Top Startup and Tech Funding News – July 23, 2025

5C Group Raises $835M in Funding to Scale AI Data Center Infrastructure

5C Group, a Montreal-based AI infrastructure and data center provider, has secured a massive $835 million funding round to accelerate development of its next-generation facilities. Formed via Hypertec’s acquisition of 5C Data Centers, the company boasts over 2 GW of potential capacity to power hundreds of thousands of GPUs.

The fresh capital infusion, structured as an equity-led financing, will fuel 5C Group’s expansion of scalable AI-ready data centers across North America. With Brookfield and Deutsche Bank leading the round, 5C Group is positioned to deliver the high-density compute infrastructure demanded by AI workloads at unprecedented scale.

Funding Details:

-

Startup: 5C Group

-

Investors: Brookfield (lead), Deutsche Bank (lead)

-

Amount Raised: $835 million

-

Total Raised: Not disclosed

-

Funding Stage: Growth funding (Equity & debt)

-

Funding Date: July 23, 2025

Vanta Raises $150M in Series D Funding for AI Trust Management

Vanta, a San Francisco-based AI trust management startup, has raised $150 million in Series D financing at a valuation of $4.15 billion. The round was led by new investor Wellington Management, with participation from existing backers including Goldman Sachs, Sequoia, J.P. Morgan, Craft Ventures, Y Combinator, Atlassian Ventures, and CrowdStrike Ventures.

Vanta’s platform helps organizations automate security and compliance, offering zero-touch verification across numerous frameworks and vendor risk assessments. The fresh funds will accelerate Vanta’s AI-driven product innovation and expansion into new areas like third-party risk management and government compliance. This latest raise brings Vanta’s total funding to over half a billion dollars since its 2021 launch, underscoring its leading position in the cybersecurity compliance arena.

Funding Details:

-

Startup: Vanta

-

Investors: Wellington Management (lead); Goldman Sachs, Sequoia Capital, J.P. Morgan, Craft Ventures, Y Combinator, Atlassian Ventures, CrowdStrike Ventures (existing)

-

Amount Raised: $150 million

-

Total Raised: $504 million

-

Funding Stage: Series D

-

Funding Date: July 23, 2025

Gupshup Secures Over $60M in Funding to Expand Conversational AI Platform

Gupshup, a Mumbai-based conversational AI and messaging platform, has closed over $60 million in a new funding round combining equity and debt. The raise was co-led by Globespan Capital Partners and EvolutionX Debt Capital. Gupshup will use the proceeds to further enhance its AI-powered platform for customer engagement and to accelerate go-to-market expansion across India, the Middle East, Latin America, and Africa.

Founded by Beerud Sheth, Gupshup enables businesses to automate complex customer interactions via AI chatbots, conversational ads, agent assist tools, and more – all while maintaining human-like dialogue. With more than 50,000 customers worldwide and recognition from Gartner and IDC, Gupshup’s latest infusion will help scale its operations and solidify its position in the global conversational AI landscape.

Funding Details

-

Startup: Gupshup

-

Investors: Globespan Capital Partners, EvolutionX Debt Capital

-

Amount Raised: $60 million+ (equity and debt)

-

Total Raised: Not disclosed

-

Funding Stage: Growth funding (Equity & debt)

-

Funding Date: July 23, 2025

Buena Lands $58M in Series A Funding for AI-Driven Property Management

Buena, a Berlin-based property management startup, has raised $58 million in Series A funding to fuel its expansion in the real estate market. The round was led by GV (Google Ventures), with participation from 20VC, Stride, and Capnamic.

Founded in 2023 by CEO Din Bisevac, Buena uses AI-driven software to automate and optimize rental property management – from finding tenants to handling maintenance – enabling everyday individuals to build wealth through owning real estate.

The company already manages over 60,000 apartments and has acquired more than 20 property management firms as it rapidly scales. With this new capital, Buena will further develop its AI platform and broaden its footprint across Germany, aiming to improve outcomes for both landlords and tenants through technology.

Funding Details

-

Startup: Buena

-

Investors: GV (lead); 20VC, Stride, Capnamic

-

Amount Raised: $58 million

-

Total Raised: Not disclosed

-

Funding Stage: Series A

-

Funding Date: July 23, 2025

Swift Navigation Secures $50M in Series E Funding for Precise Positioning Tech

Swift Navigation, a San Francisco-based precision positioning company, has closed a $50 million Series E round to advance its autonomous navigation technology. The financing was led by Crosslink Capital, with strong support from existing investors NEA, Eclipse Ventures, EPIQ Capital, First Round Capital, and TELUS Ventures, alongside new backers Niterra Ventures, AlTi Tiedemann, GRIDS Capital, Essentia Ventures, Shea Ventures, and EnerTech Capital.

Swift Navigation provides a cloud-based GNSS corrections service called Skylark that boosts GPS accuracy to the centimeter level, crucial for self-driving vehicles, drones, robotics, and precision logistics. CEO Timothy Harris says the new funds will drive broader adoption of Swift’s technology beyond advanced driver-assistance systems (ADAS) into new industries. With over 10 million devices already using its services, Swift’s total funding now exceeds $250 million as it continues enabling high-precision positioning at global scale.

Funding Details

-

Startup: Swift Navigation

-

Investors: Crosslink Capital (lead); NEA, Eclipse Ventures, EPIQ Capital, First Round Capital, TELUS Ventures, Niterra Ventures, AlTi Tiedemann, GRIDS Capital, Essentia Ventures, Shea Ventures, EnerTech Capital

-

Amount Raised: $50 million

-

Total Raised: $250 million+

-

Funding Stage: Series E

-

Funding Date: July 23, 2025

April Raises $38M in Series B Funding for AI Tax Automation

April, a New York-based fintech startup offering an AI-powered tax platform, has raised $38 million in Series B funding to simplify tax planning and filing. The round was led by QED Investors, with participation from Nyca Partners and Team8. April (styled “april”) provides a year-round, embedded tax solution that integrates into partner apps and payroll systems, giving users real-time insights into how life changes – from each paycheck to stock trades – affect their taxes.

Led by CEO Ben Borodach, the platform helps individuals optimize withholdings, manage quarterly payments, and plan for scenarios like capital gains or small business income. The infusion of capital will support April’s product development and partnerships, accelerating its mission to turn taxes into a strategic advantage for users. This funding brings April’s total raised to $78 million to date.

Funding Details

-

Startup: April

-

Investors: QED Investors (lead); Nyca Partners, Team8

-

Amount Raised: $38 million

-

Total Raised: $78 million

-

Funding Stage: Series B

-

Funding Date: July 23, 2025

Scrunch AI Raises $15M in Series A Funding to Boost Brands in AI Search

Scrunch AI, a Salt Lake City-based AI startup, has secured a $15 million Series A round to help brands stay visible in the age of AI-driven search. The funding was led by Decibel, with participation from Mayfield, Homebrew, and other strategic investors. Scrunch’s platform enables businesses to understand how their content is being indexed and presented by AI assistants and chatbots.

Under CEO Chris Andrew, the company’s Agent Experience Platform (AXP) analyzes a brand’s competitive positioning and content gaps, then optimizes websites and data so that AI models retrieve and present them favorably. With this new capital, Scrunch AI plans to accelerate development of its infrastructure and roll out tools that allow enterprises – and marketing agencies serving them – to ensure they remain prominent and relevant as AI becomes a primary interface for search.

Funding Details

-

Startup: Scrunch AI

-

Investors: Decibel (lead); Mayfield, Homebrew, and other strategics

-

Amount Raised: $15 million

-

Total Raised: Not disclosed

-

Funding Stage: Series A

-

Funding Date: July 23, 2025

Dash Bio Secures $11M in Funding to Advance Automated Bioanalysis

Dash Bio, a Newton, MA-based startup reinventing lab testing for drug development, secured an $11 million funding round to expand its automated bioanalysis platform. The financing – which brings Dash’s total funding to $17.5 million – was led by The Aligned Fund, with participation from Freestyle Capital, Cybernetix Ventures, Swift Ventures, LifeX Ventures, Drive Capital, and others.

Dash Bio operates a fully automated, Good Laboratory Practice (GLP) compliant lab that uses robotics, AI, and integrated software to dramatically speed up processes like blood sample analysis for clinical trials. CEO Dave Johnson (former Moderna AI officer) says Dash’s technology can deliver critical assay results up to 10 times faster than traditional CROs, helping biotech companies move from idea to FDA approval more quickly.

The new funding will go toward scaling Dash’s platform, expanding its assay menu and software capabilities, and onboarding more pharma and biotech clients from preclinical through late-stage trials.

Funding Details

-

Startup: Dash Bio

-

Investors: The Aligned Fund (lead); Freestyle Capital, Cybernetix Ventures, Swift Ventures, LifeX Ventures, Drive Capital

-

Amount Raised: $11 million

-

Total Raised: $17.5 million

-

Funding Stage: Series A

-

Funding Date: July 23, 2025

Estes Energy Snags $11M in Seed Funding for Zero-Emission Power Systems

Estes Energy, a San Francisco-based hardware startup, raised $11 million in seed funding to develop zero-emission power systems for heavy vehicles and equipment. The round was led by BMW i Ventures and Fortescue, with participation from New System Ventures and returning investor DCVC. Led by CEO Dustin Grace, Estes Energy is building high-performance electric powertrains aimed at replacing diesel engines in commercial and industrial applications.

The fresh capital will allow Estes to expand its engineering team, build out a pilot manufacturing line, and begin deploying its battery-based powertrain systems to early customers by the end of 2025. Estes Energy’s technology promises to help large vehicle OEMs and fleet operators meet emissions goals by delivering standardized electrification solutions that match or beat diesel on cost and performance.

Funding Details

-

Startup: Estes Energy

-

Investors: BMW i Ventures (lead), Fortescue (lead); New System Ventures, DCVC

-

Amount Raised: $11 million

-

Total Raised: Not disclosed

-

Funding Stage: Seed

-

Funding Date: July 23, 2025

Hypernatural Raises $9.2M in Funding to Democratize AI Video Creation

Hypernatural, a New York City-based AI video generator, has raised $9.2 million in funding across two seed rounds to make professional video production accessible to everyone. The startup’s recent investments were led by AIX Ventures and Underscore VC, with support from Adverb Ventures, Character.vc, and 43 VC.

Founded by CEO Rebecca Kossnick, Hypernatural enables users – from marketers and small businesses to authors and filmmakers – to create polished, customized videos in minutes simply by inputting text. Its platform offers a library of 2 million AI-generated stock video clips, as well as tools for designing custom characters, voiceovers, and styles on the fly. With over 1 million users already, Hypernatural will use the new funds to grow its operations and further develop features that blend the speed of AI generation with the consistency and control of traditional video editing.

Funding Details

-

Startup: Hypernatural

-

Investors: AIX Ventures (lead), Underscore VC (lead); Adverb Ventures, Character.vc, 43 VC

-

Amount Raised: $9.2 million

-

Total Raised: Not disclosed

-

Funding Stage: Seed (two rounds)

-

Funding Date: July 23, 2025

Kluisz.ai Grabs $9.6M in Seed Funding to Build GenAI Cloud Platform

Kluisz.ai, a Bengaluru-based deeptech startup, has raised $9.6 million in seed funding to develop a next-generation cloud platform optimized for the AI era. The round was led by RTP Global, with participation from Unicorn India Ventures, Blume Founders Fund, Climber Capital, and notable angel investors including Ritesh Agarwal (OYO), Dr. Ritesh Malik (Innov8), and Aditya Virwani (Embassy Group).

Founded just three months ago by a trio of tech industry veterans, Kluisz.ai aims to provide a secure, scalable “developer-first” cloud that offers zero-trust security and full control across hybrid and edge environments. The new capital will help Kluisz.ai accelerate engineering and go-to-market efforts for its AI-centric cloud infrastructure, positioning the young startup to support enterprises’ growing demand for reliable and sovereign cloud solutions tailored to artificial intelligence workloads.

Funding Details

-

Startup: Kluisz.ai

-

Investors: RTP Global (lead); Unicorn India Ventures, Blume Founders Fund, Climber Capital; angels including Ritesh Agarwal, Ritesh Malik, Aditya Virwani

-

Amount Raised: $9.6 million

-

Total Raised: Not disclosed

-

Funding Stage: Seed

-

Funding Date: July 23, 2025

Volca Raises $5.5M Seed for AI Marketing in Home Services

Volca, a New York City-based startup building an AI-powered marketing platform for home services businesses, has raised a $5.5 million seed round to accelerate its growth. Pathlight Ventures led the funding, joined by MetaProp, GTMfund, Recall Capital, and a roster of founders and executives from successful tech companies like Ramp, Gusto, Scale AI, Plaid, Figma, Stripe, and more.

Co-founded by Brendan Kazanjian, Brandon Rabovsky, and Jack Morton, Volca offers a full-stack platform that uses artificial intelligence to supercharge every aspect of a contractor’s sales and customer service pipeline – from intelligent lead generation and automated communications to post-service upsells and review management. With the new capital, Volca plans to advance its product roadmap and scale customer support, aiming to become the go-to growth engine for the home maintenance and remodeling industry.

Funding Details

-

Startup: Volca

-

Investors: Pathlight Ventures (lead); MetaProp, GTMfund, Recall Capital; founders/executives from Ramp, Gusto, Scale AI, Plaid, Figma, Stripe (angels)

-

Amount Raised: $5.5 million

-

Total Raised: Not disclosed

-

Funding Stage: Seed

-

Funding Date: July 23, 2025

Modern Baker Secures £2.5M in Series A Funding for Food-as-Medicine Startup

Modern Baker, an Oxford-based “food-as-medicine” startup, closed a £2.5 million Series A round (approximately $3.2 million USD) to expand its healthy food innovation efforts. The funding was led by Adjuvo, an investor network that backs science-driven ventures. Co-founded by Leo Campbell and Melissa Sharp, Modern Baker is developing nutrient-dense, functional foods aimed at improving health outcomes.

The company has leveraged seven UK government grants and collaborations with university labs to create its core technology – an ingredient platform that enhances everyday staples with clinically proven health benefits. Modern Baker’s first product, SUPERLOAF, is a high-fiber bread developed with baking giant Hovis and now sold in major UK supermarkets. With the new Series A funds, the startup will scale operations and R&D, as well as pursue additional partnerships to bring more “healthy ultra-processed” foods to market.

Funding Details

-

Startup: Modern Baker

-

Investors: Adjuvo (lead)

-

Amount Raised: £2.5 million (Series A)

-

Total Raised: Not disclosed

-

Funding Stage: Series A

-

Funding Date: July 23, 2025

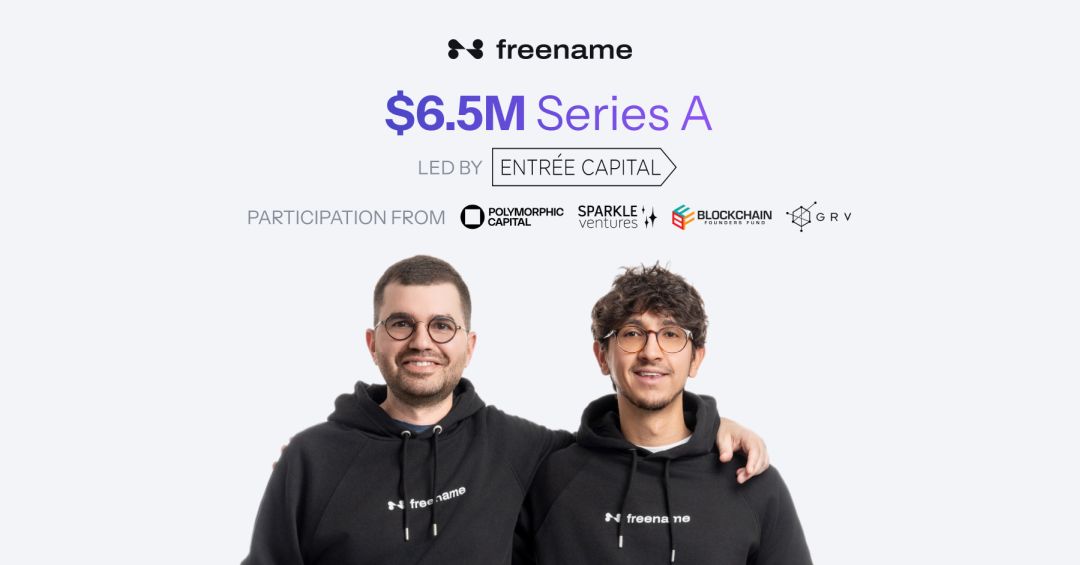

Freename Raises $6.5M in Series A Funding for Web3 Domain Platform

Freename, a Zurich-based blockchain domain startup, has raised $6.5 million in a Series A round to further its mission of bridging traditional DNS with Web3 technologies. The investment was led by Entrée Capital, with Polymorphic Capital co-leading. Seed investors Sparkle Ventures, Blockchain Founders Fund, and Golden Record Ventures also joined, alongside new angel backers such as Mike Lobanov (Target Global) and the Rashwan family office.

Freename’s platform enables users and brands to create and monetize custom top-level domains (TLDs) on blockchain networks, opening up new revenue streams via the sale of domain names. Its system ensures these Web3 domains are compatible with both crypto wallets and standard web browsers, thanks to proprietary tech that resolves naming collisions across blockchains and integrates with traditional DNS infrastructure. The fresh funds will fuel product innovation and global expansion as Freename works to unify Web2 and Web3 digital identity.

Funding Details

-

Startup: Freename

-

Investors: Entrée Capital (lead), Polymorphic Capital (lead); Sparkle Ventures, Blockchain Founders Fund, Golden Record Ventures; angels including Mike Lobanov

-

Amount Raised: $6.5 million

-

Total Raised: Not disclosed

-

Funding Stage: Series A

-

Funding Date: July 23, 2025

Starseer Gets $2M in Seed Funding for AI Governance & Compliance Tools

Starseer, a Knoxville, TN-based AI governance startup, has raised $2 million in seed funding to help organizations safely deploy AI systems. The round was led by Gula Tech Adventures, the fund of cybersecurity veteran Ron Gula. Starseer, founded by CEO Tim Schulz, is developing an “AI exposure management” platform that makes enterprise AI models more transparent and secure.

Starseer’s software allows companies to analyze how AI systems make decisions, monitor them for vulnerabilities or bias, and generate audit-ready documentation to meet compliance requirements. With growing interest from both enterprises and government agencies in AI risk management, Starseer plans to use the seed capital to speed up product development, expand its engineering team, and scale up pilots with customers in high-stakes sectors. The goal is to empower security and compliance teams (even those without deep technical backgrounds) to trust and verify AI systems in production.

Funding Details

-

Startup: Starseer

-

Investors: Gula Tech Adventures (lead)

-

Amount Raised: $2 million

-

Total Raised: Not disclosed

-

Funding Stage: Seed

-

Funding Date: July 23, 2025

Coluxe Closes Friends & Family Round to Launch Lab-Grown Diamond Brand

Coluxe, a New Delhi-based lab-grown diamond venture founded by entrepreneur Priyanka Gill, has closed a friends-and-family funding round (amount undisclosed) as it gears up for a public launch. The strategic early backing comes from a group of angel investors and startup veterans, including Startup Sherpas, Ajai Chowdhry, Tej Kapoor, Sairee Chahal, and others in Gill’s network.

Coluxe plans to use the capital to roll out its digital storefront next month and broaden its product catalog of sustainable, lab-created diamonds and jewelry. With over 300 designs ready for launch, the company is positioning itself at the intersection of luxury and technology, aiming to offer consumers an eco-friendly alternative to mined diamonds. Coluxe is also already in talks with venture firms as it prepares for a seed round to fuel further growth after the initial launch.

Funding Details

-

Startup: Coluxe

-

Investors: Friends & family including Startup Sherpas, Ajai Chowdhry, Tej Kapoor, Sairee Chahal, and others

-

Amount Raised: Undisclosed

-

Total Raised: Not disclosed

-

Funding Stage: Friends & family (pre-seed)

-

Funding Date: July 23, 2025

Inbound Aerospace Lifts Off with $1M Pre-Seed Funding for Reusable Spacecraft

Inbound Aerospace, an IIT Madras-incubated space tech startup, has raised over $1 million in a pre-seed round led by Speciale Invest, with participation from Piper Serica. Founded in 2025 by Aravind IB, Vishal Reddy, and retired Navy Captain Abhijit Bhutey, Inbound Aerospace is developing autonomous, reusable re-entry vehicles for in-orbit experiments and microgravity manufacturing.

The fresh capital will accelerate R&D for the startup’s first spacecraft, helping validate critical subsystems and reach key design milestones on the path to orbital testing. Inbound’s technology arrives as the International Space Station nears retirement later this decade, and it aims to fill a looming gap in infrastructure for microgravity research. By enabling reliable, repeatable return of experimental payloads from space, Inbound Aerospace could play a crucial role in the next wave of the space economy.

Funding Details

-

Startup: Inbound Aerospace

-

Investors: Speciale Invest (lead); Piper Serica

-

Amount Raised: $1 million+

-

Total Raised: Not disclosed

-

Funding Stage: Pre-Seed

-

Funding Date: July 23, 2025

Grexa AI Secures $1.9M in Seed Funding to Empower Small Business Marketing

Grexa AI, based in New Delhi, announced a ₹15.5 crore seed funding round (approximately $1.9 million) to expand its AI-driven marketing platform for small businesses. The round was led by Utsav Somani (Founder of Offline Club and ex-AngelList India), with participation from DeVC (Z47’s seed fund), Bharat Founders Fund, Vernalis Capital, and prominent angel investors like Revant Bhate (Mosaic Wellness), Vaibhav Domkundwar (Better Capital), Sumit Gupta (CoinDCX), and Ramakant Sharma (Livspace).

Grexa’s platform uses generative AI to give India’s millions of small and mid-sized businesses access to affordable, data-driven marketing—an alternative to pricey agencies or complex software. Co-founder and CEO Ashutosh Kumar says the startup will invest the funds in product development and go-to-market growth, including continually training Grexa’s AI on business performance data to improve campaign outcomes. The goal is to help the 95% of Indian businesses that have never had structured marketing finally grow through AI-powered strategies.

Funding Details

-

Startup: Grexa AI

-

Investors: Utsav Somani (lead); DeVC (Z47), Bharat Founders Fund, Vernalis Capital; angels including Revant Bhate, Vaibhav Domkundwar, Sumit Gupta, Ramakant Sharma

-

Amount Raised: ₹15.5 crore (seed round)

-

Total Raised: Not disclosed

-

Funding Stage: Seed

-

Funding Date: July 23, 2025

Roast Foods Scores Strategic Investment to Fuel Healthy Snacks Expansion

Roast Foods, a Nagpur, India-based healthy snack maker, has secured a strategic investment (amount undisclosed) to accelerate its global expansion. The funding comes from Pagariya Exports Pvt Ltd, led by Umesh and Neel Pagariya, which will now partner with Roast Foods as it scales.

Founded by Soniya Raisoni, Roast Foods produces roasted, nutritious snack foods as a better-for-you alternative to fried snacks. The infusion of capital will enable the company to enhance its manufacturing capabilities, develop new products, and extend its international reach. “We firmly believe the global snacking market presents immense growth potential,” said Raisoni, noting that the partnership will help bring their healthy roasted snacks to a wider audience.

This strategic backing underscores confidence in Roast Foods’ mission to make guilt-free snacking accessible worldwide.

Funding Details

-

Startup: Roast Foods

-

Investors: Pagariya Exports Pvt Ltd (strategic investor, led by Umesh & Neel Pagariya)

-

Amount Raised: Undisclosed

-

Total Raised: Not disclosed

-

Funding Stage: Strategic investment

-

Funding Date: July 23, 2025

Magma Attracts GVFL in Extended Series A Funding to Scale Industrial Solutions

Magma, an Ahmedabad, India-based industrial solutions startup, has extended its Series A round with a strategic investment from GVFL (Gujarat Venture Finance Ltd). While the amount was not disclosed, this infusion will support Magma’s efforts to scale its operations nationally. Founded in 2022 by Neal Thakker, Magma provides a technology platform addressing factories’ needs across raw material procurement, green energy, waste management, and logistics. The company already serves over 350 industrial customers and is operating at a ₹300 crore annual revenue run-rate.

Magma sees GVFL as an ideal growth partner given its deep roots in Gujarat’s industrial landscape. Founder Neal Thakker noted that having a local investor who understands traditional industries will add tremendous value as Magma expands to new regions. The extended Series A funding will help Magma strengthen its product suite and ramp up its market presence in India’s manufacturing hubs.

Funding Details

-

Startup: Magma

-

Investors: GVFL (strategic investor in Series A extension)

-

Amount Raised: Undisclosed

-

Total Raised: Not disclosed

-

Funding Stage: Series A (extended)

-

Funding Date: July 23, 2025

Tech Funding Summary Table

| Startup | Investors (Lead and notable investors) | Amount Raised | Total Raised | Funding Stage | Funding Date |

|---|---|---|---|---|---|

| 5C Group | Brookfield (lead); Deutsche Bank | $835 M | Not disclosed | Growth (Equity & debt) | Jul 23 2025 |

| Vanta | Wellington Management (lead); Goldman Sachs, Sequoia, J.P. Morgan, etc. | $150 M | $504 M | Series D | Jul 23 2025 |

| Gupshup | Globespan Capital; EvolutionX Debt Capital (co-leads) | $60 M+ | Not disclosed | Growth (Equity & debt) | Jul 23 2025 |

| Buena | GV (Google Ventures) (lead); 20VC, Stride, Capnamic | $58 M | Not disclosed | Series A | Jul 23 2025 |

| Swift Navigation | Crosslink Capital (lead); NEA, Eclipse, First Round, TELUS Ventures, etc. | $50 M | $250 M+ | Series E | Jul 23 2025 |

| April | QED Investors (lead); Nyca Partners, Team8 | $38 M | $78 M | Series B | Jul 23 2025 |

| Scrunch AI | Decibel (lead); Mayfield, Homebrew | $15 M | Not disclosed | Series A | Jul 23 2025 |

| Dash Bio | The Aligned Fund (lead); Freestyle, Cybernetix, Swift, LifeX, Drive Capital | $11 M | $17.5 M | Series A | Jul 23 2025 |

| Estes Energy | BMW i Ventures (lead), Fortescue (lead); DCVC, New System Ventures | $11 M | Not disclosed | Seed | Jul 23 2025 |

| Hypernatural | AIX Ventures (lead), Underscore VC (lead); Adverb, Character.vc, 43 VC | $9.2 M | Not disclosed | Seed | Jul 23 2025 |

| Kluisz.ai | RTP Global (lead); Unicorn India, Blume Fund, Climber Capital; angels | $9.6 M | Not disclosed | Seed | Jul 23 2025 |

| Volca | Pathlight Ventures (lead); MetaProp, GTMfund, Recall Capital; angels | $5.5 M | Not disclosed | Seed | Jul 23 2025 |

| Modern Baker | Adjuvo (lead) | £2.5 M (~$3.2 M) | Not disclosed | Series A | Jul 23 2025 |

| Freename | Entrée Capital (lead), Polymorphic Capital; Sparkle, BFF, Golden Record; angels | $6.5 M | Not disclosed | Series A | Jul 23 2025 |

| Starseer | Gula Tech Adventures (lead) | $2 M | Not disclosed | Seed | Jul 23 2025 |

| Coluxe | (Friends & family: Startup Sherpas, Ajai Chowdhry, Tej Kapoor, etc.) | Undisclosed | Not disclosed | Friends & Family | Jul 23 2025 |

| Inbound Aerospace | Speciale Invest (lead); Piper Serica | $1 M | Not disclosed | Pre-Seed | Jul 23 2025 |

| Grexa AI | Utsav Somani (lead); DeVC (Z47), Bharat Founders, Vernalis; angels | ₹15.5 Cr (~$1.9 M) | Not disclosed | Seed | Jul 23 2025 |

| Roast Foods | Pagariya Exports (strategic investor) | Undisclosed | Not disclosed | Strategic Investment | Jul 23 2025 |

| Magma | GVFL (strategic investor) | Undisclosed | Not disclosed | Series A (extension) | Jul 23 2025 |