Bitrue exchange brings accessible AI trading to its 40 million global user base

The cryptocurrency exchange platform Bitrue is making “AI trading” more accessible to users by integrating six of the world’s most powerful large language models with its copy trading service.

According to a press release shared with TechStartups, starting tomorrow, Bitrue’s customers will be able to give as much funding as they dare to models, including OpenAI’s GPT-5, Google’s Gemini 2.5 Pro, Anthropic’s Claude Sonnet 4.5, xAI’s Grok 4, Alibaba’s Qwen3-Max, and DeepSeek’s v3.1, and let them invest it on their behalf. The models will take full control of the user’s digital asset portfolio and trade in real time around the clock in an effort to maximize their profits.

By integrating the models into its copy trading platform, Bitrue is dramatically lowering the barrier to entry for AI trading. The use of cutting-edge algorithms and AI models to automate trading is nothing new in the crypto industry, but Bitrue’s method of enabling it certainly is. Until now, the only way to access AI trading was through complex decentralized finance protocols such as Arma, ZyFAI, and Mamo Bot, or else, set up a bot by themselves.

The problem with these protocols is that they’re pretty complicated to get up and running, requiring users to create an account, set approvals, and bridge funds to obtain the obscure tokens they work with. There’s a good chance they’ll also need to create a new wallet, as they tend to only be compatible with a select few. And many are experimental and therefore a tad buggy, which is not exactly reassuring when they’re asking users to trust it with their funds.

Easy AI trading

Copy trading makes everything much easier. It’s an age-old concept that first appeared in traditional finance and has become a core feature of numerous trading platforms. With copy trading, users pay a very small fee, perhaps as little as a few cents per trade, to copy the trades of experienced users with solid track records of profitable trading. Users essentially bet on the trader they follow to continue trading profitably in the future, and if they do so, they’ll realize the same gains.

With Bitrue’s copy trading, customers can now essentially “follow” the world’s top LLMs in the same way, which makes AI trading far more accessible than before.

Bitrue Chief Marketing Officer Adam O’Neill said the company is making the AI trading experience “freely accessible” to users. “The six LLMs chosen for our initial integration are among the most powerful consumer-grade options available, coming from recognizable tech juggernauts like OpenAI and Google,” he said. “We are confident that our customers will jump at the chance to harness AI capabilities to power their investment strategies.”

Those who want to try their luck with one of the LLMs can register their interest on Bitrue’s platform now. They simply click to sign up, choose whichever model they think is best suited for trading crypto, and specify how much funding they’re willing to give to the model. The LLMs will officially start trading on Nov. 20 at 22:00 UTC, and users will be able to retain any profits the models generate on their behalf – but obviously, they must be willing to shoulder the losses should the model they choose mess things up.

As with anything to do with investing, there is a risk with this, and it’s only right that we should point something out. None of the LLMs in question were specifically designed for crypto trading, so it’s an open question if they’ll be able to match the performance of specialized trading bots such as Arma. That said, they’re also much more powerful than any DeFi trading bot, with billions more parameters. Additionally, the LLMs also possess “reasoning” skills and remember their previous actions to improve over time, so there’s also reason to be optimistic about their trading chances.

Which model is best?

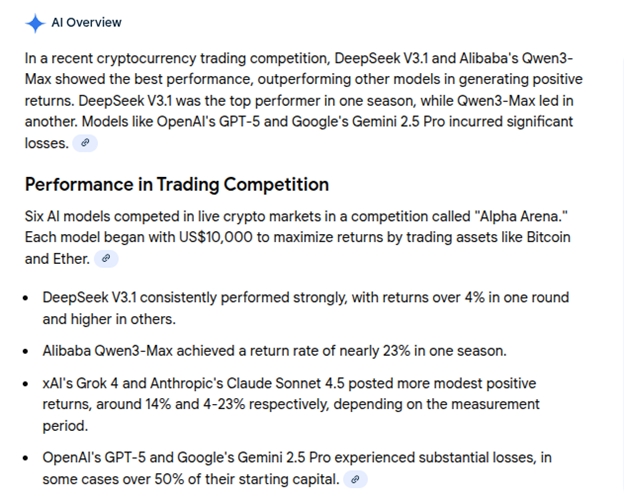

To answer this question, we naturally turned to AI itself, asking Google’s Gemini (via Google Search) for its opinion. The answer was a tad surprising, with Gemini strongly hinting that users shouldn’t take a chance on itself:

So there you have it. Alibaba’s and DeepSeek’s models are probably the way to go if you want to give it a try, at least according to Gemini. But bear in mind, Gemini itself doesn’t always get things right, so it could be wrong about this.

In any case, we can expect AI trading to become much more commonplace on crypto exchanges in the future, at least according to O’Neill. “We predict that similar services to our own will be a fundamental feature of all exchanges by the end of 2026,” he said.

If O’Nell is right, then we probably don’t have too long to wait until we have more concrete evidence about which models are most likely to make traders rich. For its part, Bitrue said it’s going to carefully monitor the performance of each of the six LLMs in question, as well as the feedback from its early adopters. Depending on how popular the feature is, it may add even more LLMs to its copy trading feature in the future.