Top Startup and Tech Funding News Roundup – Week Ending August 22, 2025

It’s Friday, August 22, 2025, and we’re back with the top startup and tech funding stories that shaped the week. From billion-dollar AI infrastructure raises to seed bets on next-gen biotech and African AI platforms, investors kept the capital flowing across every stage, sector, and geography.

This week’s coverage spans Monday, August 15, through Friday, August 22, 2025, and the funding activity cuts across every stage, sector, and geography. In just eight days, we saw landmark raises in AI, fintech, healthtech, defense, and clean energy — with founders pushing the boundaries in fields ranging from autonomous robotics and vertical AI assistants to metabolic “digital twins,” modular nuclear reactors, and gene therapies tackling age-related disease.

Funding Highlights

Databricks led the week with a colossal $1 billion round at a $100 billion valuation to push deeper into AI-first databases. FieldAI followed with a $405 million raise to develop universal robot brains, while Kriya Therapeutics pulled in $313 million to advance its gene therapy pipeline. EliseAI doubled its valuation with $250 million for healthcare and housing automation, and Nuro added $203 million to fuel autonomous deliveries. Rounding out the nine-figure club were Eight Sleep and Aalo Atomics, each securing $100 million to scale AI-powered sleep technology and modular nuclear reactors for data centers.

Fintech and defense also made headlines: Istanbul’s Midas closed an $80 million round — the largest fintech raise in Turkey’s history — while Berlin-based Stark raised $62 million to ramp up production of AI-powered defense drones. Healthtech was another standout, with Twin Health banking $53 million for its metabolic “digital twin” platform.

Investor Activity

Blue-chip firms like Thrive Capital, Insight Partners, Andreessen Horowitz, Sequoia Capital, ICONIQ Capital, QED Investors, and Valor Equity Partners anchored the week’s biggest checks. Corporate giants stepped in as well, with Nvidia, Uber, Foxconn, Hitachi, and Baillie Gifford making strategic bets across AI, autonomy, and energy. Government-linked funds, including the NATO Innovation Fund, In-Q-Tel, and IFC, also appeared on cap tables, highlighting growing state interest in defense, infrastructure, and financial inclusion.

The spread showed a barbell pattern: massive late-stage financings alongside healthy seed and Series A activity, including rounds for TinyFish ($47M), Firecrawl ($14.5M), Definite ($10M), and Convoke ($8.6M). Collectively, this underscores investor conviction that AI, autonomy, and biotech remain defining themes — with energy infrastructure and fintech also drawing landmark support.

Here’s the full breakdown. Until next week, have a great weekend.

Databricks Is Raising $1B in Funding to Expand AI Data Platform

Databricks, the San Francisco-based data analytics powerhouse, is raising a fresh $1 billion funding round at a massive $100 billion valuation. The oversubscribed round – co-led by Thrive Capital and Insight Partners – brings Databricks’ total funding to nearly $20 billion to date.

Already profitable and in no rush to IPO, Databricks will use this new war chest to expand into the AI-first database market and launch an intelligent agent platform. These initiatives aim to cement Databricks’ position at the forefront of enterprise AI infrastructure, targeting a $100 billion+ market long dominated by legacy players.

Founded in 2013 by Ghodsi and fellow UC Berkeley researchers, Databricks has grown into a company of 8,000 employees. Its backers read like a who’s who of tech venture capital, including Andreessen Horowitz, Thrive, Insight, and WCM Investment Management.

Funding Details:

-

Startup: Databricks (California, U.S. – data & AI software)

-

Investors: Thrive Capital and Insight Partners (co-leads)

-

Amount Raised: $1 billion

-

Total Raised: ~ $20 billion

-

Funding Stage: Late-stage (Series K)

-

Funding Date: August 19, 2025

FieldAI Secures $405M in Funding to Build Universal Robot Brains

FieldAI, an Irvine, CA-based robotics startup, secured a combined $405 million in funding across consecutive rounds at a $2 billion valuation to accelerate development of its “universal robot brains.” FieldAI’s AI platform enables industrial robots to autonomously learn and adapt, performing dirty, dull, or dangerous tasks in sectors like manufacturing and logistics.

The oversubscribed financing was led by Khosla Ventures and joined by investors including Nvidia’s NVentures, Jeff Bezos’s Expeditions fund, and others. The new fresh capital injection positions FieldAI to scale its team and deployments globally. The strong backing from tech luminaries underscores investor enthusiasm for intelligent automation as FieldAI aims to transform how machines operate across industries.

Founder and CEO Ali Agha described the moment as an inflection point, saying that hardware and software are finally aligning in a way that makes scalable, real-world robotic autonomy possible. FieldAI isn’t just tinkering with prototypes—it already has robots working daily jobs across Japan, Europe, and the U.S. in industries like construction, energy, manufacturing, and logistics.

Funding Details:

-

Startup: FieldAI (California, U.S. – AI robotics platform)

-

Investors: Khosla Ventures (lead); NVentures (Nvidia); Bezos Expeditions; Canaan Partners; Intel Capital

-

Amount Raised: $405 million

-

Total Raised: $405 million

-

Funding Stage: Series B

-

Funding Date: August 20, 2025

Kriya Therapeutics Lands $313M in Funding to Advance Gene Therapy Pipeline

Kriya Therapeutics, a gene therapy startup based in North Carolina, has raised $313.3 million in a financing round to fuel its pipeline of single-dose genetic medicines. The hefty raise – disclosed via an SEC filing with two large but undisclosed investors – brings Kriya’s total funding to over $830 million to date. It vaults Kriya into the top tier of biopharma financings this year, underscoring strong investor appetite for its approach amid a challenging gene therapy market.

The funds will support advancing multiple programs (spanning ophthalmology, neurology, and metabolic disorders) toward human trials and eventual commercialization, including Kriya’s lead candidate for geographic atrophy (vision loss), which is poised to enter the clinic.

Funding Details:

-

Startup: Kriya Therapeutics (Morrisville, NC – gene therapy developer)

-

Investors: Undisclosed (two large investors)

-

Amount Raised: $313.3 million

-

Total Raised: ~ $830 million

-

Funding Stage: Undisclosed (late-stage round)

-

Funding Date: August 18, 2025

EliseAI Raises $250M in Series E Funding to Automate Healthcare and Housing

New York-based EliseAI, an enterprise AI software startup, has raised $250 million in a Series E round led by Andreessen Horowitz to expand its automation tools for the healthcare and housing industries.

The funding doubled EliseAI’s valuation to over $2.2 billion and comes as the company surpassed $100 million in annual recurring revenue this year. EliseAI’s platform uses vertical-specific AI assistants to fully automate customer service and operational workflows – from handling apartment rental inquiries to managing clinic appointments – rather than relying on generic chatbots.

With the new capital, EliseAI plans to fuel product innovation and aggressive hiring (aiming to roughly double its 300-person team) to meet rising demand. The raise underscores investor appetite for “vertical AI” solutions that tackle costly, complex tasks in major sectors like real estate and healthcare.

Founded in 2017 by Minna Song (CEO) and Tony Stoyanov (CTO), EliseAI has been building vertical-specific AI systems that can run call centers, manage patient scheduling, and field apartment rental requests without the endless back-and-forth that usually burns out staff and frustrates customers.

Funding Details:

-

Startup: EliseAI (New York, U.S. – AI automation for healthcare & housing)

-

Investors: Andreessen Horowitz (lead); Bessemer Venture Partners; Sapphire Ventures; Navitas Capital; other existing investors

-

Amount Raised: $250 million

-

Total Raised: Not disclosed

-

Funding Stage: Series E

-

Funding Date: August 20, 2025

Nuro Raises $203M in Series E Funding for Autonomous Delivery

Nuro, the Silicon Valley startup building autonomous delivery vehicles, announced that its Series E round has reached $203 million. The latest infusion included a major investment from Nvidia and new backers like Uber, alongside returning supporters such as Baillie Gifford, and brings Nuro’s total funding to about $2.3 billion.

This funding will help Nuro accelerate development of its driverless platform and expand operations in the rapidly growing autonomous delivery market. The $203 million Series E reportedly values Nuro at roughly $6 billion, underscoring continued investor confidence in its technology and vision. Founded by ex-Google engineers in 2016, Nuro is a leader in developing zero-occupant vehicles designed to transport goods without a human driver.

Funding Details:

-

Startup: Nuro (California, U.S. – autonomous delivery vehicles)

-

Investors: Nvidia (lead); Icehouse Ventures; Kindred Ventures; Pledge Ventures; Uber; Baillie Gifford (existing)

-

Amount Raised: $203 million

-

Total Raised: ~ $2.3 billion

-

Funding Stage: Series E

-

Funding Date: August 21, 2025

Eight Sleep Raises $100M in Funding to Expand AI-Powered Sleep Tech Platform

Eight Sleep, a New York-based “sleep fitness” startup, announced a $100 million funding round to accelerate its AI-driven sleep technology offerings. Eight Sleep’s smart mattresses and bedding use sensors and machine learning to track sleep patterns and proactively optimize temperature, elevation, and firmness for better rest. The fresh capital – led by HongShan (HSG) – attracted a host of prominent backers, including Valor Equity Partners, Founders Fund, Y Combinator, and even sports figures like F1 driver Charles Leclerc and McLaren Racing CEO Zak Brown.

With this round, Eight Sleep has amassed roughly $260 million in total funding. While the company didn’t disclose its new valuation, insiders say it’s approaching the coveted $1 billion “unicorn” mark (about double the $500 million post-money valuation from Eight Sleep’s Series C in 2021).

The funds will help Eight Sleep expand internationally and develop condition-specific sleep features as it pushes toward making beds into proactive health devices. Co-founder Alexandra Zatarain noted that executing the startup’s AI roadmap – including its new “Sleep Agent” that creates digital twin models for users – will be key to turning smarter beds into better health outcomes.

Funding Details:

-

Startup: Eight Sleep (New York, U.S. – AI sleep technology)

-

Investors: HongShan (lead); Valor Equity Partners; Founders Fund; Y Combinator; notable angels like Charles Leclerc and Zak Brown

-

Amount Raised: $100 million

-

Total Raised: ~ $260 million

-

Funding Stage: Series D

-

Funding Date: August 19, 2025

Aalo Atomics Lands $100M in Series B Funding for Modular Nuclear Data Center Power

Aalo Atomics, an Austin, Texas-based nuclear energy startup, has closed a $100 million Series B round led by Valor Equity Partners to accelerate the build-out of its modular “microreactors” designed for powering data centers. The raise brings Aalo’s total funding to over $136 million to date. The fresh capital will help Aalo finish construction of its first 50 MW reactor (“Aalo-X”) by next summer at Idaho National Laboratory – an aggressive timeline as part of a U.S. Department of Energy pilot program for advanced nuclear deployment.

Founded in 2023, Aalo is developing fully modular “Aalo Pod” nuclear plants composed of five small reactors driving a single turbine. The system is air-cooled (requiring no external water) and aims to deliver carbon-free power at about $0.03 per kWh, competitive with gas or solar. With surging power needs from AI and cloud data centers, Aalo plans to double its 60-person team and scale up manufacturing, positioning itself to roll out safe, mass-produced nuclear units that can be co-located with data centers.

Funding Details:

-

Startup: Aalo Atomics (Texas, U.S. – modular nuclear reactors for data centers)

-

Investors: Valor Equity Partners (lead); Fine Structure Ventures; Hitachi Ventures; NRG Energy; Vamos Ventures; Tishman Speyer; Kindred Ventures; 50 Years; Harpoon Ventures; others

-

Amount Raised: $100 million

-

Total Raised: $136 million+

-

Funding Stage: Series B

-

Funding Date: August 20, 2025

Midas Secures $80M in Series B Funding for Commission-Free Investing Platform

Istanbul-based fintech startup Midas secured an $80 million Series B investment – marking the largest-ever fintech funding in Turkey. Midas’s popular brokerage app allows 3.5 million users to invest in U.S. and Turkish stocks with zero commissions, fundamentally democratizing access to equity markets in Turkey.

The record-breaking round was led by QED Investors and joined by new investors, including IFC (World Bank Group) and H Capital (formerly Sequoia China), as well as existing backers like Spark Capital, Portage Ventures, and others who doubled down.

Midas will use the funds to fortify its platform’s security and compliance to international standards and to roll out advanced trading features for power users – including launching derivatives trading (U.S. stock options) in the coming months. Since its 2020 founding, Midas has rapidly grown by offering a seamless, low-cost trading experience, reportedly saving its customers nearly $50 million in fees and unlocking a new wave of retail investors in Turkey.

Funding Details:

-

Startup: Midas (Istanbul, Turkey – commission-free stock trading platform)

-

Investors: QED Investors (lead); International Finance Corporation (IFC); H Capital (Sequoia China); Spark Capital; Portage Ventures; others

-

Amount Raised: $80 million

-

Total Raised: ~ $140 million

-

Funding Stage: Series B

-

Funding Date: August 20, 2025

Stark Raises $62M in Funding to Build AI-Powered Defense Drones

Stark, a German startup developing AI-driven military drones, has raised $62 million in a new funding round led by Sequoia Capital. The financing, which included participation from 8VC, Thiel Capital, the NATO Innovation Fund, In-Q-Tel, and others, values the company at roughly $500 million and brings its total funding to about $100 million.

Launched in 2024 by CEO Florian Seibel, Stark develops unmanned aerial systems (loitering drones) equipped with onboard AI for targeting and navigation, used by NATO allies and partner militaries (including field tests in Ukraine). Stark will use the investment to scale production of its autonomous drone systems and accelerate deployment of its defense technologies. The company plans to expand manufacturing (potentially establishing local production in Ukraine if demand grows) and invest in R&D for AI-assisted targeting, as it aims to meet growing demand from defense forces for advanced robotic capabilities.

Funding Details:

-

Startup: Stark (Berlin, Germany – AI-powered defense drones)

-

Investors: Sequoia Capital (lead); 8VC; Thiel Capital; NATO Innovation Fund; In-Q-Tel; Project A Ventures; Döpfner Capital

-

Amount Raised: $62 million

-

Total Raised: ~ $100 million

-

Funding Stage: Series C (growth round)

-

Funding Date: August 21, 2025

Twin Health Raises $53M in Series E Funding for AI Metabolic Health Platform

Twin Health, a Silicon Valley startup specializing in AI-driven metabolic health solutions, secured a $53 million Series E round, raising its valuation to $950 million. The funding was led by Danish firm Maj Invest, with participation from existing investors Iconiq Capital and Temasek. Twin Health’s platform uses “digital twin” models of the human body to personalize interventions for type-2 diabetes and other metabolic disorders.

By continuously monitoring a patient’s biomarkers and lifestyle data, Twin’s AI can recommend tailored diet, activity, and treatment plans to improve metabolic health. With this new capital, Twin Health is nearing unicorn status and plans to further develop its platform and expand its reach to more patients and healthcare partners worldwide, as it seeks to demonstrably improve outcomes for chronic disease management through AI.

Funding Details:

-

Startup: Twin Health (California, U.S. – AI metabolic health platform)

-

Investors: Maj Invest (lead); Iconiq Capital; Temasek

-

Amount Raised: $53 million

-

Total Raised: Not disclosed

-

Funding Stage: Series E

-

Funding Date: August 21, 2025

Seemplicity Grabs $50M in Series B Funding to Automate Cybersecurity Remediation

Seemplicity, a fast-growing startup in the cybersecurity “remediation ops” space, has raised $50 million in a Series B funding round to scale its AI-powered vulnerability management platform. Headquartered in Tel Aviv with a Palo Alto-based US arm, Seemplicity’s platform aggregates and prioritizes security findings, then automatically routes and tracks remediation tasks – streamlining what are typically manual, time-consuming processes for IT and DevOps teams.

The new funding, announced Wednesday, will be used to enhance the product’s AI capabilities (including developing AI agents that deliver personalized risk insights and automated fixes) and to expand Seemplicity’s go-to-market presence in the US, UK, and Europe. The Series B was led by Sienna Venture Capital with participation from Essentia VC, alongside existing investors Glilot Capital, NTTVC, and S Capital. Founded in 2020 by veteran security entrepreneurs, Seemplicity has seen remarkable traction – growing annual recurring revenue by 800% since its $26 million Series A in 2022, and now processing over 1.5 billion security findings daily for its customers.

Funding Details:

-

Startup: Seemplicity (Tel Aviv, Israel – cybersecurity automation platform)

-

Investors: Sienna Venture Capital (lead); Essentia VC; existing backers Glilot Capital, NTTVC, S Capital

-

Amount Raised: $50 million

-

Total Raised: Not disclosed

-

Funding Stage: Series B

-

Funding Date: August 20, 2025

TinyFish Lands $47M in Series A Funding to Scale AI Web Agents

AI startup TinyFish has raised $47 million in a Series A round led by ICONIQ Capital to grow its platform for AI-powered web agents. Based in Palo Alto, TinyFish builds “autonomous web agents” that can simulate human browsing to automate complex online tasks – for example, dynamically monitoring competitors’ prices, promotions, and inventory in real time for retail or travel companies.

Founded in 2024, TinyFish has about 25 employees and says the new funding gives it a healthy 3–4 year runway to invest in product development and expand its go-to-market operations. The Series A saw participation from USVP, MongoDB Ventures, and Sheryl Sandberg’s SBV (Sandberg & Bernthal Ventures) alongside ICONIQ.

TinyFish’s technology is part of a broader “AI agent” gold rush – its early pilots with clients (including an integration with Google) have shown it can reliably turn the messy, dynamic internet into analyzable data, potentially saving enterprises time and money.

Funding Details:

-

Startup: TinyFish (California, U.S. – AI-powered web agents)

-

Investors: ICONIQ Capital (lead); USVP; MongoDB Ventures; Sandberg & Bernthal Ventures

-

Amount Raised: $47 million

-

Total Raised: Not disclosed

-

Funding Stage: Series A

-

Funding Date: August 20, 2025

Medallion Reels In $43M in Funding to Automate Healthcare Provider Networks

Medallion, a San Francisco-based company offering AI-powered credentialing and compliance software for healthcare providers, has raised $43 million in new funding to grow its platform. The round was led by Acrew Capital with participation from Washington Harbour Partners and prominent existing backers like Sequoia Capital, GV (Google Ventures), and Spark Capital.

Medallion’s cloud-based solution streamlines the back-office paperwork for health systems and insurance networks – automating tasks such as clinician credentialing, insurance enrollment, and license verification that are traditionally manual and time-consuming. The fresh capital brings Medallion’s total funding to roughly $130 million.

The company will use it to enhance its product (including a new shared credentialing clearinghouse called CredAlliance) and to scale its customer reach, as demand grows for technology to reduce administrative bottlenecks in healthcare.

Funding Details:

-

Startup: Medallion (California, U.S. – healthcare credentialing automation)

-

Investors: Acrew Capital (lead); Washington Harbour Partners; Sequoia Capital; GV; Spark Capital; others

-

Amount Raised: $43 million

-

Total Raised: ~ $130 million

-

Funding Stage: Series C

-

Funding Date: August 18, 2025

XOPS Raises $40M in Series A Funding to Automate Enterprise IT Operations

XOPS, a Pleasanton, CA-based startup building autonomous IT operations software, raised $40 million in a Series A round to expand its platform. The funding was co-led by Activant Capital and FPV Ventures, and marks the company’s first major funding since its 2022 founding. XOPS is developing an AI-driven system to monitor and manage enterprise IT infrastructure with minimal human intervention, aiming to prevent outages and optimize performance in mission-critical environments.

By ingesting data from across an organization’s tech stack, XOPS’s platform can detect anomalies, orchestrate responses, and continually fine-tune systems – essentially an “autopilot” for IT operations. With the $40 million now in hand (also the company’s total funding to date), XOPS will invest in product development and customer acquisition, targeting Fortune 500 firms looking to cut IT downtime and costs through automation.

Funding Details:

-

Startup: XOPS (California, U.S. – AI-powered IT operations platform)

-

Investors: Activant Capital and FPV Ventures (co-leads)

-

Amount Raised: $40 million

-

Total Raised: $40 million

-

Funding Stage: Series A

-

Funding Date: August 14, 2025

Keychain Snags $30M in Series B Funding to Scale its CPG Supply Chain Platform

Keychain, a New York-based startup helping consumer packaged goods brands find and manage manufacturing partners, raised $30 million in a Series B round to double down on growth. Founded in 2023 by Oisin Hanrahan and Umang Dua (previously of Handy), Keychain operates a marketplace that connects top retailers and CPG brands with vetted third-party manufacturers. Uniquely, the company built its core product and engineering team in Gurugram, India, leveraging that tech talent to serve North American clients.

With the new funding, Keychain plans to expand its India-based R&D team from 35 to about 100 over the next year while also expanding its platform into Europe. The Series B was led by Wellington Management with participation from existing investor BoxGroup and others. It brings Keychain’s total funding to $68 million to date.

Keychain’s software (offered free to brands, with manufacturers paying a subscription) is already used by 8 of the top 10 U.S. retailers – including 7-Eleven and Whole Foods – and dozens of major brands to source manufacturing partners. By bolstering its tech platform and team, Keychain aims to streamline global supply chains and meet growing demand from CPG clients.

Funding Details:

-

Startup: Keychain (New York, U.S. – CPG manufacturing marketplace)

-

Investors: Wellington Management (lead); BoxGroup; other existing backers

-

Amount Raised: $30 million

-

Total Raised: $68 million

-

Funding Stage: Series B

-

Funding Date: August 19, 2025

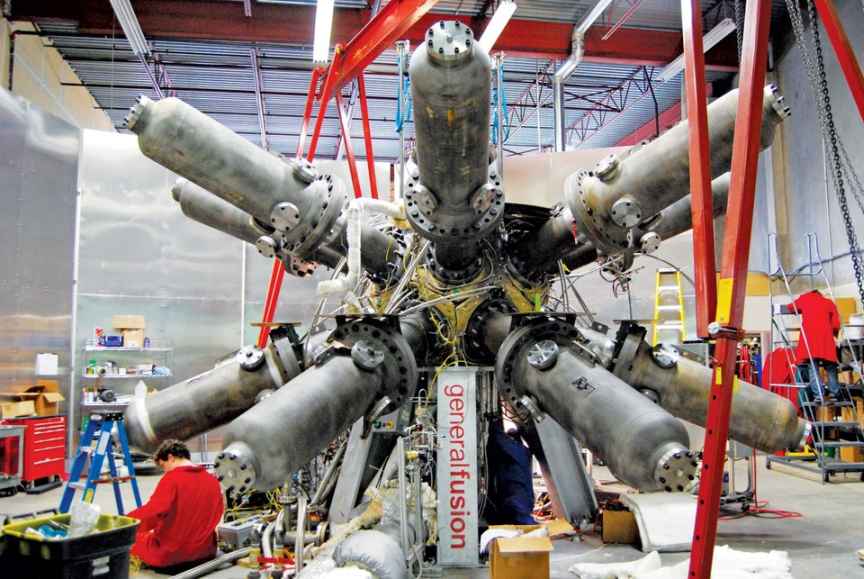

General Fusion Raises $22M in Funding to Continue Fusion Development

General Fusion, the British Columbia-based fusion energy startup, announced it has secured $22 million in new financing to return to growth after a challenging period. The round, raised after the company’s CEO publicly appealed for funding, will support continued work on its “LM26” fusion demonstration machine and progress toward commercial fusion energy goals.

Investors in this round include Segra Capital, PenderFund, Chrysalix Venture Capital, Milfam, Jimco, Gaingels, Thistledown Capital, Presight Capital, and Hatch. Including the latest infusion, General Fusion has now raised roughly $366 million (including government grants) since its founding, reflecting strong backing for its clean energy mission.

Founded in 2002 by physicist Michel Laberge, the Burnaby, Canada-based company aims to transform the world’s energy supply with clean, safe, and abundant fusion power. General Fusion is developing utility-scale fusion using magnetized target fusion – the same process that powers the sun – and this funding gives it a much-needed boost to continue toward a viable fusion reactor.

Funding Details:

-

Startup: General Fusion (Burnaby, Canada – fusion energy technology)

-

Investors: Segra Capital (lead); PenderFund; Chrysalix Venture Capital; Milfam; Jimco; Gaingels; Thistledown Capital; Presight Capital; Hatch

-

Amount Raised: $22 million

-

Total Raised: ~ $366 million (incl. grants)

-

Funding Stage: Undisclosed (venture equity)

-

Funding Date: August 21, 2025

Firecrawl Fetches $14.5M in Series A Funding for AI Web Crawling Platform

Firecrawl, an AI-powered web crawler startup, has raised $14.5 million in a Series A round led by Nexus Venture Partners. The San Francisco company offers a wildly popular open-source web crawling tool that’s used by over 350,000 developers and has notched nearly 50,000 stars on GitHub.

Firecrawl’s technology allows developers – and even autonomous AI agents – to index and navigate the web via API, enabling use cases from large-scale data collection to automated web monitoring.

The new funding will be used to expand Firecrawl’s platform capabilities and community, as the startup aims to capitalize on growing demand for web automation. By making the dynamic internet machine-readable, Firecrawl is positioning itself as critical infrastructure for the next generation of AI-driven applications.

Funding Details:

-

Startup: Firecrawl (California, U.S. – open-source web crawling platform)

-

Investors: Nexus Venture Partners (lead)

-

Amount Raised: $14.5 million

-

Total Raised: Not disclosed

-

Funding Stage: Series A

-

Funding Date: August 19, 2025

Definite Raises $10M in Seed Funding for Unified AI Data Platform

Definite, a Wilmington, Delaware-based startup founded in 2024, is building an AI-native data analytics platform to simplify modern data stacks. The company secured a $10 million seed round led by Costanoa Ventures and Acrew Capital, with participation from prominent angel investors.

Definite’s software uses AI to automate SQL query generation and seamlessly integrate data warehousing, ETL, business intelligence, and modeling into one system. The new funding will be used to accelerate product development and grow its customer base as the startup works to make data analytics faster and more accessible. By unifying tools and using AI “under the hood,” Definite aims to save data teams time and eliminate the need to juggle multiple disparate analytics products.

Funding Details:

-

Startup: Definite (Delaware, U.S. – AI-native data analytics platform)

-

Investors: Costanoa Ventures (lead); Acrew Capital; angel investors

-

Amount Raised: $10 million

-

Total Raised: $10 million

-

Funding Stage: Seed

-

Funding Date: August 21, 2025

Robocore Raises $10M in Foxconn-Led Series D Funding for Elder Care Robots

Robocore, a Hong Kong-based service robotics company known for its Temi telepresence robots, announced the completion of its Series D funding, securing an initial $10 million investment from Foxconn Technology. Foxconn’s investment arm (through subsidiary Q-Run Holdings) is committing up to $30 million in total to Robocore’s unit (RoboTemi Global), with two further $10 million tranches planned over the next two years.

The new funding will be used to expand Robocore’s telemedicine and elderly-care robotics offerings globally, strengthen its smart manufacturing and AI capabilities, and prepare for a future IPO. This strategic partnership with Foxconn – including manufacturing and supply-chain support – is expected to accelerate Robocore’s growth across the US, Europe, and Asia as the company scales up deployment of assistive robots for healthcare and home use.

Funding Details:

-

Startup: Robocore (Hong Kong – telepresence & elder-care robotics)

-

Investors: Foxconn Technology (lead, via Q-Run Holdings)

-

Amount Raised: $10 million (initial tranche)

-

Total Raised: $30 million (committed)

-

Funding Stage: Series D

-

Funding Date: August 21, 2025

Convoke Raises $8.6M in Seed Funding to Accelerate AI-Powered Drug Development

San Francisco-based Convoke, an AI software startup for the biopharma industry, raised $8.6 million in seed funding to build out its platform and accelerate drug development. The seed round was co-led by Kleiner Perkins and Dimension Capital, with participation from notable angel investors and funds.

Convoke is developing an AI-native operating system for pharmaceutical R&D – a platform that automates data analysis and integrates workflows for biotech companies to help identify drug candidates faster and run trials more efficiently. By streamlining laborious research processes with machine learning, Convoke aims to cut the time and cost required to bring new therapies to market.

The fresh seed capital will support product development and initial deployments with biopharma partners, as Convoke works to demonstrate that its AI can shorten the drug development cycle.

Funding Details:

-

Startup: Convoke (California, U.S. – AI platform for biopharma R&D)

-

Investors: Kleiner Perkins (co-lead); Dimension Capital (co-lead); other angels and funds

-

Amount Raised: $8.6 million

-

Total Raised: $8.6 million

-

Funding Stage: Seed

-

Funding Date: August 19, 2025

BetterPic Reels In $2.5M in Seed Funding for AI Photo Studio Platform

BetterPic, a Belgium-based AI imaging startup, closed a $2.5 million seed round to expand its AI-powered photo studio platform. The round was led by Market One Capital (MOC) and Shilling VC, with participation from tech and creative industry angels. BetterPic’s platform uses generative AI to produce professional-quality photographs – such as corporate headshots and product images – without the need for a traditional photoshoot.

Users can simply upload ordinary photos or input data, and BetterPic’s algorithms generate new high-resolution images styled for their branding needs. The startup will use the seed funding to enhance its AI models and scale up its service across Europe and beyond, aiming to meet growing demand from businesses for quick, cost-effective visual content creation.

Funding Details:

-

Startup: BetterPic (Brussels, Belgium – AI photo studio platform)

-

Investors: Market One Capital (lead); Shilling VC; plus angel investors (e.g. Showpad co-founder)

-

Amount Raised: $2.5 million

-

Total Raised: $2.5 million

-

Funding Stage: Seed

-

Funding Date: August 18, 2025

ChatBlu Snags $500K in Pre-Seed Funding for AI E-Commerce Agent

ChatBlu, a nascent startup, has secured a $500,000 pre-seed investment to develop its AI-powered agent for e-commerce sellers. The company is building a virtual assistant that helps small online retailers manage their inventory and operations through natural language and automation.

With ChatBlu’s platform, a seller could ask an AI assistant to update product listings, track stock levels, handle customer inquiries, or even reorder merchandise – simplifying tasks that typically consume time and attention. The pre-seed funding (provided by angel investors) will support ChatBlu in bringing its prototype to life and launching pilot programs. By leveraging AI to automate back-office work, ChatBlu aims to empower direct-to-consumer businesses to scale without hiring large support teams.

Funding Details:

-

Startup: ChatBlu (location undisclosed – AI assistant for e-commerce operations)

-

Investors: Not disclosed (angel investors)

-

Amount Raised: $500,000

-

Total Raised: $500,000

-

Funding Stage: Pre-Seed

-

Funding Date: August 20, 2025

Yamify Secures $100K in Pre-Seed Funding to Launch Africa’s AI Infrastructure Platform

Yamify, a Democratic Republic of Congo–based AI infrastructure startup, has raised $100,000 in pre-seed funding from Felix Anane (an early Paystack investor) to launch its platform. Yamify is building a cloud-like service that enables users in Africa to provision and run AI tools on local GPU clusters, offering affordable, open-source infrastructure for the continent’s tech ecosystem.

By developing this “AI app store” and Model Context Protocol, Yamify aims to reduce African developers’ reliance on overseas cloud providers and to foster homegrown AI innovation. The startup will use the pre-seed capital to develop its platform and begin onboarding pilot users. Yamify’s vision is to empower Africa’s burgeoning AI community with accessible computing power and to become a linchpin of the region’s AI growth.

Funding Details:

-

Startup: Yamify (Kinshasa, D.R. Congo – cloud platform for AI tools in Africa)

-

Investors: Felix Anane (angel investor, Paystack early backer)

-

Amount Raised: $100,000

-

Total Raised: $100,000

-

Funding Stage: Pre-Seed

-

Funding Date: August 20, 2025

Tech Funding Summary Table

| Startup | Investors (Lead and notable) | Amount Raised | Total Raised | Funding Stage | Funding Date |

|---|---|---|---|---|---|

| Databricks | Thrive Capital (lead), Insight Partners | $1 billion | ~$20 billion | Late-stage (Series K) | Aug 19, 2025 |

| FieldAI | Khosla Ventures (lead), NVentures (Nvidia), Bezos Expeditions, others | $405 million | $405 million | Series B | Aug 20, 2025 |

| Kriya Therapeutics | Undisclosed (two investors) | $313.3 million | ~$830 million | Late-stage (Undisclosed) | Aug 18, 2025 |

| EliseAI | Andreessen Horowitz (lead), Bessemer, Sapphire, Navitas | $250 million | Not disclosed | Series E | Aug 20, 2025 |

| Nuro | Nvidia (lead), Icehouse Ventures, Kindred Ventures, Uber | $203 million | ~$2.3 billion | Series E | Aug 21, 2025 |

| Eight Sleep | HongShan (lead), Valor Equity, Founders Fund, Y Combinator | $100 million | ~$260 million | Series D | Aug 19, 2025 |

| Aalo Atomics | Valor Equity Partners (lead), Fine Structure, Hitachi, NRG | $100 million | $136 million+ | Series B | Aug 20, 2025 |

| Midas | QED Investors (lead), IFC, H Capital (Sequoia China), Spark Capital | $80 million | ~$140 million | Series B | Aug 20, 2025 |

| Stark | Sequoia Capital (lead), 8VC, Thiel Capital, NATO IF, In-Q-Tel | $62 million | ~$100 million | Series C | Aug 21, 2025 |

| Twin Health | Maj Invest (lead), Iconiq Capital, Temasek | $53 million | Not disclosed | Series E | Aug 21, 2025 |

| Seemplicity | Sienna VC (lead), Essentia VC, Glilot, NTTVC | $50 million | Not disclosed | Series B | Aug 20, 2025 |

| TinyFish | ICONIQ Capital (lead), USVP, MongoDB Ventures, SBV | $47 million | Not disclosed | Series A | Aug 20, 2025 |

| Medallion | Acrew Capital (lead), Sequoia, GV, Spark Capital | $43 million | ~$130 million | Series C | Aug 18, 2025 |

| XOPS | Activant Capital & FPV Ventures (co-leads) | $40 million | $40 million | Series A | Aug 14, 2025 |

| Keychain | Wellington Management (lead), BoxGroup | $30 million | $68 million | Series B | Aug 19, 2025 |

| General Fusion | Segra Capital (lead), PenderFund, Chrysalix VC, others | $22 million | ~$366 million | Undisclosed (Equity) | Aug 21, 2025 |

| Firecrawl | Nexus Venture Partners (lead) | $14.5 million | Not disclosed | Series A | Aug 19, 2025 |

| Definite | Costanoa Ventures (lead), Acrew Capital | $10 million | $10 million | Seed | Aug 21, 2025 |

| Robocore | Foxconn Technology (lead, via Q-Run) | $10 million (initial) | $30 million (planned) | Series D | Aug 21, 2025 |

| Convoke | Kleiner Perkins (co-lead), Dimension Capital (co-lead) | $8.6 million | $8.6 million | Seed | Aug 19, 2025 |

| BetterPic | Market One Capital (lead), Shilling VC | $2.5 million | $2.5 million | Seed | Aug 18, 2025 |

| ChatBlu | Not disclosed (angel investors) | $500,000 | $500,000 | Pre-Seed | Aug 20, 2025 |

| Yamify | Felix Anane (angel) | $100,000 | $100,000 | Pre-Seed | Aug 20, 2025 |