Top 10 Startup and Tech Funding News – July 31, 2025

Ramp Raises $500M Series E-2 Funding to Expand AI-Powered Finance Platform

Ramp, a New York-based expense management fintech startup, has raised a hefty $500 million in a Series E-2 round to accelerate its AI-driven corporate finance tools. The funding, which values Ramp at $22.5 billion, was led by Iconiq Capital with participation from existing investors, including Founders Fund, D1 Capital.

Coming just weeks after a prior funding, this new infusion will fuel Ramp’s expansion of “finance co-pilot” AI agents aimed at automating expense reporting, bill pay, and other back-office tasks for its 40,000 business customers.

Founded in 2019 by Eric Glyman, Gene Lee, and Karim Atiyeh, Ramp began with a simple pitch: help companies save money. What started as a corporate card platform has quietly grown into something much bigger—a financial stack that handles everything from travel and bookkeeping to bill pay and vendor procurement.

Funding Details:

-

Startup: Ramp

-

Investors: Iconiq Capital (lead), Founders Fund, D1 Capital, among others.

-

Amount Raised: $500 million

-

Total Raised: $1.9 billion

-

Funding Stage: Series E-2

-

Funding Date: July 30, 2025

MapLight Therapeutics Secures $372.5M in Series D Funding for Neuroscience Drug Pipeline

MapLight Therapeutics, a California biotech startup targeting brain and central nervous system disorders, landed a colossal $372.5 million Series D round to advance its neuroscience drug pipeline. The financing was co-led by Forbion and Goldman Sachs’ life sciences arm, and brought in strategic pharma backers including Sanofi and T. Rowe Price.

The new capital positions MapLight to push its lead schizophrenia treatment through Phase 2 trials and scale up manufacturing, as the startup aims to challenge established neuropharmaceutical therapies.

“With this financing, MapLight will advance ML-007C-MA through ongoing Phase 2 trials for schizophrenia and Alzheimer’s disease psychosis. The financing will also fund the exploration of other potential indications for ML-007C-MA, as well as the continued advancement of other clinical and preclinical pipeline programs,” the company said in a news release.

Funding Details:

-

Startup: MapLight Therapeutics

-

Investors: Forbion and Goldman Sachs Alternatives (co-leads); participation from Sanofi, T. Rowe Price, Avego Capital; existing investors Novo Holdings, 5AM Ventures, Blue Owl, others

-

Amount Raised: $372.5 million

-

Total Raised: Not disclosed

-

Funding Stage: Series D

-

Funding Date: July 28, 2025

Apptronik Attracts $350M in Series A Funding to Build Humanoid Robots

Austin-based Apptronik, a University of Texas spinout making humanoid robots, secured $350 million in a massive Series A round to scale production of its Apollo robot for real-world work. The round was co-led by B Capital and Capital Factory, with participation from Google (via its DeepMind division) as a strategic partner.

Apptronik, which has worked with NASA on robotics, will use the funds to accelerate manufacturing and deployment of its AI-powered humanoids, aiming to put them to use in logistics and industrial settings by 2026.

Funding Details:

-

Startup: Apptronik

-

Investors: B Capital and Capital Factory (co-leads); participation from Google’s DeepMind

-

Amount Raised: $350 million

-

Total Raised: ~$378 million

-

Funding Stage: Series A

-

Funding Date: July 31, 2025

Observe Raises $156M in Funding to Improve Observability in an Era of Nonstop Software Releases

Observe, a San Mateo-based software startup, raised $156 million in new funding to challenge monitoring giants like Datadog and Splunk with its AI-powered observability platform. Sutter Hill Ventures led the Series C round, joined by Madrona Ventures, Alumni Ventures, and the venture arms of Snowflake and Capital One.

Observe’s platform centralizes logs, metrics, and traces on a Snowflake data lake to simplify troubleshooting of complex software systems. With ~100 enterprise customers and rapid revenue growth, the company will use the capital to enhance its product (including natural-language AI assistants) and grow its team for a broader North American reach.

Observe is an observability platform founded in 2017 with the idea of streamlining how companies troubleshoot problems across their software stacks. As companies began shipping updates faster and more often, the volume of data generated skyrocketed—creating new challenges in tracking system behavior and pinpointing failures. Observe set out to make sense of that chaos.

Funding Details:

-

Startup: Observe

-

Investors: Sutter Hill Ventures (lead); Madrona Ventures, Alumni Ventures, Snowflake Ventures, Capital One Ventures.

-

Amount Raised: $156 million

-

Total Raised: Over $270 million

-

Funding Stage: Series C

-

Funding Date: July 30, 2025

Anaconda Snags $150M in Series C Funding to Expand Open-Source AI Tools

Anaconda, a provider of open-source Python software for data science and AI, has raised $150 million in a Series C round led by Insight Partners. Abu Dhabi’s Mubadala Capital also participated in a deal that reportedly values the Austin-based company at $1.5 billion.

Anaconda said the fresh funds will support product development, potential acquisitions, and international expansion of its platform, which is widely used by enterprises for AI and machine learning development. The investment comes amid surging demand for AI developer tools as organizations shift to broader AI applications.

Anaconda was founded in 2012 by Peter Wang and Travis Oliphant to make Python more accessible for business data analytics. Since then, Python has become the most widely used programming language in the world—and Anaconda has grown alongside it. The company now employs more than 300 people globally and supports a user base of over 40 million.

Funding Details:

-

Startup: Anaconda

-

Investors: Insight Partners (lead), Mubadala Capital

-

Amount Raised: $150 million

-

Total Raised: Not disclosed

-

Funding Stage: Series C

-

Funding Date: July 31, 2025

Artbio Raises $132M in Series B Funding to Advance Cancer Radiotherapies

Artbio, a radiopharmaceutical startup developing alpha-particle therapies for cancer, secured $132 million in Series B funding to accelerate its lead drug program. The round was co-led by Sofinnova Investments and B Capital, with participation from existing investors F-Prime Capital, Omega Funds, Third Rock Ventures, and new backers including Qatar Investment Authority (QIA) and Alexandria Venture Investments.

Based in the U.S., Artbio will use the funds to push its lead prostate cancer treatment through Phase 2 trials and to scale up its radioisotope production network in preparation for later-stage development..

Funding Details:

-

Startup: Artbio

-

Investors: Sofinnova Investments and B Capital (co-leads); existing investors F-Prime, Omega Funds, Third Rock, with new investors Qatar Investment Authority and Alexandria Venture Investments

-

Amount Raised: $132 million

-

Total Raised: Not disclosed

-

Funding Stage: Series B

-

Funding Date: July 29, 2025

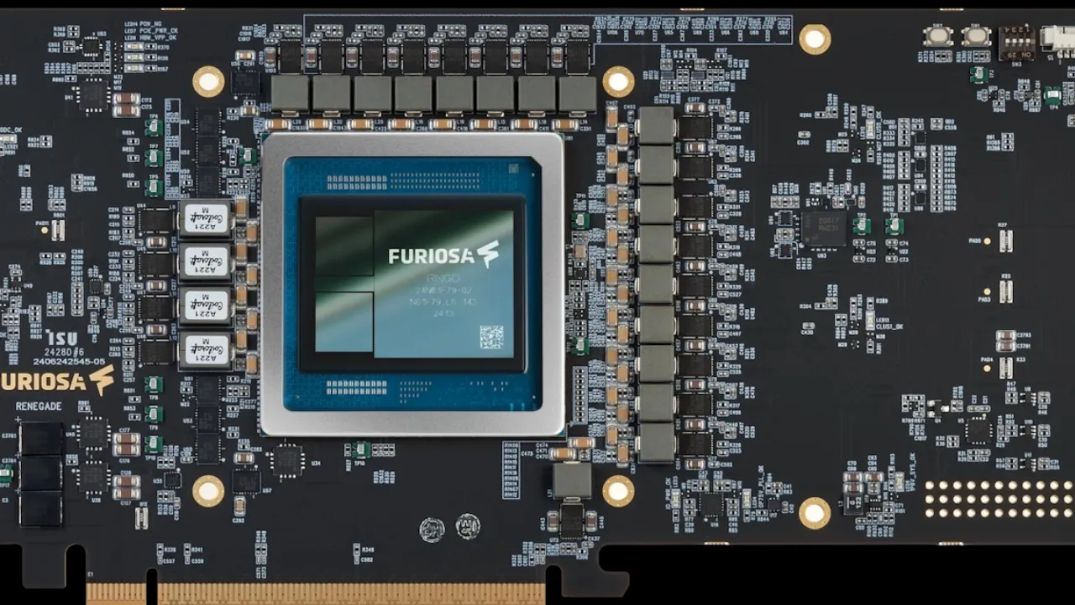

FuriosaAI Lands $125M in Funding to Scale Energy-Efficient AI Chips

FuriosaAI, a Seoul-based AI semiconductor startup, has closed a $125 million Series C bridge funding round to ramp up production of its next-gen AI inference chips. The raise was supported by major Korean investors like Korea Development Bank, Industrial Bank of Korea, Keistone Partners, and Kakao Investment.

Furiosa’s hardware (“RNGD” accelerators) promises higher efficiency for running large AI models. With this infusion – which brings its total funding to $246 million and a valuation of roughly $735 million – FuriosaAI plans to scale up manufacturing globally and develop its next chip generation, tackling the power and cost constraints of today’s GPU-based AI infrastructure.

Founded in 2017, FuriosaAI is a semiconductor startup building AI chips specifically for data centers and enterprise inference workloads. Rather than iterate on existing designs, the company rethinks both hardware and software from the ground up to enable more sustainable and scalable AI computing.

Funding Details:

-

Startup: FuriosaAI

-

Investors: Korea Development Bank, Industrial Bank of Korea, Keistone Partners, Kakao Investment (among others)

-

Amount Raised: $125 million

-

Total Raised: $246 million

-

Funding Stage: Series C (bridge)

-

Funding Date: July 30, 2025

Noma Security Grabs $100M in Series B Funding to Protect AI Systems from Cyber Threats

Noma Security, an Israeli cybersecurity startup whose platform secures enterprise data and AI models against malicious “AI agents,” has raised $100 million in a Series B round. The funding was led by U.S.-based Evolution Equity Partners, with continued participation from Ballistic Ventures and Israel’s Glilot Capital.

The round brings Noma’s total funding to $132 million to date. Noma plans to use the capital to expand its operations across North America, Europe, the Middle East, and Africa, and to grow its R&D team in Tel Aviv as cyber threats against AI systems rise.

Noma Security emerged from stealth in November 2024 and quickly gained traction, ending the year with a robust base of enterprise customers already in production. Over the past year, the company grew its annual recurring revenue (ARR) by more than 1,300%, securing dozens of deployments across financial services, life sciences, retail, and large tech firms.

The new funding arrives at a pivotal moment for enterprise CISOs, who are under growing pressure to secure and govern agentic AI systems before widespread adoption. UBS Research reports that 53% of organizations plan to implement agentic AI by 2026, with that number rising to 83% by 2028.

Funding Details:

-

Startup: Noma Security

-

Investors: Evolution Equity Partners (lead), Ballistic Ventures, Glilot Capital

-

Amount Raised: $100 million

-

Total Raised: $132 million

-

Funding Stage: Series B

-

Funding Date: July 31, 2025

Ultromics Diagnoses $55M in Series C Funding for AI Heart Scans

Ultromics, an Oxford, UK-based healthtech using AI to detect heart disease from ultrasounds, raised $55 million in Series C funding to expand its platform across the U.S. healthcare system. The round was co-led by Legal & General, Allegis Capital, and Lightrock with additional support from Oxford Science Enterprises, GV (Google Ventures), Blue Venture Fund, and others.

Ultromics’ FDA-cleared EchoGo software uses AI to analyze echocardiograms for early signs of heart failure. The new funding will help deploy EchoGo at scale in hospitals and clinics, grow the company’s product pipeline, and forge more partnerships with healthcare providers to improve cardiovascular outcomes.

Funding Details:

-

Startup: Ultromics

-

Investors: Legal & General, Allegis Capital, and Lightrock (co-leads); participation from Oxford Science Enterprises, GV (Google Ventures), Blue Venture Fund, UCM Ventures, UPMC Enterprises

-

Amount Raised: $55 million

-

Total Raised: Not disclosed

-

Funding Stage: Series C

-

Funding Date: July 31, 2025

Delian Alliance Industries Raises $14M in Funding to Scale Autonomous Defense Systems

Delian Alliance Industries, an Athens-based defense tech startup founded by ex-Apple engineer Dimitrios Kottas, has raised $14 million in Series A funding to develop autonomous military-grade systems. The round was co-led by Air Street Capital and Marathon Venture Capital, with participation from 201 Ventures, HCVC, Entropy Industrial Capital, and Nebular.

Delian Alliance is building AI-powered defense platforms – such as drones and surveillance towers – amid growing demand for cutting-edge security tech in Europe. The company says it will use the funds to expand its engineering and field deployment teams and accelerate production to meet interest from NATO partners and other allied defense organizations.

Funding Details:

-

Startup: Delian Alliance Industries

-

Investors: Air Street Capital and Marathon VC (co-leads); 201 Ventures, HCVC, Entropy Industrial Capital, Nebular

-

Amount Raised: $14 million

-

Total Raised: ~ $20 million

-

Funding Stage: Series A

-

Funding Date: July 29, 2025

Tech Funding Summary Table

| Startup | Investors (Lead and notable investors) | Amount Raised | Total Raised | Funding Stage | Funding Date |

|---|---|---|---|---|---|

| Ramp | Iconiq Capital (lead); Founders Fund, D1 Capital, others | $500 M | $1.9 B | Series E-2 | July 30, 2025 |

| MapLight Therapeutics | Forbion, Goldman Sachs Alt. (co-leads); Sanofi, T. Rowe Price | $372.5 M | Not disclosed | Series D | July 28, 2025 |

| Apptronik | B Capital, Capital Factory (co-leads); Google (DeepMind)m | $350 M | ~$378 M | Series A | July 31, 2025 |

| Observe | Sutter Hill (lead); Madrona, Snowflake Ventures, Capital One Ventures | $156 M | $270 M+ | Series C | July 30, 2025 |

| Anaconda | Insight Partners (lead); Mubadala Capital | $150 M | Not disclosed | Series C | July 31, 2025 |

| Artbio | Sofinnova, B Capital (co-leads); QIA, Third Rock Ventures | $132 M | Not disclosed | Series B | July 29, 2025 |

| FuriosaAI | Korea Dev. Bank, Industrial Bank of Korea, Kakao Investment | $125 M | $246 M | Series C (Bridge) | July 30, 2025 |

| Noma Security | Evolution Equity (lead); Ballistic Ventures, Glilot Capital | $100 M | $132 M | Series B | July 31, 2025 |

| Ultromics | Legal & General, Allegis, Lightrock (co-leads); GV (Google Ventures) | $55 M | Not disclosed | Series C | July 31, 2025 |

| Delian Alliance | Air Street, Marathon VC (co-leads); HCVC, Nebular | $14 M | ~$20 M | Series A | July 29, 2025 |