Top Startup and Tech Funding News – November 17, 2025

It’s Monday, November 17, 2025, and we’re back with the top startup and tech funding news stories across AI infrastructure, fintech, biotech, space technology, semiconductors, climate-tech, and emerging enterprise platforms. The momentum was broad and deep, spanning late-stage expansion rounds, mid-stage breakthroughs, and early-stage innovation. Capital continued to flow toward companies building critical infrastructure, scientific advancements, and next-generation AI-driven systems.

Ramp Raises $300 Million in Funding, Pushing Valuation to $32 Billion as Fintech Demand Surges

Ramp has tightened its grip on the corporate spend and finance-automation market with a fresh $300 million funding round that values the startup at about $32 billion. The New York–based fintech has become a core financial stack for thousands of high-growth companies, offering a unified platform for corporate cards, expense management, bill payments, and real-time insights on how teams spend money.

The latest round, led by Lightspeed Venture Partners with participation from a roster of top-tier investors, follows a year in which Ramp says it doubled both revenue and customer count. That pace, in a tighter funding environment, signals strong product-market fit and a clear willingness among CFOs to replace legacy tools with a more integrated system.

Ramp’s pitch is straightforward: help companies spend less and move faster by automating workflows that finance teams still manage in spreadsheets and email. For founders and finance leaders, that means tighter controls, better visibility into burn, and fewer manual reconciliations at month-end. For investors, it positions Ramp as a category-defining player in modern financial operations, with a large and expanding customer base across startups, mid-market, and enterprises.

With this new capital, Ramp is expected to keep investing in product development, deepen its analytics and automation capabilities, and expand internationally as demand grows for next-generation finance infrastructure.

Funding Details:

-

Startup: Ramp

-

Investors: Lightspeed Venture Partners (lead), Founders Fund, D1 Capital, Coatue, GIC, Avenir Growth, Thrive Capital, Sutter Hill Ventures

-

Amount Raised: $300 million

-

Total Raised: Not disclosed

-

Funding Stage: Growth / late-stage venture

-

Funding Date: November 17, 2025

PowerLattice Raises $25 Million in Series A Funding to Slash Chip Power Consumption

PowerLattice has emerged from stealth with a $25 million Series A round to attack one of the biggest bottlenecks in modern computing: energy-hungry chips that strain power and cooling budgets in data centers and advanced devices. The semiconductor startup is developing chiplet-based architectures that it says can reduce power consumption by more than 50%, a meaningful step in an era dominated by AI workloads and dense compute clusters.

The round is co-led by Playground Global and Celesta Capital, with participation from former Intel CEO Pat Gelsinger and other strategic backers. That investor roster gives PowerLattice both capital and deep industry experience as it tries to move from promising benchmarks to commercial deployments. The founding team brings engineering leadership from Qualcomm, NUVIA, and Intel, which strengthens the company’s credibility as it engages hyperscalers, OEMs, and system integrators.

PowerLattice’s approach centers on breaking traditional monolithic chips into modular chiplets that can be mixed, matched, and optimized for specific workloads. By focusing on energy efficiency without sacrificing performance, the startup is positioning itself as a key enabler for AI data centers, edge-compute systems, and high-performance devices that are increasingly constrained by heat and power.

The Series A funding will be used to accelerate silicon development, expand the engineering team, and move early designs into customer evaluations and pilot deployments. If the company can validate its power savings at scale, it could become an important player in the broader shift toward more efficient, modular compute architectures.

Funding Details:

-

Startup: PowerLattice

-

Investors: Playground Global (co-lead), Celesta Capital (co-lead), former Intel CEO Pat Gelsinger and other strategic investors

-

Amount Raised: $25 million

-

Total Raised: Approximately $31 million (including prior seed)

-

Funding Stage: Series A

-

Funding Date: November 17, 2025

Runlayer Launches with $11 Million Seed Round to Secure AI Agent Ecosystems

Runlayer has launched out of stealth with an $11 million seed round to tackle a fast-emerging problem: how to secure AI agents that interact with live data, tools, and enterprise systems. As companies experiment with Model Context Protocol (MCP)–based agents and increasingly autonomous workflows, the risk surface is expanding far beyond traditional API integrations or chatbots. Runlayer is positioning itself as the guardrail layer for this new stack.

Backed by investors including Khosla Ventures’ Keith Rabois and Felicis Ventures, along with a group of unicorn founders and operators, Runlayer is building security infrastructure purpose-built for AI agents. The platform monitors how agents access tools, data, and external services, applying policies that can detect abuse, prevent sensitive data leakage, and stop agents from executing unexpected or harmful actions.

From an EEAT standpoint, Runlayer benefits from early validation by experienced security and infrastructure investors who have backed multiple category leaders in enterprise software. The company is also entering the market at a moment when enterprises are moving beyond pilots and starting to wire agents into production workflows across finance, customer support, engineering, and operations.

The seed funding will be used to expand the engineering and security research teams, deepen integrations with leading AI platforms, and roll out early deployments with design partners. For founders and CTOs exploring AI agents, Runlayer’s pitch is clear: you should not connect autonomous systems to critical tools without the same level of oversight and policy control you expect from other core security layers.

Funding Details:

-

Startup: Runlayer

-

Investors: Khosla Ventures (via Keith Rabois), Felicis Ventures, a group of unicorn founders and strategic backers

-

Amount Raised: $11 million

-

Total Raised: $11 million (seed)

-

Funding Stage: Seed

-

Funding Date: November 17, 2025

CustoMED Raises $6 Million in Funding to Scale AI-Powered 3D-Printed Orthopedic Solutions

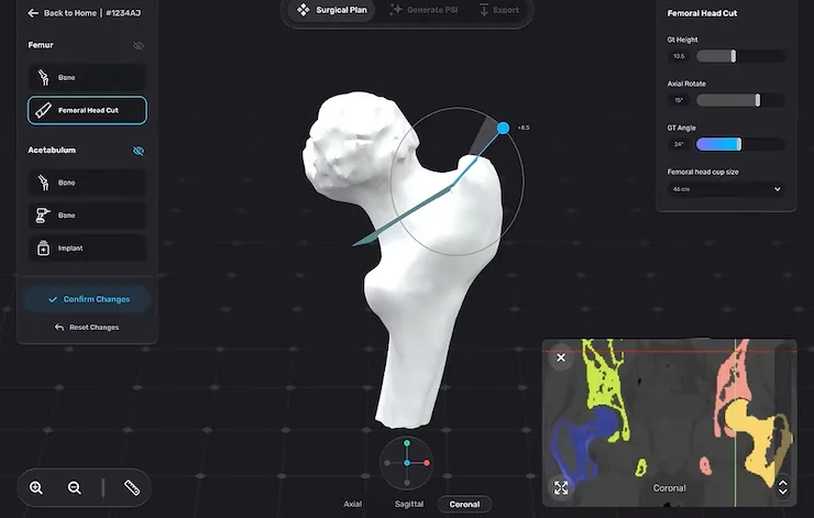

CustoMED has raised $6 million to expand its AI-driven, 3D-printed solutions for orthopedic surgery, as hospitals and surgeons look for more precise and patient-specific tools. The medtech startup develops personalized surgical guides and implants that can be manufactured on demand, using AI to optimize fit, geometry, and load distribution for each patient.

Its technology is already being used in hundreds of surgeries worldwide, which gives the company important real-world clinical experience and a foundation of evidence as it scales. By combining imaging data with AI-based planning and 3D printing, CustoMED aims to reduce operating times, improve surgical accuracy, and shorten recovery for patients—benefits that matter to clinicians, hospital systems, and payers.

From an expertise and trust standpoint, adoption in live surgical settings is a strong signal that regulatory, safety, and workflow hurdles are being taken seriously. CustoMED’s platform integrates into existing surgical planning processes, which is critical in a field where surgeons cannot afford experimentation that disrupts standard-of-care procedures.

The new funding will support expansion into additional markets, deeper clinical partnerships, and the build-out of an end-to-end platform that spans preoperative planning, device design, and manufacturing logistics. As orthopedic surgery becomes more data-driven and outcomes-focused, startups like CustoMED that can show tangible improvements in precision and patient outcomes are likely to attract sustained interest from both investors and strategic partners.

Funding Details:

-

Startup: CustoMED

-

Investors: Not publicly disclosed

-

Amount Raised: $6 million

-

Total Raised: $6 million (current round)

-

Funding Stage: Early-stage (seed/Series A, not formally specified)

-

Funding Date: November 17, 2025

Celero Communications Raises $140 Million to Tackle AI Data Center Networking Bottlenecks

Celero Communications has raised $140 million to address one of the most pressing infrastructure challenges in AI: moving data efficiently between increasingly dense clusters of accelerators. The company develops coherent digital signal processor (DSP) technology and optical networking solutions to link AI data centers at high speed and lower cost, targeting the backbone that connects GPUs and custom AI chips across racks and regions.

The funding package includes a $100 million Series B led by CapitalG, Alphabet’s independent growth fund, along with a previously raised $40 million round led by Sutter Hill Ventures. Additional backers include Valor Equity Partners, Atreides Management, and Maverick Silicon. That investor mix combines deep experience in semiconductors, infrastructure, and large-scale AI deployments, which strengthens Celero’s position as it negotiates with hyperscalers and major cloud providers.

As AI models grow larger and training runs stretch into billions or trillions of parameters, networking becomes a performance and cost bottleneck. Celero’s coherent DSP solutions aim to increase bandwidth, reduce latency, and improve energy efficiency across optical links, allowing data centers to scale AI clusters without a linear increase in networking complexity and cost.

The new capital will be used to accelerate product development, ramp manufacturing with key partners, and support trials and deployments with top-tier customers. For founders building in AI infrastructure, Celero’s round is another signal that the ecosystem is moving beyond chips alone and into the full stack of networking, cooling, and power technologies required to sustain AI growth.

Funding Details:

-

Startup: Celero Communications

-

Investors: CapitalG (lead), Sutter Hill Ventures, Valor Equity Partners, Atreides Management, Maverick Silicon

-

Amount Raised: $140 million

-

Total Raised: $140 million (disclosed)

-

Funding Stage: Series B

-

Funding Date: November 17, 2025