Top Startup and Tech Funding News – September 16, 2025

It’s Tuesday, September 16, 2025, and we’re back with the top startup and tech funding news stories shaping today’s headlines. From billion-dollar robotics bets and consumer hardware plays to biotech breakthroughs and fintech expansion, capital is flowing across every stage and geography.

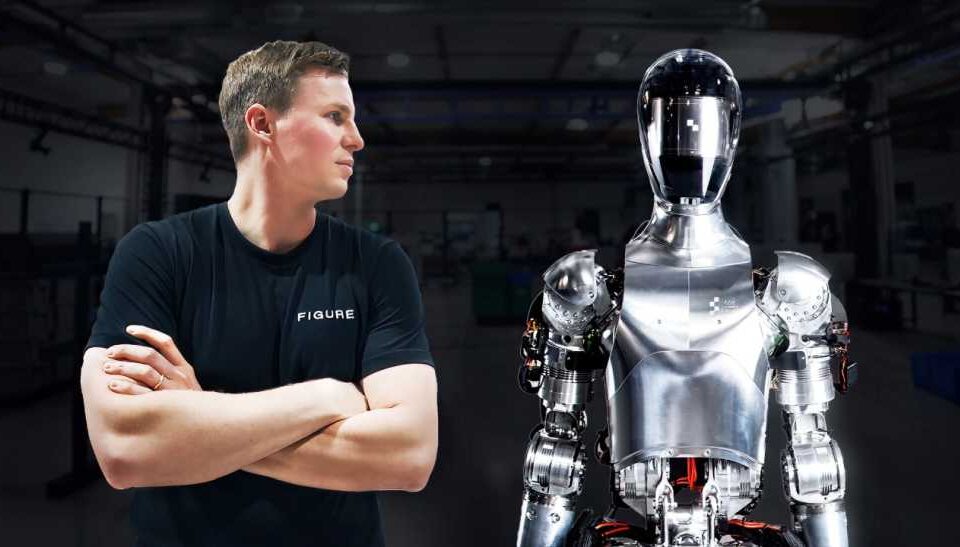

Today’s coverage spotlights both late-stage giants and ambitious up-and-comers. Figure captured global attention with a blockbuster $1 billion+ Series C for humanoid robotics, while Carl Pei’s Nothing pulled in $200 million to push deeper into AI-driven consumer electronics. Biotech had its moment with Dualitas ($65M Series A) and AllRock Bio ($50M Series A) advancing next-generation therapies, while fintech player HALA secured $157 million to expand SME banking in the Middle East. Agtech innovator Nofence raised $35 million, and U.S. compliance AI provider WorkFusion added $45 million to fuel bank partnerships.

Funding Highlights

-

Figure dominated the day with a Series C north of $1 billion, propelling its humanoid robots into homes and commercial use.

-

Nothing raised $200 million at a $1.3 billion valuation to expand its lineup of AI-driven devices.

-

HALA secured $157 million to accelerate SME financial inclusion across Saudi Arabia and beyond.

-

Biotech activity was strong: Dualitas ($65M) and AllRock Bio ($50M) are advancing clinical programs in immunology and pulmonary disease.

-

WorkFusion’s $45 million round highlighted demand for AI-driven compliance in global banking.

Investor Activity

Today’s funding drew heavyweight participation across the venture spectrum. Parkway Venture Capital, Tiger Global, and TPG’s Rise Fund anchored the largest rounds, while corporates like Nvidia, Intel Capital, Qualcomm Ventures, and Salesforce Ventures placed strategic bets. Versant Ventures and Qiming drove momentum in biotech, while early-stage backers Together Fund and Z47 supported new SaaS infrastructure plays.

The spread revealed a barbell pattern once again: massive late-stage rounds for capital-intensive AI and robotics alongside healthy Series A and seed activity across biotech, fintech, and developer tools. Together, these deals underscore investor conviction in founders tackling fundamental industries and reshaping core infrastructure.

Here’s the full breakdown. Until tomorrow, have a great evening.