Top Public Companies Worth Billions With No Revenue

Posted On October 16, 2025

0

2.6K Views

The Zero Dollar Club: Meet the Public Companies Worth Billions Without Making a Dime

A strange new club has emerged on Wall Street: billion-dollar public companies with zero revenue. Once the stuff of Silicon Valley legend, this kind of speculation has now gone mainstream. Investors are pouring billions into companies that don’t sell a single product yet — betting instead on future breakthroughs in nuclear energy, quantum computing, and next-gen materials.

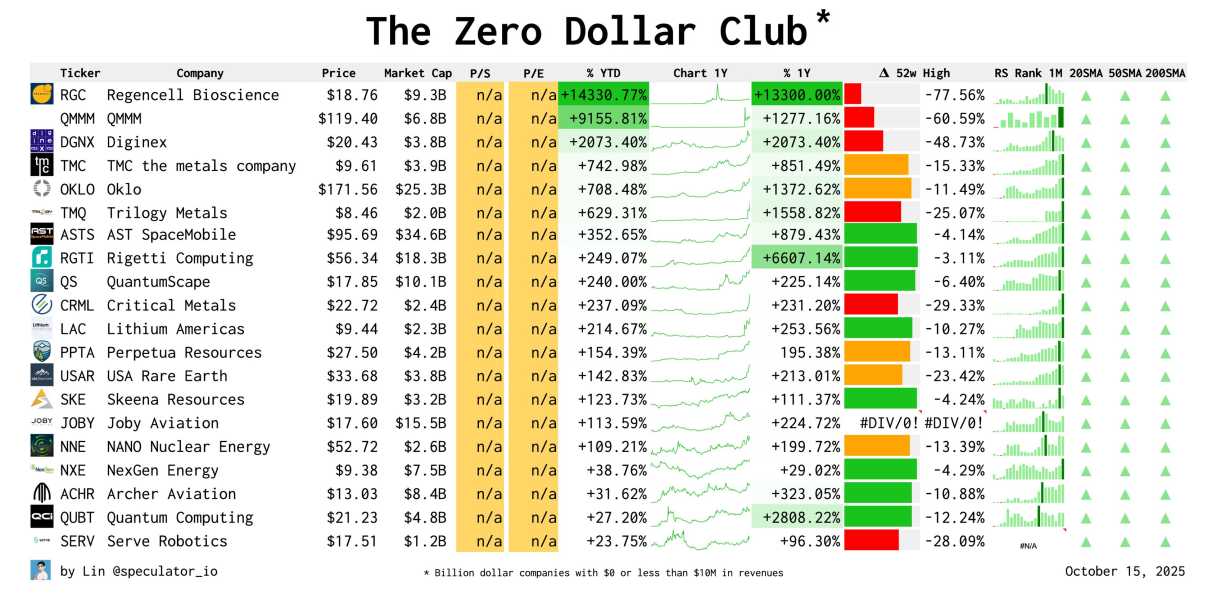

Below is a snapshot of some of the biggest names driving this phenomenon. Every one of them is valued in the billions. Most generate less than $10 million in annual revenue. A few make nothing at all.

The list is compiled from public filings and market data as of October 15, 2025.

It tracks public companies valued above $1 billion but generating less than $10 million in annual revenue. In most cases, reported sales remain at or near zero.

The most striking outlier is Regencell Bioscience (RGC) — a Hong Kong–based biotech whose market cap exploded to roughly $9.3 billion, up more than 14,000 percent year-to-date.

It has no product on the market, no recurring sales, and no clear timeline for commercialization — yet investors have treated it like the next generational breakthrough.

This pattern repeats across the group: sky-high valuations, negligible revenue, and stories powerful enough to attract retail traders and institutional bets alike.

The Zero Dollar Club

The Zero Dollar Club spans nearly every frontier industry — from fusion dreams to quantum promises, and from deep-sea mining to flying taxis. These companies are united by a single paradox: sky-high valuations without a single product on the shelf. Each sector tells a different story, but all share the same faith — that the future will eventually pay for today’s imagination.

QuantumScape (QS), Lithium Americas (LAC), and Archer Aviation (ACHR) represent the electric-mobility surge.

All three trade on expectations, not earnings. Their valuations hinge on battery breakthroughs, lithium extraction, and future FAA certification rather than today’s revenue lines.

AST SpaceMobile (ASTS), Joby Aviation (JOBY), and Oklo (OKLO) promise to reshape how we communicate, fly, and power cities.

Each remains in a pre-commercial phase, waiting on regulatory milestones and multi-year infrastructure rollouts.

Nano Nuclear Energy (NNE), NexGen Energy (NXE), and Trilogy Metals (TMQ) are bets on the next energy cycle.

They’re valued for future production potential — uranium, modular reactors, and U.S.-backed energy security — even though most have no operating revenue.

Rigetti Computing (RGTI) and Quantum Computing Inc. (QUBT) are tiny players in a trillion-dollar dream.

Their combined revenue wouldn’t cover a mid-sized seed round, yet their valuations ride on being early to the quantum-hardware race.

The Metals Company (TMC), Perpetua Resources (PPTA), Critical Metals (CRML), and USA Rare Earth (USAR) round out the materials frontier.

They produce no current revenue but command billion-dollar valuations on hopes of supplying the next generation of EVs and defense systems.

The question practically asks itself: why would anyone pour billions into companies with no revenue? The answer lies in a mix of narrative, momentum, and macro conditions that refuse to die.

Narrative Valuation

Investors are buying potential, not profits. These firms are seen as call options on the future — the promise of a solid-state battery, a functioning fusion reactor, or a low-orbit telecom network. As long as the story feels possible, the price can outrun the product.

Cheap-Money Legacy

The speculative fever of 2020–2021 reshaped investor psychology. Years of near-zero interest rates created a generation of traders who value possibility more than profitability. Even as rates rise, that mindset lingers.

Retail Momentum and FOMO

Platforms like X and Reddit have turned market participation into entertainment. When a stock like Regencell or The Metals Company catches fire, retail traders swarm in — not for fundamentals, but for the thrill of catching the next rocket.

National Security and Policy Tailwinds

Some names benefit from being on the “right side” of history. Nuclear power, quantum computing, and critical minerals are viewed as strategic sectors. Grants, government partnerships, and policy support often replace early revenue as a sign of legitimacy.

Together, these forces create an environment where narrative feels like traction. In that gap between belief and proof, billions of dollars move.

For every moonshot in the Zero Dollar Club, there’s an equally brutal chart behind it. Many of these companies are still down 70–90% from their previous highs, even as they’ve rallied in 2025. Volatility cuts both ways — story stocks soar on hope and collapse on silence.

Investors betting on dreams often underestimate the time, cost, and complexity of building physical technology. Delays, failed tests, or regulatory holdups can erase billions overnight.

For founders, that’s the takeaway. Momentum opens doors, but execution keeps them open. The market will always fund imagination — until it asks for proof.

In a world that rewards bold storytelling, the real differentiator isn’t who dreams bigger — it’s who delivers first.

| Ticker | Company | Sector | Market Cap | Revenue Status | YTD Change |

|---|---|---|---|---|---|

| RGC | Regencell Bioscience | Biotech | $9.3B | $0 | +14,330% |

| QS | QuantumScape | EV Batteries | $10.1B | $0 | +240% |

| OKLO | Oklo | Nuclear Energy | $25B | $0 | +708% |

| ASTS | AST SpaceMobile | Satellite Tech | $34.6B | <$10M | +352% |

| JOBY | Joby Aviation | eVTOL | $15.5B | ≈$0 | +113% |

| TMC | The Metals Company | Deep-Sea Mining | $3.9B | $0 | +742% |

| NNE | Nano Nuclear Energy | Nuclear | $2.6B | $0 | +109% |

| RGTI | Rigetti Computing | Quantum | $18.3B | $1.8M | +249% |

| LAC | Lithium Americas | Clean Energy | $12B | $0 | +180% |

| NXE | NexGen Energy | Uranium | $3.5B | $0 | +95% |

| PPTA | Perpetua Resources | Mining | $2.2B | $0 | +71% |

The speculative behavior that used to fuel unicorns in Silicon Valley has now migrated to Wall Street.

What began as a startup phenomenon — founders raising billions on vision slides and market potential — has become a mainstream investing mindset. Public markets are now rewarding the same playbook that once built private unicorns: tell a story bold enough, and valuation will follow.

For founders, this is both inspiring and sobering. It shows how narrative can still move capital at scale — but also how quickly that capital can vanish when the story breaks. The Zero Dollar Club isn’t just about public companies with no revenue; it’s a mirror reflecting the startup world’s own obsession with growth over grounding.

The rise of billion-dollar, revenue-free public companies should make every founder pause. It’s proof that markets still reward vision — but also that hype alone can’t hold forever.

1. Vision Still Sells

Every company on this list — from QuantumScape to Joby Aviation — built its valuation on a story. Investors weren’t buying numbers; they were buying narratives. The promise of a better battery, cleaner power, or faster quantum computer became the product itself. Founders should take note: storytelling isn’t marketing fluff — it’s market fuel.

2. Timing Is Everything

Most of these firms went public during waves of excitement — the EV boom, the SPAC craze, the clean-energy rush. They didn’t just sell ideas; they sold them at the perfect moment. Founders don’t need perfect timing, but they do need awareness. Knowing when capital is greedy — and when it’s scared — can be the difference between survival and obscurity.

3. Valuation Isn’t Validation

A billion-dollar market cap without a dollar in revenue isn’t success; it’s speculation. Founders should remember that valuation is opinion, not outcome. It buys headlines, not sustainability. The real validation still comes from customers, not capital.

4. The Reckoning Always Comes

Nearly all of these companies have faced brutal drawdowns since their highs. The market always asks for proof — products shipped, users gained, or deals signed. For startups, that means building something that lasts longer than a funding cycle.

5. Optimism Still Wins — When It’s Earned

Despite the froth, these companies exist because the world wants to believe in big ideas again — nuclear, quantum, fusion, space. That’s good news for founders. The appetite for bold innovation hasn’t died; it’s just waiting for execution to catch up with ambition.

The Zero Dollar Club isn’t a warning against dreaming big — it’s a reminder to ground your dreams in reality. Capital will chase stories for a while, but it stays with those who deliver.