply offering wellness tests, Function is building a “medical intelligence” engine: it ingests lab results, body scans and wearable streams and applies machine-learning to translate raw health data into actionable insights for users and their care teams.

With this new funding round, Function Health plans to expand its lab-testing network, enhance its AI models and deepen its integration of real-time biometric data. The raise signals strong investor conviction that the consumer-health market is shifting toward medically rigorous, analytics-enabled care rather than just lifestyle pointers. For founders and investors, Function Health’s success underscores that tech-enabled health companies that move beyond “tracking” toward “interpreting” human biology are gaining large commitments.

Funding Details:

-

Startup: Function Health

-

Investors: Redpoint Ventures (lead), with participation from Andreessen Horowitz, Aglaé Ventures, Alumni Ventures, Battery Ventures, and individual athlete backers

-

Amount Raised: $298 million

-

Total Raised: ~ $350 million (previous rounds)

-

Funding Stage: Series B

-

Funding Date: November 19, 2025

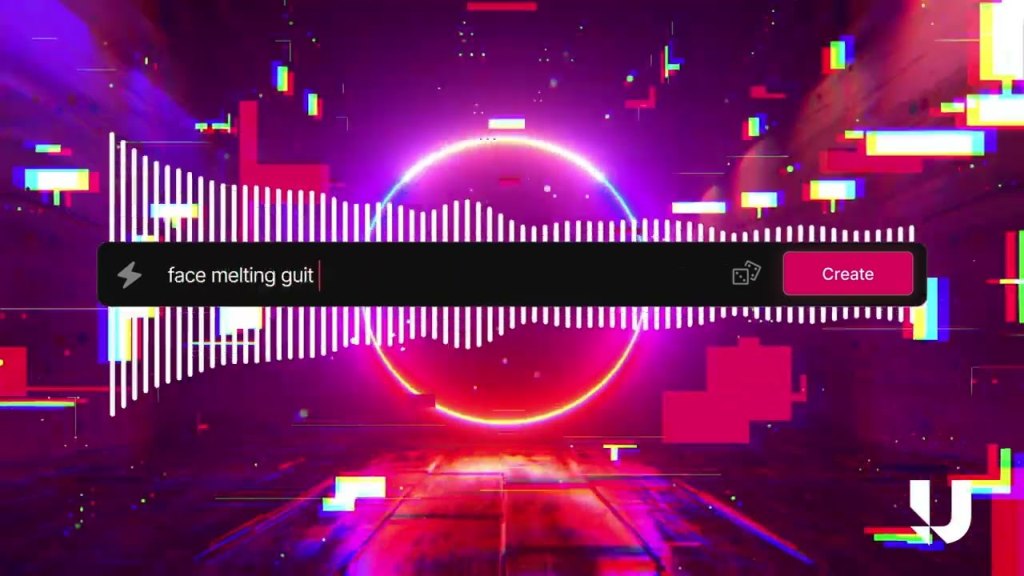

Suno Raises $250M in Series C Funding at $2.45 B Valuation for AI Music Platform

Suno, a Massachusetts-based AI-powered music generation startup, has closed $250 million Series C funding round, valuing the company at roughly $2.45 billion. Suno enables users—from casual creators to professional producers—to generate original music tracks via text prompts and its underlying AI engine. The company reports annual recurring revenue near $200 million, driven by subscriptions and professional tools.

The funding will support product development (including mobile apps and pro audio workstations), global expansion and deeper work on its audio AI models. Importantly, the raise comes amid growing scrutiny of AI and music rights: Suno is engaged in legal and regulatory discussions around training models on existing recordings and the future of creator tools. Nonetheless, investor confidence appears robust, reflecting belief in the growing creator economy and the role of AI in content production. For startup founders, Suno serves as a case study in scaling a vertical-specific AI platform (music) that combines consumer mass market, creative professionals and deep tech.

Funding Details:

-

Startup: Suno

-

Investors: Menlo Ventures (lead), with participation from NVentures (NVIDIA’s VC arm), Lightspeed, Matrix, Hallwood Media

-

Amount Raised: $250 million

-

Total Raised: Not disclosed

-

Funding Stage: Series C

-

Funding Date: November 19, 2025

Arbiter Raises $52M in Seed Funding at ~$400 M Valuation to Automate Healthcare Administration

Arbiter, founded by a former pharmaceutical and health-services executive, has raised $52 million in a seed financing round, with a reported implied valuation near $400 million. The company is tackling one of healthcare’s least-seen but costliest problems: administrative waste, inefficiency in referrals, scheduling, care coordination and provider-payer hand-offs. Arbiter’s AI-powered “operating spine” aims to integrate disparate systems, automate manual workflows and surface predictive insights for providers, payers and patients.

Unlike many venture-backed startups, Arbiter’s round is led by family offices and non-traditional backers, indicating investor interest in foundational infrastructure plays in health-tech rather than headline consumer brands. With this capital, Arbiter plans to accelerate platform development, expand hiring of clinical-operational talent, and scale pilot programs with large health networks. For entrepreneurs focused on healthcare, the round illustrates that technical platforms addressing backend workflows—rather than only front-end patient apps—can attract substantial seed investment.

Funding Details:

-

Startup: Arbiter

-

Investors: TriEdge Investments & MFO Ventures (co-lead), WindRose Health Investors and other family offices

-

Amount Raised: $52 million

-

Total Raised: Seed stage (first disclosed institutional funding)

-

Funding Stage: Seed

-

Funding Date: November 19, 2025

AlphaXiv Raises $7M in Seed Funding to Bridge AI Research and Production

AlphaXiv has announced a $7 million seed funding round led by Menlo Ventures and Haystack, with additional support from angel investors, including former tech executives. AlphaXiv aims to build a platform that accelerates the translation of cutting-edge AI research into production-ready systems—essentially a “GitHub for AI research artifacts, models and workflows.” As enterprises increasingly struggle to deploy academic research at scale,

AlphaXiv’s infrastructure-first approach offers a bridge between labs and applied systems. The startup will use the funds to develop its core platform, recruit research and engineering teams, and build early enterprise partnerships. For founders in AI-infrastructure, this raise is a reminder that while applications get attention, the tooling and flow-from-prototype-to-production remains an underserved high-leverage space.

Funding Details:

-

Startup: AlphaXiv

-

Investors: Menlo Ventures (lead), Haystack (lead), plus Shakti VC, Conviction Embed and angel backers such as Eric Schmidt and Sebastian Thrun

-

Amount Raised: $7 million

-

Total Raised: Seed round

-

Funding Stage: Seed

-

Funding Date: November 19, 2025

Kaaj Raises $3.8M in Seed Funding to Automate Small-Business Lending with AI

Kaaj, a San Francisco-based fintech startup, has raised $3.8 million in a seed funding round. The company is focused on enabling lenders to underwrite small-business loans more efficiently via AI-driven credit intelligence: analyzing bank statements, cash-flow data, document ingestion and risk modelling in real time.

With loan-underwriting costs historically too high for smaller loans, Kaaj’s platform seeks to unlock capital for underserved small businesses. The seed capital will support product development, expansion of lender partnerships and scaling of its AI models. For fintech entrepreneurs, the raise signals that while lending has been crowded, there remains room for AI-first entrants targeting the structural cost barrier of small-loan origination.

Funding Details:

-

Startup: Kaaj

-

Investors: Kindred Ventures (lead), Better Tomorrow Ventures, additional backers

-

Amount Raised: $3.8 million

-

Total Raised: Seed stage

-

Funding Stage: Seed

-

Funding Date: November 19, 2025

Modern Life Raises $20M in Series A Funding to Embed AI in Life-Insurance Advisory

Modern Life (also known as Modern Life Group) has raised $20 million Series A financing round led by Thrive Capital, increasing its total capital raised to approximately $35 million. The company is re-imagining life insurance advisory and policy sales by leveraging AI and digital workflows: automating data capture, risk assessment, matching customers to suitable policies, and streamlining ongoing servicing for advisers and clients.

The round reflects investor belief that the life-insurance industry, often bogged down in legacy processes and paperwork, is ripe for tech disruption. With the funding, Modern Life plans to scale its adviser partner network, deepen its AI underwriting models and expand its customer acquisition. For insurtech founders, this is a reminder that the domain beyond mere distribution—into advisory, servicing and underwriting—is becoming increasingly attractive.

Funding Details:

-

Startup: Modern Life

-

Investors: Thrive Capital (lead), New York Life Ventures, Northwestern Mutual, Allegis

-

Amount Raised: $20 million

-

Total Raised: ~$35 million

-

Funding Stage: Series A

-

Funding Date: November 19, 2025

TULU Extends Series A to $37M for Global Smart Product-Access Platform

TULU, a New York-based proptech startup that enables “access instead of ownership” of household appliances and lifestyle products via IoT-enabled in-building units, announced an extension of its Series A by $17 million, bringing total Series A funding to $37 million (cumulative funding around $42 million). TULU’s model places IoT kiosks or units in apartment buildings, lounges or common spaces, allowing residents to rent or access items (e-scooters, vacuums, VR headsets, appliances) via an app.

Its proprietary AI engine, “TULU Brain,” analyzes usage data to personalize experiences for residents and provide analytics to landlords and brand-partners. The new funding will support global expansion, deeper AI personalisation, hardware roll-out and increased brand integrations. For proptech and usage-economy startups alike, TULU’s raise highlights the momentum behind shifting consumer models from ownership to consumption and the importance of data and IoT in enabling this.

Funding Details:

-

Startup: TULU

-

Investors: GreenSoil PropTech Ventures (co-lead), Bosch Ventures, New Era Capital Partners, plus Regeneration VC, Good Company, Aviv Growth, i3 Partners

-

Amount Raised: $17 million (extension)

-

Total Raised: ~$42 million

-

Funding Stage: Series A (extension)

-

Funding Date: November 19, 2025

Hermes Biosciences Raises Seed Round to Scale EV-Isolation Platform

Hermes Biosciences, a life-science tools startup focused on automating the isolation of extracellular vesicles (EVs) for diagnostics and therapeutics, announced a seed funding round led by Genoa Ventures with support from Paladin Capital Group and Vertical Venture Partners. While the exact funding amount was not publicly disclosed, the raise reflects early investor commitment to infrastructural biotech plays rather than just end-therapy companies.

Hermes aims to provide scalable hardware and software solutions that make EV-based assays viable for research labs and pharma. With the funds, the company will accelerate product development, pilot deployments with research partners and manufacturing readiness. For founders in biotech tools, this example illustrates that capital continues to flow into platform plays that enable next-gen biology, even at an early stage.

Funding Details:

-

Startup: Hermes Biosciences

-

Investors: Genoa Ventures (lead), Paladin Capital Group, Vertical Venture Partners

-

Amount Raised: Not disclosed

-

Total Raised: Seed stage (first institutional funding)

-

Funding Stage: Seed

-

Funding Date: November 19, 2025

Healthcare-AI Startup Ember Raises $4.3M in Seed Funding

Ember, a healthcare-AI company, has secured $4.3 million in seed funding, led by Nexus Venture Partners. Ember is developing AI-based tools to improve healthcare delivery—whether through diagnostics, workflow automation or decision-support.

The seed infusion gives Ember runway to develop its algorithms, recruit healthcare domain expertise, and engage early clinical/enterprise customers. On a broader level, Ember’s raise underscores that even at early stages, AI applied to healthcare remains a strong focus for investors: the combination of domain complexity, regulatory barrier and high-impact outcome makes such startups mission-attractive.

Funding Details:

-

Startup: Ember

-

Investors: Nexus Venture Partners (lead)

-

Amount Raised: $4.3 million

-

Total Raised: Seed stage

-

Funding Stage: Seed

-

Funding Date: November 19, 2025

Doppel Raises $70M in Series C Funding at Over $600 M Valuation to Combat AI-Powered Social Engineering

Doppel, a cybersecurity startup focused on combating advanced social engineering attacks—particularly those powered by generative AI—announced a $70 million Series C financing, at a valuation reported to exceed $600 million. Doppel’s platform uses behavioural analytics, real-time threat detection and adaptive modelling to protect organisations from sophisticated phishing, impersonation and identity-based attacks that leverage AI and deep-fake tools.

The round indicates investors’ belief that cybersecurity must evolve in tandem with adversarial AI and that companies focused on the next-gen attack surface are earning premium valuations. With this capital, Doppel will scale its enterprise go-to-market, bolster R&D to stay ahead of evolving threats and expand globally. For cyber founders, this raise reiterates that defence-tech remains a rich category for growth despite general VC caution.

Funding Details:

-

Startup: Doppel

-

Investors: Lead investors not fully disclosed publicly

-

Amount Raised: $70 million

-

Total Raised: Not disclosed

-

Funding Stage: Series C

-

Funding Date: November 19, 2025

Tech Funding Summary Table

| Startup | Investors (Lead + notable) | Amount Raised | Total Raised | Funding Stage | Funding Date |

|---|---|---|---|---|---|

| Function Health | Redpoint Ventures (lead); Andreessen Horowitz; Aglaé Ventures; Alumni Ventures; others | $298 M | ~ $350 M | Series B | Nov 19, 2025 |

| Suno | Menlo Ventures (lead); NVentures (NVIDIA VC); Lightspeed; Matrix; Hallwood Media | $250 M | Not disclosed | Series C | Nov 19, 2025 |

| Arbiter | TriEdge Investments & MFO Ventures (co-lead); WindRose Health Investors | $52 M | Seed stage | Seed | Nov 19, 2025 |

| AlphaXiv | Menlo Ventures (lead); Haystack (lead); Shakti VC; Conviction Embed; Eric Schmidt (angel); Sebastian Thrun (angel) | $7 M | Seed stage | Seed | Nov 19, 2025 |

| Kaaj | Kindred Ventures (lead); Better Tomorrow Ventures | $3.8 M | Seed stage | Seed | Nov 19, 2025 |

| Modern Life | Thrive Capital (lead); New York Life Ventures; Northwestern Mutual; Allegis | $20 M | ~ $35 M | Series A | Nov 19, 2025 |

| TULU | GreenSoil PropTech Ventures (co-lead); Bosch Ventures; New Era Capital Partners; others | $17 M | ~ $42 M | Series A (extension) | Nov 19, 2025 |

| Hermes Biosciences | Genoa Ventures (lead); Paladin Capital Group; Vertical Venture Partners | Not disclosed | Seed stage | Seed | Nov 19, 2025 |

| Ember | Nexus Venture Partners (lead) | $4.3 M | Seed stage | Seed | Nov 19, 2025 |

| Doppel | Not fully disclosed | $70 M | Not disclosed | Series C | Nov 19, 2025 |

Closing

That wraps up today’s major funding activity across global markets — a day powered by medical intelligence platforms, AI-native creative tools, healthcare automation, enterprise credit infrastructure, proptech ecosystems, and next-generation cybersecurity. These founders are building systems that sit deeper in the operational stack: analyzing human biology, generating original content, automating clinical workflows, underwriting small-business credit, rethinking residential IoT usage, and defending enterprises against AI-driven adversaries. Each represents a slice of the technological foundation taking shape as we move toward 2026.

We’ll continue tracking every new round — from high-velocity seed experiments to billion-dollar growth financings — to keep you ahead of the shifts that matter across U.S., European, Asian, and emerging startup hubs. Tomorrow’s slate will bring another wave of signals about where capital is concentrating, which categories are accelerating, and how AI-first infrastructure continues to reshape the global innovation cycle.

Until then, stay sharp — and stay ahead.