Top Startup and Tech Funding News – September 15, 2025

It’s Monday, September 15, 2025, and we’re back with the top startup and tech funding news shaping the day. From billion-dollar fintech financings and digital manufacturing plays to early bets in fertility, Web3, and edtech, capital flowed across every stage and geography.

Today’s highlights include a massive $2.4 billion credit facility for Saudi fintech Tamara, a $290 million Series E for Divergent Technologies to expand its AI-driven 3D manufacturing, and a $235 million Series A for Lila Sciences to build autonomous AI research labs. On the other end of the spectrum, scrappy up-and-comers like Tin Can, PopChill, and Epoch Protocol also made headlines with fresh seed and early-stage rounds.

Funding Highlights

-

Tamara secured a record-breaking $2.4 billion Shariah-compliant facility to expand its buy-now-pay-later super app ambitions.

-

Divergent Technologies raised $290 million in Series E funding to scale its AI-powered 3D manufacturing platform.

-

Lila Sciences closed a $235 million Series A to build AI-driven “science factories.”

-

CuspAI landed $100 million Series A for materials discovery with AI.

-

Conceivable Life Sciences raised $50 million in Series A funding to automate IVF labs.

-

MarqVision secured $48 million in Series B funding to grow its brand protection platform.

-

Arch brought in $52 million in Series B funding to streamline private market investing.

-

GreenLite raised $49.5 million in Series B funding for AI-powered construction reviews.

-

Seed and pre-seed momentum continued with Tin Can ($3.5M), Epoch Protocol ($1.2M), CrazyGoldFish (undisclosed government seed grant), and MyNaksh (~$0.9M pre-seed).

Investor Activity

Today’s deals drew heavyweight participation from global names including Goldman Sachs, Citi, Apollo, Rochefort Asset Management, Oak HC/FT, Insight Partners, NEA, Temasek, and Salesforce Ventures. Corporate investors like Samsung Ventures, Hyundai Motor Group, and ADIA deepened their bets, while early-stage backers such as Eximius Ventures and PSL Ventures seeded fresh ideas in fintech, Web3, and edtech.

The mix underscored a familiar barbell pattern: mega-rounds powering capital-intensive fintech and industrial AI alongside healthy seed and Series A activity across fertility, education, and consumer tech. Together, these financings highlight continued conviction in founders reimagining how people live, build, and invest.

Here’s the full breakdown. Until tomorrow, stay tuned.

Lila Sciences Raises $235M in Series A Funding for AI-Driven Research Labs

Lila Sciences, a Flagship Pioneering-backed startup, has closed a $235 million Series A funding to expand its autonomous AI-powered research labs. The Cambridge-based company is building “AI Science Factories” to fully automate the scientific method – an effort dubbed creating a “scientific superintelligence.”

The round was co-led by Braidwell and Collective Global, and included investors such as Altitude Life Science Ventures, Alumni Ventures, ARK Venture Fund, Common Metal, and an Abu Dhabi Investment Authority subsidiary. This financing follows a $200M seed raised in March 2025, bringing Lila’s total funding to roughly $435M. The new capital will help the company scale its robotic labs and accelerate drug and material discovery using AI-driven workflows.

Funding Details:

-

Startup: Lila Sciences

-

Investors: Braidwell (co-lead), Collective Global (co-lead), Altitude Life Science Ventures, Alumni Ventures, ARK Venture Fund, Common Metal, Abu Dhabi Investment Authority (ADIA)

-

Amount Raised: $235 million

-

Total Raised: ~$435 million (including prior seed)

-

Funding Stage: Series A

-

Funding Date: September 15, 2025

Saudi Fintech Tamara Secures $2.4B Shariah-Compliant Credit Facility

Saudi Arabia’s buy-now-pay-later unicorn Tamara has secured up to $2.4 billion in a new Shariah-compliant financing facility to fuel its growth. The package provides an immediate $1.4B draw and an additional $1.0B available over three years (subject to approvals), refinancing and expanding a prior $500M facility led by Goldman Sachs.

Global investors, including Goldman Sachs, Cit,i and Apollo-managed funds, are backing the deal, one of the largest fintech financings in the Gulf. Tamara serves over 20 million customers and 87,000 merchants (including Apple, Amazon, and IKEA), and plans to use the new capital to broaden its payment and credit offerings and advance its vision of becoming a financial “super app.” CEO Abdulmajeed Al-Sukhan noted that this landmark facility accelerates the company’s growth trajectory in line with Saudi Vision 2030.

Funding Details:

-

Startup: Tamara

-

Investors: Goldman Sachs, Citi, Apollo-managed funds

-

Amount Raised: $2.4 billion (credit facility)

-

Total Raised: ~$2.74 billion (including prior equity rounds)

-

Funding Stage: Shariah-compliant debt facility

-

Funding Date: September 15, 2025

Conceivable Life Sciences Raises $50M in Series A Funding for Automated IVF Lab

Conceivable Life Sciences, a California fertility tech startup, has closed a $50 million Series A funding to bring its AI-powered robotic IVF lab (called AURA) to clinics across the U.S.. The round was led by Advance Venture Partners (AVP) with backing from ARTIS Ventures, Stride, and ACME, lifting Conceivable’s total funding to $70M after a $20M seed round in 2022.

Conceivable’s AURA platform automates over 200 steps of the IVF process using robotics and AI, aiming to improve pregnancy outcomes, reduce costs, and expand access to fertility treatments. The company plans a commercial debut of its fully automated IVF lab in early 2026. CEO Alan Murray said the funding validates the vision of transforming IVF through consistent, AI-driven automation and will help bring this breakthrough technology to market faster.

Funding Details:

-

Startup: Conceivable Life Sciences

-

Investors: Advance Venture Partners (lead), ARTIS Ventures, Stride, ACME

-

Amount Raised: $50 million

-

Total Raised: $70 million

-

Funding Stage: Series A

-

Funding Date: September 15, 2025

Tin Can Raises $3.5M in Funding to Launch Kid-Friendly Landline Phone

Tin Can, a Seattle startup creating a colorful, Wi-Fi-connected landline phone for children, has raised $3.5 million in seed funding. The round was backed by PSL Ventures (lead), Newfund Capital, Mother Ventures, and Solid Foundations.

Tin Can’s toy-like phone (shaped like an oversized tin can) lets kids call each other or approved contacts without internet apps, tapping into parental demand to limit screen time. Founder Chet Kittleson noted that families have eagerly adopted the phones – the company sold out its first two batches and is now taking December pre-orders.

The new funds will help Tin Can scale manufacturing and expand its kid-safe social calling platform amid growing interest in analog alternatives to smartphones.

Funding Details:

-

Startup: Tin Can

-

Investors: PSL Ventures (lead), Newfund Capital, Mother Ventures, Solid Foundations

-

Amount Raised: $3.5 million

-

Total Raised: $3.5 million

-

Funding Stage: Seed

-

Funding Date: September 15, 2025

CuspAI Raises $100M in Series A Funding for AI-Driven Materials Discovery

CuspAI, a Cambridge, UK startup building an AI “search engine” for materials science, announced a $100 million Series A funding to scale its platform. The round was co-led by New Enterprise Associates (NEA) and Temasek, with participation from Samsung Ventures, Hyundai Motor Group, NVentures, Basis Set Ventures, Prosus Ventures, Northzone, LocalGlobe, and Giant Ventures. Notably, leading AI investors and founders (including OpenAI co-founder Durk Kingma, Google researcher Zoubin Ghahramani, and Hugging Face’s Thomas Wolf) joined as angel backers.

CuspAI’s platform enables rapid discovery of new materials for applications like clean energy and electronics, and it already partners with companies such as Hyundai (on sustainable energy) and Meta (on carbon capture). The fresh funding will expand CuspAI’s operations in the US and Asia and accelerate product development. This Series A follows a $30M seed round in 2024, bringing total capital raised to about $130M.

Funding Details:

-

Startup: CuspAI

-

Investors: New Enterprise Associates (co-lead), Temasek (co-lead), Samsung Ventures, Hyundai Motor Group, NVentures, Basis Set Ventures, Prosus Ventures, Northzone, LocalGlobe, Giant Ventures (plus prominent angel investors)

-

Amount Raised: $100 million

-

Total Raised: $130 million

-

Funding Stage: Series A

-

Funding Date: September 15, 2025

PopChill Raises $3M in Series A Funding to Power Resale Platform

PopChill, a Taipei-based marketplace for luxury secondhand fashion, has raised $3 million in a Series A round. The round was led by Darwin Ventures, with participation from ITIC, AVA Angels, Taipei Angels, and Dream Co-Founder Angel One ASO Global Fund. PopChill plans to use the capital to enhance its AI-driven platform – developing smarter recommendation engines and automated fraud prevention – to improve the buyer and seller experience.

CEO Andy Kuo says PopChill aims to foster a sustainable shopping community by allowing users to easily trade pre-owned designer clothing, shoes, and bags. The new funds will fuel technology development and marketing as PopChill scales its user base in Taiwan and beyond.

Funding Details:

-

Startup: PopChill

-

Investors: Darwin Ventures (lead), ITIC, AVA Angels, Taipei Angels, Dream Co-Founder Angel One ASO Global Fund

-

Amount Raised: $3 million

-

Total Raised: $3 million

-

Funding Stage: Series A

-

Funding Date: September 15, 2025

CrazyGoldFish Secures Government Seed Grant for AI Education Tech

CrazyGoldFish, an AI-driven education startup incubated at IIT Mandi’s iHub, secured funding under India’s Startup India Seed Fund Scheme. The exact amount was not disclosed (seed fund grants typically range in the low millions), but the government-backed investment will enable CrazyGoldFish to advance its plug-and-play AI reasoning layer for educational content.

The platform unifies exam results, learning data, and content to identify gaps and deliver personalized, bias-free assessments. Founder Rahul Khandelwal said this seed funding will help the team “reclaim teacher time and democratize personalization” by integrating their AI tools into ed-tech products. CrazyGoldFish plans to pilot its solution in India before expanding globally to improve learning outcomes across institutions.

Funding Details:

-

Startup: CrazyGoldFish

-

Investors: Government of India (Startup India Seed Fund Scheme)

-

Amount Raised: Not disclosed (seed grant)

-

Total Raised: Not disclosed

-

Funding Stage: Seed (government grant)

-

Funding Date: September 15, 2025

MyNaksh Raises $0.9 million in Pre-Seed Funding for AI Astrology Platform

MyNaksh, an AI-powered personal astrology platform based in India, raised ₹7.5 crore (about $0.9 million) in a pre-seed funding round. The round was led by Eximius Ventures and Gemba Capital, with participation from a curated network of angel investors, including Infinyte Club. MyNaksh’s app uses AI to create deeply personalized astrological guidance from day one, combining technology with expert astrologers and personal connections.

Founder Nitesh Salvi says the investment will help restore astrology’s status as a culturally rooted tool for self-awareness and growth, moving beyond gimmicks. The funds will be used to accelerate product development and expand MyNaksh’s user base across India’s large astrology market.

Funding Details:

-

Startup: MyNaksh

-

Investors: Eximius Ventures (lead), Gemba Capital, Infinyte Club (angels)

-

Amount Raised: ₹7.5 crore (≈$0.9 million)

-

Total Raised: ₹7.5 crore

-

Funding Stage: Pre-Seed

-

Funding Date: September 15, 2025

MarqVision Raises $48M in Series B Funding to Expand Brand Protection Platform

MarqVision, a Los Angeles startup providing an AI-powered platform for brand protection, closed a $48 million Series B. The round was led by Peak XV Partners, with participation from Salesforce Ventures, HSG, Coral Capital, and notable investors like Michael Seibel (Partner Emeritus at Y Combinator) and returning backers Y Combinator, Altos Ventures, and Atinum Investment.

MarqVision will use the new capital to accelerate its global expansion and advance its managed-service platform, which detects and removes counterfeit, piracy, and impersonation across e-commerce channels. CEO Mark Lee noted that the company now serves 350 global brands across industries (from fashion and gaming to pharma and automotive). The Series B brings MarqVision’s total funding to date to $90 million.

Funding Details:

-

Startup: MarqVision

-

Investors: Peak XV Partners (lead), Salesforce Ventures, HSG, Coral Capital, Michael Seibel, Y Combinator, Altos Ventures, Atinum Investment

-

Amount Raised: $48 million

-

Total Raised: $90 million

-

Funding Stage: Series B

-

Funding Date: September 15, 2025

Arch Raises $52M in Series B Funding to Scale Alternative Investing Platform

Arch, a New York fintech simplifying private market investing, has raised $52 million in a Series B round. The financing was led by Oak HC/FT, with Menlo Ventures, Craft Ventures, Quiet Capital, and other investors participating. Arch’s platform automates the lifecycle of alternative investments (private equity, venture, hedge funds, real estate, etc.), giving investors real-time visibility and reporting across their portfolios.

CEO Ryan Eisenman said Arch is focused on meeting the needs of institutional investors, wealth managers, and family offices. The new funds will support Arch’s ongoing expansion and product development as it currently manages services for over $250 billion in private assets across hundreds of allocators.

Funding Details:

-

Startup: Arch

-

Investors: Oak HC/FT (lead), Menlo Ventures, Craft Ventures, Quiet Capital

-

Amount Raised: $52 million

-

Total Raised: $52 million

-

Funding Stage: Series B

-

Funding Date: September 15, 2025

Epoch Protocol Closes $1.2M in Seed Funding Round for Web3 Intent Platform

Epoch Protocol, a Singapore-based Web3 startup building an “intent-solver” coordination layer, closed $1.2 million in seed funding. The round was led by L2Iterative Ventures and included Alphemy Capital, G20 Group, LongHash Ventures, SAFE VC, Hadron Ventures, and a syndicate of angel investors, including engineers from Avail, Anoma, Gaianet, Rayo Capital, Push Protocol, Devfolio, and Manta Network.

Epoch’s platform lets users specify high-level desired outcomes (intents) without dealing with underlying blockchain protocols or gas mechanics. The funds will support the development of Epoch’s protocol and the launch of public testnets to onboard developer and node operator partners. Epoch aims to abstract multi-chain complexity and enable anyone to express and execute multi-chain transactions in simple terms.

Funding Details:

-

Startup: Epoch Protocol

-

Investors: L2Iterative Ventures (lead), Alphemy Capital, G20 Group, LongHash Ventures, SAFE Ventures, Hadron FC, plus other angel investors

-

Amount Raised: $1.2 million

-

Total Raised: $1.2 million

-

Funding Stage: Seed

-

Funding Date: September 15, 2025

GreenLite Raises $49.5M in Series B Funding to Grow AI Construction Platform

GreenLite, a New York-based construction technology startup, raised $49.5 million in a Series B round to expand its AI-driven plan review platform. The financing was led by Insight Partners, with Energize Capital and existing backers Craft Ventures, LiveOak Ventures, and Chicago Ventures participating. GreenLite’s LiteTable product uses computer vision and AI to automatically ingest building plans and flag code compliance issues, dramatically speeding up the permitting process.

The company counts nearly 100 Fortune 500 customers (retailers, developers, builders) using its platform. GreenLite will deploy the new funds to expand into additional verticals (lodging, industrial, clean energy, etc.) and continue enhancing its machine-learning capabilities.

Funding Details:

-

Startup: GreenLite

-

Investors: Insight Partners (lead), Energize Capital, Craft Ventures, LiveOak Ventures, Chicago Ventures

-

Amount Raised: $49.5 million

-

Total Raised: $49.5 million

-

Funding Stage: Series B

-

Funding Date: September 15, 2025

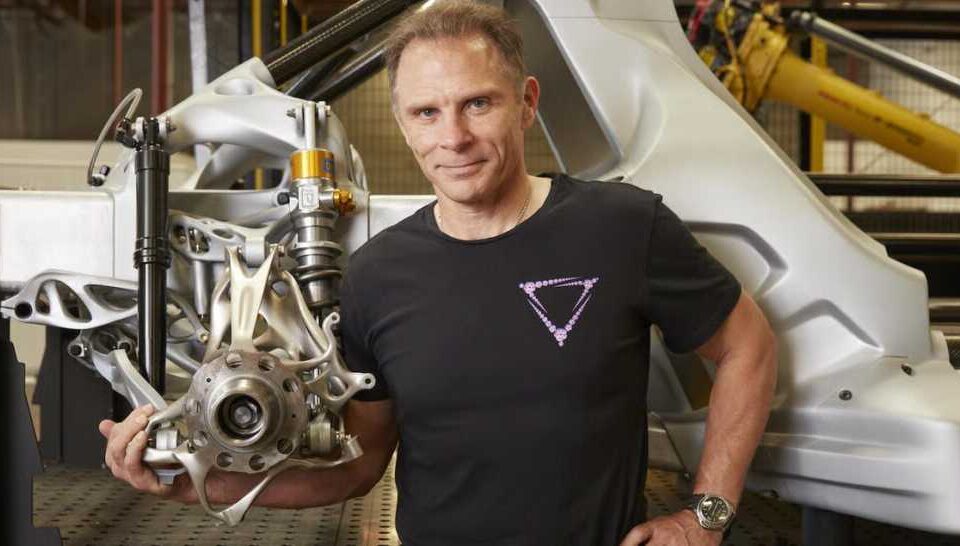

Divergent Technologies Raises $290M in Series E Funding to Scale Digital Manufacturing

Divergent Technologies, a Torrance, California startup pioneering AI-driven 3D manufacturing, closed a $290 million Series E round. The round was led by Rochefort Asset Management and included $250M in equity and $40M in debt financing. Divergent will use the capital to scale its Divergent Adaptive Production System (DAPS), an end-to-end digital manufacturing platform that designs, 3D-prints, and assembles complex components for aerospace, defense, and automotive customers.

Founded in 2014 by CEO Lukas Czinger, Divergent has produced parts for brands like Aston Martin, Bugatti, and McLaren. The new funding will help grow manufacturing capacity and develop next-generation capabilities, as the company ramps up supply for its existing and future customers.

Funding Details:

-

Startup: Divergent Technologies

-

Investors: Rochefort Asset Management (lead)

-

Amount Raised: $290 million

-

Total Raised: $290 million

-

Funding Stage: Series E

-

Funding Date: September 15, 2025

Nestimate Closes $3M Funding Round for Retirement Analytics

Nestimate, a Lincoln, Nebraska startup offering analytics for 401(k) retirement plans, has raised $3 million in funding. The round was led by S3 Ventures, with participation from PruVen Capital, TIAA Ventures, and Invest Nebraska. Nestimate’s platform provides fiduciaries, advisors, and employers with data-driven insights and modeling to implement retirement income solutions for plan participants. CEO Kelby Meyers said the new funds will support the expansion of the engineering team and further development of the product. The company plans to use the capital to extend its market reach and product offerings as it helps more organizations improve retirement outcomes for their members.

Funding Details:

-

Startup: Nestimate

-

Investors: S3 Ventures (lead), PruVen Capital, TIAA Ventures, Invest Nebraska

-

Amount Raised: $3 million

-

Total Raised: $3 million

-

Funding Stage: Seed

-

Funding Date: September 15, 2025

Tech Funding Summary Table

| Startup | Investors (Lead and notable investors) | Amount Raised | Total Raised | Funding Stage | Funding Date |

|---|---|---|---|---|---|

| Lila Sciences | Braidwell (co-lead), Collective Global (co-lead), Altitude Life Science Ventures, Alumni Ventures, ARK Venture Fund, Common Metal, ADIA | $235M | ~$435M | Series A | Sep 15, 2025 |

| Tamara | Goldman Sachs, Citi, Apollo-managed funds | $2.4B | ~$2.74B | Shariah-compliant credit facility | Sep 15, 2025 |

| Conceivable Life Sc. | Advance Venture Partners (lead), ARTIS Ventures, Stride, ACME | $50M | $70M | Series A | Sep 15, 2025 |

| Tin Can | PSL Ventures (lead), Newfund Capital, Mother Ventures, Solid Foundations | $3.5M | $3.5M | Seed | Sep 15, 2025 |

| CuspAI | New Enterprise Associates (co-lead), Temasek (co-lead), Samsung Ventures, Hyundai Motor Group, NVentures, Basis Set, Prosus Ventures, Northzone, LocalGlobe, Giant Ventures | $100M | $130M | Series A | Sep 15, 2025 |

| PopChill | Darwin Ventures (lead), ITIC, AVA Angels, Taipei Angels, Dream Co-Founder Angel One ASO Global Fund | $3M | $3M | Series A | Sep 15, 2025 |

| CrazyGoldFish | Government of India (Startup India Seed Fund Scheme) | – | – | Seed (government grant) | Sep 15, 2025 |

| MyNaksh | Eximius Ventures (lead), Gemba Capital, Infinyte Club (angel syndicate) | ₹7.5 Cr | ₹7.5 Cr | Pre-Seed | Sep 15, 2025 |

| MarqVision | Peak XV Partners (lead), Salesforce Ventures, HSG, Coral Capital, Michael Seibel, Y Combinator, Altos Ventures, Atinum | $48M | $90M | Series B | Sep 15, 2025 |

| Arch | Oak HC/FT (lead), Menlo Ventures, Craft Ventures, Quiet Capital | $52M | $52M | Series B | Sep 15, 2025 |

| Epoch Protocol | L2Iterative Ventures (lead), Alphemy Capital, G20 Ventures, LongHash Ventures, SAFE Ventures, Hadron FC, others | $1.2M | $1.2M | Seed | Sep 15, 2025 |

| GreenLite | Insight Partners (lead), Energize Capital, Craft Ventures, LiveOak Ventures, Chicago Ventures | $49.5M | $49.5M | Series B | Sep 15, 2025 |

| Divergent Technologies | Rochefort Asset Management (lead) | $290M | $290M | Series E | Sep 15, 2025 |

| Nestimate | S3 Ventures (lead), PruVen Capital, TIAA Ventures, Invest Nebraska | $3M | $3M | Seed | Sep 15, 202 |