Tech Layoffs 2025: Comprehensive List, Trends, and What They Mean for the Industry

The layoff cycle that shook Silicon Valley in 2023 and 2024 hasn’t stopped—it’s simply changed form. As 2025 unfolds, companies across the tech spectrum are once again trimming staff, citing AI-driven efficiency, tighter venture capital, and a shift from growth-at-all-costs to profitability. From startups freezing expansion plans to Big Tech quietly restructuring teams, this year’s layoffs show an industry learning what “lean” truly means.

Behind the headlines, the pattern is familiar. Payrolls inflated during the pandemic boom are now colliding with economic reality. Automation and investor caution are forcing thousands of engineers, designers, and operators back into the job market, reshaping both talent dynamics and expectations.

So far in 2025, tech layoffs have affected over 180,000 workers across more than 400 companies globally, based on multiple industry trackers. The number includes 112,732 tech employees laid off from 218 U.S. tech companies. While estimates vary — some put the total closer to 112,000 — the direction is clear: the cuts haven’t slowed. February alone saw more than 16,000 job losses, one of the steepest single-month totals since the correction began.

The drivers remain consistent: AI investments, slowing revenue growth, and an economic reset that’s rewarding efficiency over size. Big names like Intel, Microsoft, Meta, Amazon, and TCS have all reduced headcount to streamline operations and redirect resources toward automation and product innovation.

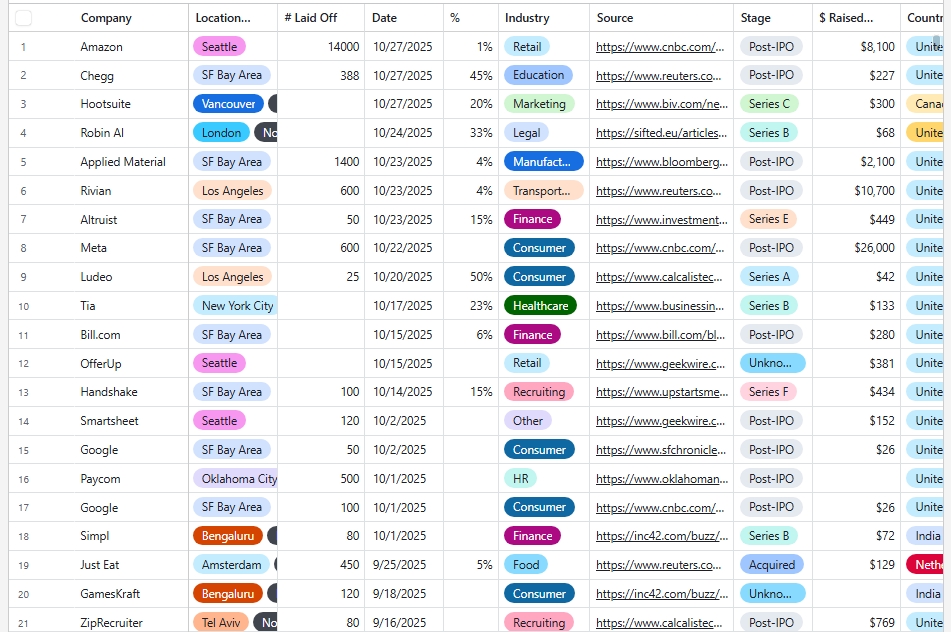

Tracking Tech Layoffs in 2025: List of Companies’ Layoffs 2025

This article tracks every major layoff of 2025 — updated throughout the year — and examines the deeper forces reshaping how tech companies hire, build, and survive in a post-hypergrowth economy.

By the Numbers: Layoff Snapshot (as of October 2025)

The year isn’t over yet, but 2025 has already matched the scale of the post-pandemic correction that reshaped the industry two years ago. Across continents, companies are recalibrating teams to meet new financial realities and technological shifts.

Key Statistics

-

Total layoffs: Over 184,000 tech jobs have been cut so far this year

-

Daily average: Roughly 645 workers are laid off every day

-

Company count: Between 413 and 582 companies have announced job cuts, depending on the data source

-

Top layoffs: Meta (8,000), Google (6,200), and Amazon (5,000) lead large-scale reductions

-

Startups vs Big Tech: Startups now account for nearly 60% of all layoffs, reversing the pattern from 2023–2024 when Big Tech dominated

-

AI factor: About one in four layoffs have been linked to “AI-driven restructuring” or automation efficiency programs

-

Most affected regions: the United States, India, and Europe

-

Hardest-hit sectors: SaaS, fintech, logistics tech, and HR tech

Major Companies with Significant Layoffs

-

Intel: Nearly 2,400 workers cut, with deep reductions in Oregon operations

-

Microsoft: 9,000 employees laid off (about 4% of global staff)

-

TCS: Announced major workforce cuts across several regions

-

Amazon: Restructured its audio and entertainment units, including layoffs at Wondery

-

ByteDance: Cut 65 employees from its U.S. operations

-

Google: Reduced 25% of its smart TV division

-

Scale AI: Cut 200 employees and ended contracts with 500 workers

-

Lenovo: Reduced its U.S. workforce by more than 100 jobs

Contributing Factors

-

AI adoption and automation: The integration of AI tools has made some roles redundant as companies streamline workflows

-

Cost-cutting: Efficiency and profitability have replaced growth as the priority metric

-

Economic pressure: Inflation, tariffs, and slower market demand have accelerated the restructuring trend

Timeline of Layoffs

January–March: Early-Year Adjustments

The year began with aggressive realignment.

-

Meta: 3,600 cuts (5%), targeting low performers for an “intense year” of productivity

-

Stripe: 300 roles cut in product and engineering

-

Amazon: Dozens removed from its communications team

-

Salesforce: 1,000 jobs cut globally, with new openings in AI sales

-

Workday: 1,750 layoffs (8.5%) tied to a global restructuring

-

HP: Up to 2,000 cuts under its Future Now program

-

Autodesk: 1,350 jobs (9%) cut to refocus on AI and cloud strategy

-

Blue Origin: About 1,000 layoffs (10%) amid engineering and management reshuffles

-

HPE: Planned 2,500 job cuts (5%) over 18 months

-

Oracle: Up to 11,000 roles (7%) eliminated in cloud and senior teams

More than 63,000 tech jobs were lost in the first half alone, driven by AI efficiencies and broader uncertainty.

April–June: Mid-Year Escalation

The spring months brought even steeper reductions, especially in AI and hardware.

-

Intel: 21,000 layoffs (20%) under new CEO Lip-Bu Tan to cut bureaucracy and compete in AI chips

-

Automattic: 240 roles (16%) cut to improve efficiency

-

CrowdStrike: 500 layoffs (5%) tied to cost realignment

-

Microsoft: Nearly 6,000 roles (3%) removed

-

Bumble: 240 roles (30%) eliminated as part of strategic consolidation

AI was cited as both a cause and a solution — companies downsizing while pouring new investment into automation infrastructure.

July–September: The Summer Surge

Layoffs peaked again mid-year.

-

Microsoft: Another 9,000 job cuts, continuing staff reductions across gaming and cloud

-

Intel: Thousands more cuts, bringing its reduction target to 22% of its workforce

-

Jamf: 6% of staff trimmed to improve margins

-

Scale AI: 200 full-time roles and 500 contractors cut in its generative AI team

-

Dell Technologies: Thousands of layoffs despite steady revenue

-

Nextdoor: 67 roles (12%) cut to accelerate profitability

-

Salesforce: 4,000 jobs cut in customer support amid AI adoption

-

Fiverr: 250 layoffs (30%) as it repositioned to become an “AI-first company”

October and Beyond: Late-Year Mega-Cuts

The final quarter opened with several large-scale announcements.

-

Google: 100+ jobs cut in its cloud unit, 50 in Sunnyvale, and 200 contractors dropped

-

Meta: 600 layoffs in its AI division

-

Amazon: 14,000 corporate job cuts (10%) to simplify operations and lean into automation

-

Chegg: 388 roles (45%) cut amid AI-driven disruption

-

Texas Instruments: 163 planned layoffs tied to a December plant closure

Tech Layoffs 2025 (Credit: Layoffs.FYI)

Trends and Implications

The 2025 layoff wave has been defined by AI adoption and tighter capital markets. The World Economic Forum projects that automation could eliminate 80–85 million jobs globally within three years, while potentially creating up to 170 million new roles. Companies are cutting to reinvest in growth areas like AI, cloud, and infrastructure.

Despite the immediate pain, these reductions reflect a long-term push toward sustainability. Total layoffs could reach 235,000 by year-end — signaling both a challenging correction and the beginning of a new phase in tech’s evolution.

Comprehensive Layoff List of Tech Layoffs (Updated Monthly)

Below is a running list of the most notable tech layoffs in 2025, covering startups, mid-size firms, and Big Tech. This tracker will continue to be updated as new layoffs are confirmed.

| Company | Employees Laid Off | % Workforce | Date | Sector | HQ | Notes |

|---|---|---|---|---|---|---|

| Meta | 8,000 | 7% | Jan 2025 | Social Media / AI | Menlo Park, CA | Second major restructuring in 18 months to consolidate overlapping AI teams. |

| 6,200 | 4% | Feb 2025 | Cloud / AI | Mountain View, CA | Reductions across cloud and hardware teams amid automation initiatives. | |

| Amazon | 19,000 | 3% | October 2025 | E-commerce / Cloud | Seattle, WA | Streamlining operations in Alexa, Devices, and Prime Video divisions. |

| Microsoft | 9,000 | 4% | Jul 2025 | Software / AI | Redmond, WA | Ongoing restructuring across gaming, cloud, and security divisions. |

| Intel | 21,000 | 20% | Apr 2025 | Semiconductors / AI Hardware | Santa Clara, CA | Deep cuts under new CEO Lip-Bu Tan to compete in AI chip manufacturing. |

| Workday | 1,750 | 8.5% | Feb 2025 | HR / SaaS | Pleasanton, CA | Global restructuring to prioritize AI sales and international expansion. |

| Oracle | 11,000 | 7% | Mar 2025 | Cloud / Enterprise Software | Austin, TX | Cost reductions across cloud infrastructure and senior management. |

| HP | 2,000 | 6% | Feb 2025 | Hardware / Computing | Palo Alto, CA | Part of the “Future Now” plan targeting $300M in annual savings. |

| Autodesk | 1,350 | 9% | Feb 2025 | SaaS / Design | San Francisco, CA | Reshaping strategy to focus on AI, cloud, and platform tools. |

| Blue Origin | 1,000 | 10% | Feb 2025 | Aerospace | Kent, WA | Engineering and management teams are being reduced to improve launch cadence. |

| CrowdStrike | 500 | 5% | May 2025 | Cybersecurity | Sunnyvale, CA | Streamlining operations to maintain margin growth. |

| Bumble | 240 | 30% | Jun 2025 | Social / Apps | Austin, TX | Major staff reduction to realign with long-term strategy. |

| Salesforce | 4,000 | 5% | Sep 2025 | SaaS / CRM | San Francisco, CA | Customer support teams cut as the company invests in AI integration. |

| Scale AI | 200 + 500 contractors | 14% | Jul 2025 | AI / Data Labeling | San Francisco, CA | Downsizing the generative AI division amid focus on profitability. |

| Fiverr | 250 | 30% | Sep 2025 | Marketplace / AI | Tel Aviv, Israel | Transitioning to an “AI-first” platform strategy. |

| Chegg | 388 | 45% | Oct 2025 | EdTech / AI | Santa Clara, CA | Cuts following AI-driven traffic declines. |

| TCS | — | — | 2025 | IT Services | Mumbai, India | Significant workforce reductions across delivery centers. |

| ByteDance | 65 | — | 2025 | Media / Apps | Los Angeles, CA | Downsized U.S. operations. |

| Texas Instruments | 163 | — | Dec 2025 | Semiconductors | Dallas, TX | Plant closure scheduled by year-end. |

Editorial Note:

This tracker includes confirmed layoffs from credible public filings and company announcements. It will be updated regularly as new information becomes available.

Trends and Patterns Emerging in 2025

The layoff wave of 2025 isn’t a repeat of the pandemic correction — it’s a full structural shift. Companies are rethinking how they operate, hire, and deploy talent in an era where AI automation and financial discipline are shaping every decision.

1. AI Is Reshaping Headcounts

Artificial intelligence is both the spark and the scalpel. Many layoffs this year were labeled as “AI-driven restructuring,” a quiet acknowledgment that automation is replacing functions once handled by humans. Tasks in engineering, data analysis, and operations are increasingly handled by large language models and machine learning tools. The result: smaller teams, faster output, and fewer middle layers.

2. Startups Feel the Pinch First

Startups, once insulated by venture capital, have been hit hardest. Nearly 60% of all layoffs have come from early and mid-stage companies as investors push for profitability. Burn rates that looked manageable in 2021 now seem reckless under today’s tighter funding conditions. Startups in SaaS, fintech, and logistics tech have been especially affected, with many cutting 10–20% of staff just to extend runway.

3. Big Tech’s Strategic Realignment

Unlike the survival cuts of smaller firms, Big Tech’s layoffs have been more calculated. Google, Meta, Microsoft, and Amazon are shifting resources toward AI and infrastructure while trimming non-core divisions. These reductions are less about crisis management and more about reshaping the workforce for long-term automation and efficiency.

4. Silent Layoffs Become Common

A growing number of companies are opting for unannounced cuts — contract non-renewals, performance-based exits, and partial team disbandments that never make headlines. Insiders estimate that these “silent layoffs” now account for up to 30% of the year’s job losses, allowing companies to reduce headcount without the public backlash.

5. The Global Shift

Layoffs have gone global. While the United States remains the epicenter, similar cuts are spreading through India, Europe, and parts of Asia. Companies that expanded remote teams during the pandemic are now scaling them back as cost advantages shrink. Outsourcing firms like TCS have also begun tightening their workforce to adjust to slowing demand.

6. AI Efficiency vs. Human Cost

Every layoff memo this year echoes the same reasoning — “efficiency,” “streamlining,” or “AI transformation.” Yet beneath those terms lies a deeper tradeoff: the speed of automation versus the stability of human employment. As AI systems become embedded in daily operations, the workforce is being rebuilt from the top down — smaller, faster, and heavily augmented by software.

The Human Side of Layoffs

Behind the numbers are real people — engineers, designers, and operators — caught in a transition that’s reshaping how work in tech is defined. For many, 2025 isn’t just another round of job cuts; it’s a wake-up call that stability in the tech sector has become the exception, not the rule.

1. From Employee to Builder

A growing number of laid-off professionals aren’t returning to corporate life. Instead, they’re launching solo projects, small SaaS tools, and micro-startups. The lower barrier to building — powered by open-source software, AI copilots, and no-code platforms — has created a new generation of independent builders. What began as a reaction to layoffs is quickly turning into a quiet entrepreneurial movement.

2. Re-skilling Becomes Survival

The fastest-growing trend among displaced workers is retraining. Online platforms are reporting spikes in enrollment for AI, automation scripting, and data infrastructure courses. Many are learning prompt engineering and no-code development, not to land new jobs, but to stay relevant in an economy where technology evolves faster than job descriptions.

3. The Emotional Fallout

After multiple layoff cycles in just a few years, fatigue has set in. Workers describe a sense of whiplash — from being told they’re part of a “family” one quarter to receiving automated exit emails the next. Anxiety and burnout are now common, with some professionals leaving tech entirely for slower, more predictable fields.

4. Finding Strength in Community

Support networks have filled the gap left by employers. Layoff survivor groups, Discord servers, and LinkedIn circles are helping affected workers share leads, freelance gigs, and startup ideas. These communities are becoming informal accelerators — part therapy, part incubator — where people are rebuilding both income and confidence.

5. The Silver Lining

The upheaval has exposed one truth: the same innovation mindset that built the tech industry is now helping workers reinvent themselves. For many, losing a job became the moment they finally built something of their own.

What It Means for the Industry

The layoffs of 2025 are more than a cost-cutting measure — they mark a permanent shift in how the tech industry defines success. After a decade fueled by cheap capital and unrestrained hiring, companies are now being judged by efficiency, profitability, and endurance.

1. Profit Over Growth

Investors have redrawn the scoreboard. Growth at all costs no longer earns a premium; sustainable revenue does. Startups that once chased user acquisition are now prioritizing recurring income and lower burn. The result is a leaner ecosystem where financial discipline is a competitive advantage, not a constraint.

2. AI Is Rewriting the Org Chart

AI isn’t just another tool — it’s changing the structure of companies themselves. Teams that once relied on layers of management and support are shrinking as automation takes over repetitive work. Marketing, customer service, and parts of engineering are now being handled by AI copilots. The future organization will look less like a pyramid and more like a network of small, cross-functional units powered by intelligent systems.

3. Founders Who Build to Survive

Venture capital is favoring founders who can weather downturns, not just raise big rounds. The best founders of 2025 are the ones who can do more with less — those who can build products that generate real cash flow and rely on small, high-impact teams. In this new cycle, resilience beats hype.

4. The Reset Before the Next Boom

History shows that every contraction plants the seeds for the next wave of innovation. The 2025 layoffs are freeing up thousands of skilled professionals who no longer want to depend on corporate stability. Many will start companies of their own — and some of those will define the next decade. What looks like retrenchment today may turn out to be renewal tomorrow.

Conclusion: The Age of Efficiency

The tech industry has entered what many now call the Age of Efficiency. After years of overhiring and explosive spending, the era of endless growth has given way to one of precision. Every role, every product, and every dollar is being re-examined through the lens of necessity.

The layoffs of 2025 mark more than a financial correction — they mark a mindset shift. Companies that once celebrated size are learning that endurance and focus matter more. The industry’s new motto is simple: do more with less, and make it count.

Yet, amid the job losses and restructuring, there’s a quiet optimism. Thousands of talented people are reemerging as founders, freelancers, and innovators. What feels like contraction may actually be creation — a forced reset that gives rise to the next wave of products, ideas, and companies built for sustainability.

If 2025 is remembered as the year tech companies cut deep, it may also be remembered as the year the industry finally grew up.

At TechStartups.com, we track the founders, funding, and shifts shaping the next generation of innovation. Since 2017, our mission has been to amplify emerging startups and the people behind them — especially in times of transition. As the industry redefines itself for a new era of efficiency, we’ll continue spotlighting the builders turning uncertainty into opportunity.