Top 10 Startup and Tech Funding News – Week Ending August 1, 2025

It’s Friday, August 1, 2025, and we’re back with the top 10 startup and tech funding news stories that shaped the week. We’re a bit late hitting send today, but we’ve more than made up for it with a loaded edition—packed with some of the boldest raises and most ambitious founders scaling new frontiers in AI, biotech, fintech, and robotics.

As July turns to August, venture capital funding is pouring into startups across the globe. This week (July 28 – August 1, 2025) saw multiple mega-rounds — including a half-billion-dollar raise by fintech unicorn Ramp — and numerous nine-figure investments fueling breakthroughs in artificial intelligence, robotics, biotech, and more. From AI “co-pilots” for finance and energy-efficient AI chips, to novel cancer therapies and autonomous defense systems, founders are securing big backing to scale their visions. Major investors like Iconiq Capital, Goldman Sachs, Insight Partners, and B Capital led the charge, joined by corporate strategics such as Sanofi and Google’s DeepMind.

Funding Highlights

Ramp raised $500 million to extend its AI-powered finance stack, while MapLight Therapeutics locked in $372.5 million to advance neurological drug therapies. Robotics upstart Apptronik landed a jaw-dropping $350 million Series A to put humanoid robots into warehouses and factories. Meanwhile, Observe, Anaconda, and Noma Security each pulled in nine-figure rounds to fuel software observability, open-source AI tooling, and next-gen cybersecurity for enterprise AI systems.

Healthtech, semiconductors, and defense also made a strong showing. Artbio secured $132 million for precision cancer treatments, FuriosaAI raised $125 million to expand its AI chip platform, and Delian Alliance emerged with $14 million to bring autonomous defense systems to the front lines of European security.

Investor Activity

The week saw aggressive participation from heavyweights like Iconiq, Insight Partners, Goldman Sachs, Sanofi, DeepMind, Mubadala, Sutter Hill, and B Capital—signaling a clear appetite for disruptive innovation at scale. Whether backing software, silicon, or synthetic biology, venture investors are placing big bets across all sectors.

Below is the full breakdown of this week’s top startup and tech funding rounds—complete with deep dives, investor rosters, and deal terms.

Here’s the full breakdown. Until next week, have a great weekend.

Ramp Raises $500M Series E-2 Funding to Expand AI-Powered Finance Platform

Ramp, a New York-based expense management fintech startup, raised a hefty $500 million in a Series E-2 round to accelerate its AI-driven corporate finance tools. The funding — which reportedly values Ramp at $22.5 billion — was led by Iconiq Capital with participation from existing backers including Founders Fund and D1 Capital. Coming just weeks after a prior raise, this new infusion will fuel Ramp’s expansion of its “finance co-pilot” AI agents that automate expense reports, bill payments, and other back-office tasks for the company’s 40,000 business customers.

Founded in 2019 by Eric Glyman, Gene Lee, and Karim Atiyeh, Ramp started as a corporate card platform to help companies save money. It has since grown into a comprehensive finance automation stack handling everything from travel and bookkeeping to vendor management. With this latest funding, Ramp plans to double down on product development and scaling, aiming to further streamline how businesses manage spend and cash flow.

Funding Details:

-

Startup: Ramp

-

Investors: Iconiq Capital (lead); Founders Fund, D1 Capital, among others

-

Amount Raised: $500 million

-

Total Raised: $1.9 billion

-

Funding Stage: Series E-2

-

Funding Date: July 30, 2025

MapLight Therapeutics Secures $372.5M in Series D Funding for Neuroscience Drug Pipeline

MapLight Therapeutics, a California-based biotech startup targeting brain and central nervous system disorders, landed a colossal $372.5 million Series D round to advance its neuroscience drug pipeline. The financing was co-led by life sciences investors Forbion and Goldman Sachs’ alternatives unit, with significant participation from pharmaceutical giant Sanofi and T. Rowe Price, among other backers. This huge raise positions MapLight to push its lead therapeutic candidate (known as ML-007C-MA, for schizophrenia and Alzheimer’s-related psychosis) through Phase 2 clinical trials and scale up manufacturing.

With the fresh capital, MapLight will also explore additional indications for its lead drug while accelerating other preclinical and clinical programs in its pipeline. The startup aims to challenge entrenched neuropharmaceutical approaches by developing more effective treatments for psychiatric and neurological diseases. The Series D funding – one of the largest biotech rounds this year – underscores strong investor conviction in MapLight’s science and its potential to address unmet needs in brain health.

Funding Details:

-

Startup: MapLight Therapeutics

-

Investors: Forbion and Goldman Sachs Alternatives (co-leads); participation from Sanofi, T. Rowe Price, Avego Capital; existing backers including Novo Holdings, 5AM Ventures, Blue Owl, among others

-

Amount Raised: $372.5 million

-

Total Raised: Not disclosed

-

Funding Stage: Series D

-

Funding Date: July 28, 2025

Apptronik Attracts $350M in Series A Funding to Build Humanoid Robots

Apptronik, an Austin-based robotics startup spun out of the University of Texas, secured $350 million in a massive Series A round to scale production of its Apollo humanoid robots for real-world work. The round — one of the largest Series A financings ever for a robotics company — was co-led by B Capital and Capital Factory, with Google’s DeepMind participating as a strategic investor. Apptronik has been developing general-purpose humanoid robots in collaboration with NASA, and this funding will accelerate manufacturing and deployment of its AI-powered robots, aiming to have them working in logistics and industrial environments by 2026.

By combining advanced robotics engineering with cutting-edge AI, Apptronik’s Apollo robot is designed to operate safely alongside humans and automate physically demanding tasks. The startup will use the new capital to expand its engineering and production teams and to refine Apollo’s capabilities for use cases like warehouse operations, manufacturing line work, and other labor-intensive jobs. Apptronik’s remarkable Series A round reflects growing confidence that humanoid robots could soon become a practical part of the workforce.

Funding Details:

-

Startup: Apptronik

-

Investors: B Capital and Capital Factory (co-leads); participation from Google (DeepMind)

-

Amount Raised: $350 million

-

Total Raised: Approximately $378 million

-

Funding Stage: Series A

-

Funding Date: July 31, 2025

Observe Raises $156M in Funding to Enhance AI-Powered Software Observability Platform

Observe, a San Mateo-based enterprise software startup, raised $156 million in new funding to take on monitoring giants like Datadog and Splunk with its AI-driven observability platform. The Series C round was led by Sutter Hill Ventures and joined by Madrona Venture Group, Alumni Ventures, and the venture arms of Snowflake and Capital One. Observe’s cloud-based platform centralizes a company’s logs, metrics, and trace data on a Snowflake data lake, using automation and AI to help engineers troubleshoot complex systems faster and more easily.

With roughly 100 enterprise customers and rapid revenue growth, Observe plans to use this large infusion to further enhance its product — including building out natural-language AI assistants for querying system data — and to expand its go-to-market presence across North America. Founded in 2017, Observe set out to simplify the explosion of operational data generated by modern applications. The latest funding will enable the company to scale its team and continue innovating in the high-demand field of software observability as enterprises grapple with ever more complex IT stacks.

Funding Details:

-

Startup: Observe

-

Investors: Sutter Hill Ventures (lead); Madrona Ventures, Alumni Ventures, Snowflake Ventures, Capital One Ventures

-

Amount Raised: $156 million

-

Total Raised: Over $270 million

-

Funding Stage: Series C

-

Funding Date: July 30, 2025

Anaconda Snags $150M in Series C Funding to Expand Open-Source AI Tools

Anaconda, an Austin-based provider of open-source software for data science and AI development, has raised $150 million in a Series C round led by Insight Partners. Abu Dhabi’s Mubadala Capital also joined the financing, which reportedly values the company at about $1.5 billion. Anaconda is well known in the developer community for its popular Python distribution and package management platform, used by over 40 million data scientists, researchers, and engineers worldwide. The fresh funds will support Anaconda’s product development (including new enterprise features and cloud offerings), potential strategic acquisitions, and international expansion to meet surging global demand for AI developer tools.

Founded in 2012 by Peter Wang and Travis Oliphant, Anaconda helped make the Python programming language more accessible for big data analytics and machine learning work. As Python’s popularity exploded — becoming the world’s most-used programming language — Anaconda grew into a central hub for AI and data science software. With more than 300 employees and a broad suite of open-source and commercial offerings, Anaconda’s new capital will enable it to accelerate innovation and better serve businesses adopting AI at scale.

Funding Details:

-

Startup: Anaconda

-

Investors: Insight Partners (lead); Mubadala Capital

-

Amount Raised: $150 million

-

Total Raised: Not disclosed

-

Funding Stage: Series C

-

Funding Date: July 31, 2025

Artbio Raises $132M in Series B Funding to Advance Cancer Radiotherapies

Artbio, a U.S.-based radiopharmaceutical startup developing alpha-particle therapies for cancer, secured $132 million in Series B funding to accelerate its lead drug program. The round was co-led by Sofinnova Investments and B Capital, with participation from existing investors F-Prime Capital, Omega Funds, and Third Rock Ventures, plus new backers including the Qatar Investment Authority (QIA) and Alexandria Venture Investments. Artbio’s platform focuses on alpha-emitting radiotherapy, which delivers potent, highly targeted radiation to tumor cells while minimizing damage to healthy tissue. Its lead candidate is a treatment for metastatic prostate cancer, now moving into Phase 2 trials.

With the new funding, Artbio will push its prostate cancer therapy through the next phase of clinical testing and also expand its radioisotope production network in anticipation of later-stage development and commercialization. The investment will additionally help advance Artbio’s other pipeline programs addressing different cancers. By harnessing the precision of alpha-particle radiation, Artbio aims to create a new class of targeted cancer treatments — an approach that has attracted both biotech-focused VCs and strategic healthcare investors in this sizable round.

Funding Details:

-

Startup: Artbio

-

Investors: Sofinnova Investments and B Capital (co-leads); existing investors F-Prime, Omega Funds, Third Rock Ventures; new investors QIA (Qatar Investment Authority), Alexandria Venture Investments

-

Amount Raised: $132 million

-

Total Raised: Not disclosed

-

Funding Stage: Series B

-

Funding Date: July 29, 2025

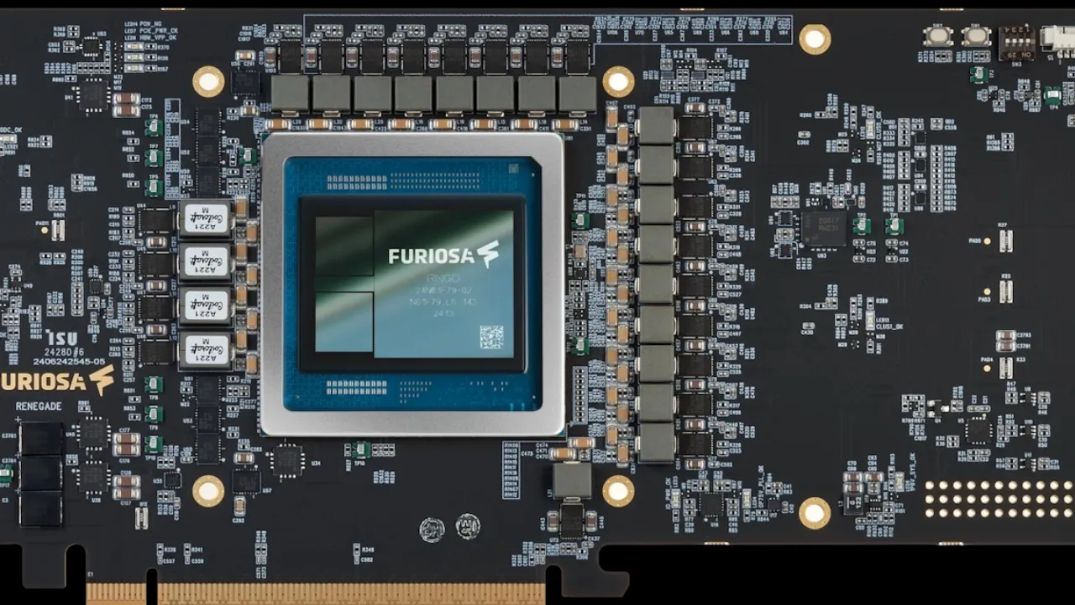

FuriosaAI Lands $125M to Scale Energy-Efficient AI Chips

FuriosaAI, a Seoul-based semiconductor startup, has closed a $125 million Series C (bridge) funding round to ramp up production of its next-generation AI chips. The raise was backed by a consortium of major Korean investors, including Korea Development Bank, Industrial Bank of Korea, Keistone Partners, and Kakao Investment. Founded in 2017, FuriosaAI designs high-performance AI inference accelerators that aim to deliver greater efficiency for running large AI models in data centers. Its “RNGD” chip architecture is built to tackle the power and cost limitations of today’s GPU-based infrastructure for artificial intelligence workloads.

This new capital brings FuriosaAI’s total funding to about $246 million and values the company at roughly $735 million. The startup plans to use the funds to scale up global manufacturing of its current chips and accelerate development of its next-gen processors. As demand soars for more efficient AI hardware – and nations like South Korea push to cultivate domestic chip champions – FuriosaAI is positioning itself as a key player in the race to power the AI boom with specialized silicon.

Funding Details:

-

Startup: FuriosaAI

-

Investors: Korea Development Bank, Industrial Bank of Korea, Keistone Partners, Kakao Investment (among others)

-

Amount Raised: $125 million

-

Total Raised: $246 million

-

Funding Stage: Series C (bridge round)

-

Funding Date: July 30, 2025

Noma Security Grabs $100M in Series B Funding to Protect AI Systems from Cyber Threats

Noma Security, an Israeli cybersecurity startup focused on safeguarding AI models and enterprise data from emerging threats, has raised $100 million in a Series B round to expand its platform. The funding was led by Evolution Equity Partners (a U.S.-based VC firm), with continued participation from Ballistic Ventures and Israel’s Glilot Capital. This round brings Noma’s total financing to $132 million to date. The startup plans to use the capital to grow its R&D team in Tel Aviv and scale its operations across North America, Europe, the Middle East, and Africa, as more organizations seek solutions to secure their AI deployments.

Emerging from stealth in late 2024, Noma quickly gained traction with large enterprises by addressing the “human and AI agent” security gap. Its platform helps companies detect and neutralize malicious AI activities and vulnerabilities in real time. Over the past year, Noma reports that it grew annual recurring revenue by over 1,300% and deployed its technology at dozens of enterprises across finance, healthcare, retail, and tech. With AI systems becoming mission-critical (and increasingly targeted), Noma’s big Series B round signals strong investor confidence in its ability to protect this next wave of enterprise technology.

Funding Details:

-

Startup: Noma Security

-

Investors: Evolution Equity Partners (lead); Ballistic Ventures, Glilot Capital

-

Amount Raised: $100 million

-

Total Raised: $132 million

-

Funding Stage: Series B

-

Funding Date: July 31, 2025

Ultromics Diagnoses $55M in Series C Funding for AI-Powered Heart Scans

Ultromics, an Oxford, UK-based healthtech company using AI to detect heart disease from ultrasound images, raised $55 million in Series C funding to expand its platform in the U.S. healthcare market. The round was co-led by Legal & General and Allegis Capital, alongside growth investor Lightrock, with additional support from existing backers including Oxford Science Enterprises, GV (Google Ventures), UCM Ventures, UPMC Enterprises, and the Blue Venture Fund. Ultromics’ flagship product, EchoGo, is FDA-cleared software that applies artificial intelligence to echocardiograms to spot early signs of heart failure and other cardiac conditions more accurately and efficiently than traditional methods.

The new funding will help Ultromics deploy EchoGo at scale across hospitals and clinics, grow its product pipeline (potentially extending into other cardiovascular diagnostics), and forge further partnerships with healthcare providers and insurers. By improving the speed and accuracy of ultrasound-based diagnosis, Ultromics aims to enable earlier intervention for heart disease and better outcomes for patients. The company’s latest round will accelerate its U.S. expansion and continued innovation at the intersection of AI and cardiology.

Funding Details:

-

Startup: Ultromics

-

Investors: Legal & General, Allegis Capital, Lightrock (co-leads); participation from Oxford Science Enterprises, GV (Google Ventures), Blue Venture Fund, UCM Ventures, UPMC Enterprises

-

Amount Raised: $55 million

-

Total Raised: Not disclosed

-

Funding Stage: Series C

-

Funding Date: July 31, 2025

Delian Alliance Industries Raises $14M to Scale Autonomous Defense Systems

Delian Alliance Industries, an Athens-based defense tech startup founded by former Apple engineer Dimitrios Kottas, has raised $14 million in Series A funding to develop autonomous military-grade systems. The round was co-led by Air Street Capital and Marathon Venture Capital, with participation from 201 Ventures, HCVC, Entropy Industrial Capital, and Nebular. Delian Alliance is building AI-powered defense platforms — such as unmanned aerial drones and automated surveillance towers — to meet the growing demand for cutting-edge security and defense technology in Europe.

The company plans to use the funds to expand its engineering team and accelerate the production and field deployment of its systems. Interest in Delian’s technology is already emerging from NATO partners and other allied defense organizations looking to bolster their capabilities with advanced autonomy. By combining robust hardware with intelligent software, Delian Alliance aims to provide militaries and defense contractors with next-generation tools for surveillance, reconnaissance, and force protection. This early-stage funding will help the startup scale up manufacturing and navigate the rigorous testing and procurement processes in the defense sector.

Funding Details:

-

Startup: Delian Alliance Industries

-

Investors: Air Street Capital and Marathon VC (co-leads); 201 Ventures, HCVC, Entropy Industrial Capital, Nebular

-

Amount Raised: $14 million

-

Total Raised: Approximately $20 million

-

Funding Stage: Series A

-

Funding Date: July 29, 2025

Tech Funding Summary Table

| Startup | Investors (Lead and notable investors) | Amount Raised | Total Raised | Funding Stage | Funding Date |

|---|---|---|---|---|---|

| Ramp | Iconiq Capital (lead); Founders Fund, D1 Capital, others | $500 M | $1.9 B | Series E-2 | July 30, 2025 |

| MapLight Therapeutics | Forbion, Goldman Sachs Alt. (co-leads); Sanofi, T. Rowe Price | $372.5 M | Not disclosed | Series D | July 28, 2025 |

| Apptronik | B Capital, Capital Factory (co-leads); Google (DeepMind) | $350 M | ~$378 M | Series A | July 31, 2025 |

| Observe | Sutter Hill (lead); Madrona, Snowflake Ventures, Capital One Ventures | $156 M | $270 M+ | Series C | July 30, 2025 |

| Anaconda | Insight Partners (lead); Mubadala Capital | $150 M | Not disclosed | Series C | July 31, 2025 |

| Artbio | Sofinnova, B Capital (co-leads); QIA, Third Rock Ventures | $132 M | Not disclosed | Series B | July 29, 2025 |

| FuriosaAI | Korea Dev. Bank, Industrial Bank of Korea, Kakao Investment | $125 M | $246 M | Series C (Bridge) | July 30, 2025 |

| Noma Security | Evolution Equity (lead); Ballistic Ventures, Glilot Capital | $100 M | $132 M | Series B | July 31, 2025 |

| Ultromics | Legal & General, Allegis, Lightrock (co-leads); GV (Google Ventures) | $55 M | Not disclosed | Series C | July 31, 2025 |

| Delian Alliance | Air Street, Marathon VC (co-leads); HCVC, Nebular | $14 M | ~$20 M | Series A | July 29, 2025 |