Top Startup and Tech Funding News – July 14, 2025

Moonvalley Raises $84M to Scale Generative AI Video Platform

Moonvalley, an AI research startup building generative video tools on licensed content, secured $84 million in additional funding to expand its cutting-edge platform for Hollywood and enterprise media. Based in Toronto and London, Moonvalley recently released “Marey,” a production-grade AI videography model that creates high-quality visuals while respecting copyright.

The new funding was led by existing backer General Catalyst and joined by Creative Artists Agency (CAA), AI cloud provider CoreWeave, Comcast Ventures, as well as Khosla Ventures and Y Combinator. With this infusion, Moonvalley will grow its engineering team, broaden its licensed content library, and add features that major studios and brands have requested as demand surges for AI-driven yet rights-compliant video production tools.

Funding Details:

- Startup: Moonvalley

- Investors: General Catalyst (lead), Creative Artists Agency, CoreWeave, Comcast Ventures, Khosla Ventures, Y Combinator

- Amount Raised: $84 million

- Total Raised: $154 million

- Funding Stage: Additional funding round (Series B extension)

- Funding Date: July 14, 2025

Illimis Therapeutics Lands $42M Series B for Alzheimer’s Drug Platform

Illimis Therapeutics, a Seoul-based biotech developing therapies for central nervous system and immune disorders, raised $42 million in a Series B round to advance its novel anti-inflammatory platform for Alzheimer’s and other diseases. A syndicate of leading Korean venture investors – including DSC Investment, Woori Venture Partners, and Korea Development Bank – backed the round alongside others such as Aju IB Investment and GS Ventures.

Illimis will use the capital to accelerate development of its proprietary GAIA technology, which modulates key immune pathways (TAM receptors) to combat neuroinflammation. The startup’s lead candidate, ILM01 for Alzheimer’s, is progressing toward clinical trials, and the Series B funding will also allow Illimis to broaden its pipeline and target additional immune-related conditions.

Funding Details:

- Startup: Illimis Therapeutics

- Investors: DSC Investment, Woori Venture Partners, Korea Development Bank, Aju IB Investment, GS Ventures, and other Asia-based venture funds

- Amount Raised: $42 million

- Total Raised: Not disclosed

- Funding Stage: Series B

- Funding Date: July 14, 2025

NetBox Labs Raises $35M Series B to Modernize Network Infrastructure

NetBox Labs, the New York City startup commercializing the popular open-source NetBox network management platform, has raised $35 million in a Series B round to meet soaring enterprise demand. The company provides tools for companies to deploy, automate, and secure complex networks and data center infrastructure.

The funding was led by NGP Capital, with participation from Sorenson Capital and Headline, as well as existing backers Flybridge Capital, Notable Capital, Mango Capital, Salesforce Ventures, Two Sigma Ventures, and IBM. NetBox Labs will leverage the new capital to scale product development and global go-to-market efforts – hiring across engineering, customer success, and sales – as it aims to become the de facto “operating system” for network and infrastructure operations. The startup previously raised a $20 million Series A in 2023.

Funding Details:

- Startup: NetBox Labs

Investors: NGP Capital (lead), Sorenson Capital, Headline, Flybridge Capital, Notable Capital, Mango Capital, Salesforce Ventures, Two Sigma Ventures, IBM

Amount Raised: $35 million

Total Raised: ~$55 million

Funding Stage: Series B

Funding Date: July 14, 2025

TeraWatt Technology Gets Major Backing (Undisclosed Series C First Close Funding)

TeraWatt Technology, a San Francisco-based lithium-ion battery maker, announced the first close of its Series C funding round with an undisclosed amount secured from high-profile global investors. The company, which produces advanced battery cells for electric vehicles and energy storage, attracted a consortium led by Khosla Ventures and Singapore’s Temasek, along with Japan’s JIC Venture Growth Investments, the Japan Bank for International Cooperation (JBIC), GX Acceleration Agency, and G.K. Goh Ventures.

This strategic funding will finance further capital investment in TeraWatt’s manufacturing facilities and increase production capacity as the startup moves toward mass production of its next-generation batteries. The Series C first close reflects strong international confidence in TeraWatt’s technology and its plan to scale up battery output.

Funding Details:

- Startup: TeraWatt Technology

- Investors: Khosla Ventures, Temasek, JIC Venture Growth Investments, Japan Bank for International Cooperation, GX Acceleration Agency, G.K. Goh Ventures

- Amount Raised: Not disclosed (Series C first close)

- Total Raised: Not disclosed

- Funding Stage: Series C (initial close)

- Funding Date: July 14, 2025

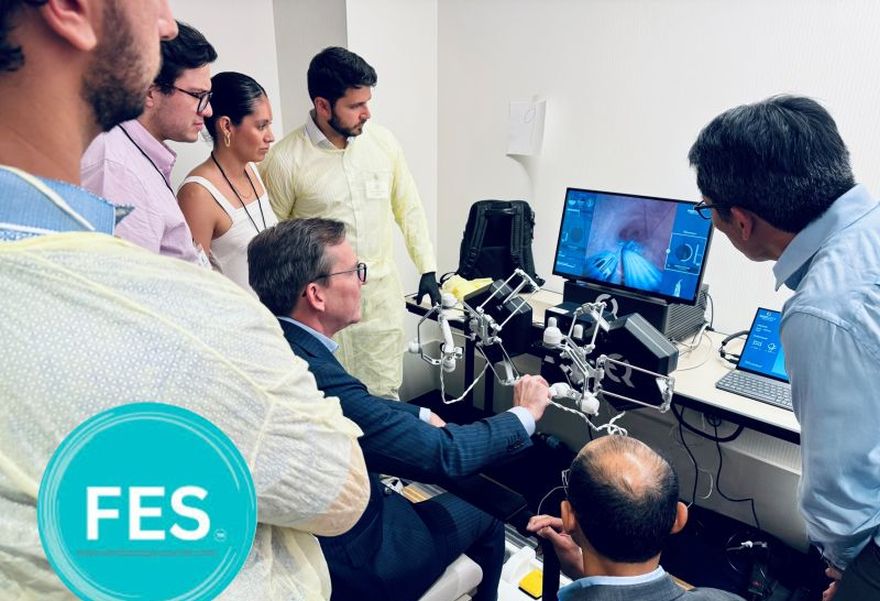

EndoQuest Robotics Closes Series D-2 to Advance Surgical Robots

EndoQuest Robotics, a Houston-based medical robotics company, has closed a Series D-2 funding round co-led by Crescent Enterprises and renowned surgical robotics pioneer Dr. Fred Moll. (Amount Not Disclosed) The financing will accelerate EndoQuest’s development of a flexible endoluminal surgical platform for scar-free gastrointestinal procedures and support ongoing clinical trials aimed at U.S. FDA clearance.

The round also included investment from Puma Venture Capital and the University of Texas Health Science Center. EndoQuest’s robotic system enables surgeons to perform advanced endoscopic procedures through natural orifices, potentially transforming how complex GI lesions are treated. With the new funding, EndoQuest is rapidly progressing its pivotal PARADIGM trial (50-patient study across leading hospitals) and building out visualization technology, all toward bringing its groundbreaking endoluminal robotics to market.

Funding Details:

- Startup: EndoQuest Robotics

- Investors: Crescent Enterprises (co-lead), Dr. Fred Moll (co-lead), Puma Venture Capital, UTHealth Houston

- Amount Raised: Not disclosed

- Total Raised: ~$202 million (estimated)

- Funding Stage: Series D-2

- Funding Date: July 14, 2025

Varda Space Industries Raises $187M Series C for Orbital Manufacturing

Varda Space Industries, a California-based startup developing infrastructure for manufacturing in microgravity, has raised a massive $187 million Series C round to scale its space-based production capabilities. The El Segundo company is pioneering reusable hypersonic reentry capsules and orbital factories to enable pharmaceutical processing and other material production in space.

This funding, led by deep-tech investors Natural Capital and Shrug Capital with participation from Founders Fund, Peter Thiel, Khosla Ventures, Caffeinated Capital, and Lux Capital, will fuel Varda’s expansion as it makes routine in-orbit manufacturing and capsule recovery a reality. The new capital comes as Varda has already completed three successful space missions and prepares to accelerate the deployment of its “orbital economy” infrastructure.

Funding Details:

- Startup: Varda Space Industries

- Investors: Natural Capital (lead), Shrug Capital (lead), Founders Fund, Peter Thiel, Khosla Ventures, Caffeinated Capital, Lux Capital

- Amount Raised: $187 million

- Total Raised: Not disclosed

- Funding Stage: Series C

- Funding Date: July 14, 2025

MOTOR Ai Raises $20M Seed to Deploy Explainable Autonomous Driving Tech

MOTOR Ai, a Berlin-based autonomous driving startup, raised $20 million in seed funding to roll out its certified Level 4 self-driving system on public roads in Germany. The company’s approach centers on explainable AI and neuroscience-inspired “active inference” decision-making, which meets stringent European safety and transparency standards.

The seed round was led by Segenia Capital and eCAPITAL, with participation from German high-net-worth investors. MOTOR Ai’s technology – already compliant with ISO 26262 (ASIL-D) and EU AI regulations – will use the funding to achieve type approval for driverless operations and begin deploying vehicles equipped with its autonomy stack (initially under safety driver supervision). By focusing on certifiable, transparent AI for driverless cars, MOTOR Ai aims to give Europe a homegrown solution for safe autonomy at scale.

Funding Details:

- Startup: MOTOR Ai

- Investors: Segenia Capital (lead), eCAPITAL (lead), plus angel investors

- Amount Raised: $20 million

- Total Raised: $20 million

- Funding Stage: Seed

- Funding Date: July 14, 2025

Zip Security Secures $13.5M Series A to Automate IT and Compliance

Zip Security, a New York-based enterprise security automation startup, has raised $13.5 million in a Series A round to streamline companies’ IT security and compliance workflows. Ballistic Ventures led the investment, joined by Silver Buckshot, Mantis VC, General Catalyst, Human Capital, and BoxGroup.

Zip Security’s platform automates cloud identity management, device security, and compliance audit preparation, helping businesses in defense, finance, health, and software stay secure and “audit-ready” with far less manual effort. The fresh funds will go toward expanding the engineering and go-to-market teams, building integrations with more third-party security tools, and extending Zip’s reach in regulated industries. The Series A brings Zip Security’s total funding to approximately $21 million to date.

Funding Details:

- Startup: Zip Security

- Investors: Ballistic Ventures (lead), Silver Buckshot, Mantis VC, General Catalyst, Human Capital, BoxGroup

- Amount Raised: $13.5 million

- Total Raised: $21 million

- Funding Stage: Series A

- Funding Date: July 14, 2025

Dextall Closes $15M Series A to Scale Prefabricated Construction Tech

Dextall, a New York City construction tech startup, closed a $15 million Series A funding round to accelerate its software-driven approach to building façades and walls for mid- and high-rise projects. The company integrates AI-powered design tools with off-site manufacturing of modular exterior wall systems, shortening construction timelines and reducing costs and carbon footprint.

Backers in this round include real estate firms L+M Development Partners and Essence Development, alongside building products leader Simpson Strong-Tie. With this funding, Dextall will expand into new markets like Boston, Philadelphia, Washington D.C., and Chicago while advancing its product automation. Led by CEO Aurimas Sabulis, Dextall’s end-to-end platform aims to eliminate millions of hours of on-site coordination by delivering prefabricated wall panels that simply install on buildings, revolutionizing how construction is executed.

Funding Details:

- Startup: Dextall

- Investors: L+M Development Partners, Essence Development, Simpson Strong-Tie

- Amount Raised: $15 million

- Total Raised: Not disclosed

- Funding Stage: Series A

- Funding Date: July 14, 2025

Murphy Raises $15M Pre-Seed to Automate Debt Collection with AI

Murphy, a Barcelona-based fintech startup, emerged from stealth with $15 million in pre-seed funding to modernize the debt collection industry through AI-powered virtual agents. Founded in late 2024, Murphy’s platform replaces traditional call centers with autonomous voice and multi-channel bots that engage debtors more effectively and respectfully.

The oversubscribed round was led by Northzone (an early backer of Klarna and Revolut) with participation from Lakestar, Seedcamp, ElevenLabs, and existing angel investors. Murphy will use the funds to scale its product and engineering teams and launch internationally. By using artificial intelligence to personalize outreach and handle routine collections, Murphy helps banks, telecoms, utilities, and loan servicers recover funds faster while cutting costs, transforming a historically analog, inefficient process into a digital-first, customer-friendly experience.

Funding Details:

- Startup: Murphy

- Investors: Northzone (lead), Lakestar, Seedcamp, ElevenLabs, and others

- Amount Raised: $15 million

- Total Raised: $15 million

- Funding Stage: Pre-Seed/Seed

- Funding Date: July 14, 2025

The GLD Shop Receives Growth Investment to Expand Lifestyle Jewelry Brand

The GLD Shop, a Miami-based lifestyle jewelry brand known for its celebrity-endorsed chains and pendants, received a significant growth investment led by private equity firm MarcyPen Capital Partners, with Brand Velocity Group also joining as an investor. (The financial terms were not disclosed.) As part of the deal, GLD’s co-founder and Chief Creative Officer, Christian Johnston, increased his ownership by reinvesting in the company, signaling confidence in GLD’s future.

The funding will support GLD’s continued global expansion and product development as it cements its status as a cultural force in jewelry, boasting millions of customers and partnerships spanning the NBA, NFL, Marvel, and more. GLD’s management team, including CEO David Reinke, will remain at the helm as the company scales its operations and marketing with the new backing.

Funding Details:

- Startup: The GLD Shop (GLD)

- Investors: MarcyPen Capital Partners (lead), Brand Velocity Group, with founder Christian Johnston reinvesting

- Amount Raised: Not disclosed

- Total Raised: Not disclosed

- Funding Stage: Growth investment

- Funding Date: July 14, 2025

J.P. Morgan Invests in Island’s Enterprise Browser Series E

Enterprise browser startup Island announced that J.P. Morgan’s Growth Equity Partners has joined its Series E round as a strategic investor. The Dallas-based company, which in March raised $250 million at a nearly $5 billion valuation for its secure, controlled web browser for businesses, will gain both capital and a key financial industry partner through J.P. Morgan’s involvement. (The additional investment amount was not disclosed.)

With its Enterprise Browser, Island embeds security, IT controls, and productivity tools directly into a Chromium-based browser, giving large organizations fine-grained governance over employee web activity. The Series E funding, now including J.P. Morgan’s backing, will help Island accelerate product innovation for CIOs and CISOs and drive adoption across regulated sectors. Island has reportedly raised around $730 million in total funding and is expanding globally from its US and Tel Aviv bases.

Funding Details:

- Startup: Island

- Investors: J.P. Morgan Private Capital – Growth Equity Partners (joining Series E round led by Coatue)

- Amount Raised: Not disclosed (strategic investment as part of Series E)

- Total Raised: ~$730 million

- Funding Stage: Series E (additional strategic investor)

- Funding Date: July 14, 2025

Independence Hydrogen Receives Strategic Investment from Sumitomo

Independence Hydrogen, a clean energy startup based in Petersburg, Virginia, received a strategic investment from Japanese conglomerate Sumitomo Corporation to boost its decentralized hydrogen supply business. (Financial terms were not disclosed.) Independence Hydrogen captures hydrogen that would otherwise be wasted (vented as a byproduct) and purifies it into fuel-cell-grade hydrogen for local distribution.

By recycling industrial hydrogen and delivering it to material handling, transportation, and backup power customers, the company provides a greener, more distributed model of hydrogen fuel supply (dubbed “DeHy”). The infusion of capital from Sumitomo – a global leader in energy and infrastructure – will help Independence Hydrogen expand its operations and develop additional production sites. Led by CEO Dat Tran, the company is scaling up its first hydrogen recycling facility in Virginia and aims to support the growing demand for low-carbon hydrogen across North America.

Funding Details:

- Startup: Independence Hydrogen

- Investors: Sumitomo Corporation (strategic corporate investor)

- Amount Raised: Not disclosed

- Total Raised: Not disclosed

- Funding Stage: Growth/strategic investment

- Funding Date: July 14, 2025

Pretzel Therapeutics Gains Funding from Mito Fund for Mitochondrial Therapies

Pretzel Therapeutics, a Cambridge- and Sweden-based biotech focused on mitochondrial disease treatments, received a funding boost from the Mito Fund to advance its lead drug program. (The investment amount was not disclosed.) Pretzel is developing novel therapies for conditions related to mitochondrial DNA depletion and polymerase (POLG) mutations, often devastating disorders with few options. Its lead candidate, PX-578, recently entered Phase 1 trials targeting a key mitochondrial DNA polymerase to restore cellular energy production.

The new capital from Mito Fund (a specialist investor in mitochondrial medicine) will support ongoing clinical development and expand Pretzel’s research operations. Founded in 2019 and with R&D teams in Boston and in Mölndal, Sweden, Pretzel Therapeutics is at the forefront of “cellular energetics” innovations that could improve or save the lives of patients with rare genetic mitochondrial diseases.

Funding Details:

- Startup: Pretzel Therapeutics

- Investors: Mito Fund

- Amount Raised: Not disclosed

- Total Raised: Not disclosed

- Funding Stage: Strategic investment / undisclosed round

- Funding Date: July 14, 2025

BondCliQ Receives Investment from FactSet to Boost Bond Market Platform

BondCliQ, a New York-based fintech operating a central market system for corporate bond trading data, received a strategic investment from financial data giant FactSet. (The deal amount was not disclosed.) BondCliQ has developed the first consolidated quote feed for U.S. corporate bonds, bringing greater price transparency to a historically opaque market. By aggregating and normalizing bond quotes from major dealers, BondCliQ’s Data-as-a-Service platform gives institutional investors and banks a clearer view of real-time bond pricing and liquidity.

FactSet’s backing will help BondCliQ accelerate enhancements to its fixed income data offerings and reach more global customers through FactSet’s platform. Led by CEO Chris White (who founded the company in 2016), BondCliQ counts leading investment banks and asset managers among its users and aims to set the market standard for corporate bond price discovery with this new partnership.

Funding Details:

- Startup: BondCliQ

- Investors: FactSet (strategic investment)

- Amount Raised: Not disclosed

- Total Raised: Not disclosed

- Funding Stage: Strategic investment

- Funding Date: July 14, 2025

Cobionix Raises $3M to Advance Autonomous Medical Robotics

Cobionix, a Kitchener, Ontario-based robotics startup, raised $3 million in seed funding to further develop its autonomous medical robot platform. The round was led by TitletownTech – a venture fund formed by the Green Bay Packers and Microsoft – with participation from Lions Investment and surgeon Dr. Paul McBeth, among others. Cobionix’s flagship robot, CODI, is a versatile platform capable of performing patient-facing procedures like diagnostic ultrasounds without direct human operation.

The system can be rapidly reconfigured for different tasks via tool changes and software updates, enabling a wide range of healthcare applications from a single robotic unit. With the new funding, Cobionix will focus on piloting CODI in clinical settings in Canada, the U.S., and the U.K., and on moving its technology toward regulatory approvals. The company, led by CEO Matthew Sefati and CTO Nima Zamani, aims to deploy CODI to fill gaps in healthcare delivery and improve patient access to diagnostic and therapeutic services.

Funding Details:

- Startup: Cobionix

- Investors: TitletownTech (lead), Lions Investment, Dr. Paul McBeth, among others

- Amount Raised: US$3 million

- Total Raised: US$3 million

- Funding Stage: Seed

- Funding Date: July 14, 2025

YPlasma Raises $2.5M Seed for Advanced Cooling via Plasma Tech

YPlasma, a deep-tech startup from Barcelona, raised $2.5 million in seed funding to commercialize its silent plasma-based cooling technology for electronics and semiconductors. The company spun out from the Spanish space agency’s research on plasma actuators and is developing compact cooling devices with no moving parts, aimed at high-performance computing and aerospace applications. The investment was led by Faber (a European hardware investor) with participation from SOSV’s HAX accelerator.

YPlasma will use the seed capital to expand its R&D efforts (now spanning Spain and HAX’s lab in Newark) and accelerate go-to-market for its cooling modules, which could revolutionize thermal management in data centers and electric vehicles. Led by CEO David Garcia, YPlasma’s plasma flow control technology also has potential uses in de-icing, air purification, and aerodynamics, reflecting a broad range of industries that could benefit from plasma innovations in energy efficiency.

Funding Details:

- Startup: YPlasma

- Investors: Faber (lead), SOSV (HAX)

- Amount Raised: $2.5 million

- Total Raised: $2.5 million

- Funding Stage: Seed

- Funding Date: July 14, 2025

Abacus Raises $6.6M Seed to Build AI Copilots for Accounting Firms

Abacus, a San Francisco-based startup building AI “agent” tools for accounting firms, raised $6.6 million in seed funding to help automate and streamline tax preparation workflows. The round was led by Menlo Ventures, with notable participation from Pear VC, and included Recall Capital and Original Capital. Founded by brothers Cody and Brandon Sugarman, Abacus is developing an “AI CPA assistant” that can gather client financial data, analyze tax documents, and input information directly into returns, reducing the manual drudgery for accountants.

The fresh funds will allow Abacus to expand its engineering team and refine its platform, which aims to tackle the talent shortage and heavy workloads in the accounting industry. By eliminating repetitive tasks while preserving accuracy and control, Abacus’s AI assistants help tax professionals focus on higher-value advisory work during the busy season.

Funding Details:

- Startup: Abacus

- Investors: Menlo Ventures (lead), Pear VC, Recall Capital, Original Capital

- Amount Raised: $6.6 million

- Total Raised: $6.6 million

- Funding Stage: Seed

- Funding Date: July 14, 2025

Duranta Raises $7M Seed to Build Operating System for Landscapers

Duranta, a Seattle-based startup, raised $7 million in seed funding to grow its software platform serving landscapers and lawn care businesses. The round was co-led by Base10 Partners, Pear VC, Coalition Operators, and Sunshine Lake Partners, with participation from tech executives Thomas Dohmke and Andrew Miklas. Duranta, founded by alumni of Aurora Solar, is building an end-to-end operating system for outdoor services companies – including “AIdan,” an AI-powered tool that automatically measures property details (from satellite imagery) and generates instant customer quotes for lawn and landscaping jobs.

The platform also offers landscape design, invoicing, and CRM features tailored to the green industry. With the new funding, CEO Samuel Adeyemo plans to expand Duranta’s engineering team and accelerate product development. The goal is to help landscaping professionals win more customers and streamline their workflow by leveraging automation and smart data, in a field that traditionally runs on pen-and-paper or generic software.

Funding Details:

- Startup: Duranta

- Investors: Base10 Partners (lead), Pear VC (lead), Coalition Operators, Sunshine Lake, plus angels Thomas Dohmke and Andrew Miklas

- Amount Raised: $7 million

- Total Raised: $7 million

- Funding Stage: Seed

- Funding Date: July 14, 2025

Asepha Raises $4M Seed to Automate Pharmacy Workflows with AI

Asepha, a Toronto-based startup developing AI agents for pharmacy operations, raised $4 million in seed funding to accelerate the rollout of its automation platform for pharmacies. The round was co-led by Glasswing Ventures and Core Innovation Capital, with participation from Panache Ventures, Redbud Ventures, Ripple Ventures, and Front Row Ventures. Asepha’s software uses artificial intelligence to handle time-consuming tasks in pharmacies, such as prescription data entry, phone triage, and navigating insurance websites, thereby reducing turnaround times and administrative burden.

Founded in 2023 by Eunice Wu and Can Uncu, Asepha plans to use the new funds to grow its engineering and go-to-market teams and to expand its presence in the U.S. with a New York City office. By offering modular AI tools that integrate into existing pharmacy systems, Asepha aims to help pharmacists and pharmacy chains improve efficiency and focus more on patient care in an increasingly strained healthcare environment.

Funding Details:

- Startup: Asepha

- Investors: Glasswing Ventures (lead), Core Innovation Capital (lead), Panache Ventures, Redbud Ventures, Ripple Ventures, Front Row Ventures

- Amount Raised: $4 million

- Total Raised: $4 million

- Funding Stage: Seed

- Funding Date: July 14, 2025

Circuit Raises $4.5M Seed for Crypto Asset Recovery Platform

Circuit, a New York-based startup that builds a digital asset recovery platform, raised $4.5 million in seed funding to help businesses and individuals reclaim lost or compromised cryptocurrency. The round was led by fintech-focused Nyca Partners, with participation from Soma Capital, New Form Capital, The Venture Dept, Silicon Badia, Druid Ventures, and strategic angels from the crypto industry (including executives from Fireblocks, Galaxy Digital, and Ripple).

Circuit’s technology embeds automated asset recovery flows into crypto wallets: users define “smart” backup rules in advance, and if a wallet is hacked or keys are lost, the platform executes pre-approved steps to transfer funds to safety. The seed funding will enable CEO Harry Donnelly and the team to expand operations and continue development of Circuit’s security platform. As crypto adoption grows, Circuit aims to provide peace of mind by making asset recovery seamless, effectively allowing Web3 users to “undo” catastrophic losses that today are often irreversible.

Funding Details:

- Startup: Circuit

- Investors: Nyca Partners (lead), Soma Capital, New Form Capital, The Venture Dept, Silicon Badia, Druid Ventures, and strategic angels (from Fireblocks, Galaxy, Ripple)

- Amount Raised: $4.5 million

- Total Raised: $4.5 million

- Funding Stage: Seed

- Funding Date: July 14, 2025

Opter AI (Opper AI) Raises $3M Pre-Seed to Turn LLMs into Reliable Agents

Opter AI – a Stockholm-based developer infrastructure startup formerly known as Opper AI – raised $3 million in pre-seed funding to help software teams turn large language models (LLMs) into dependable, structured systems. The investment came from Luminar Ventures, Emblem Venture Capital, Greens Capital, and a group of angel investors. Opter is introducing a novel approach called “task contracts,” allowing developers to define tasks (inputs, expected outputs, success criteria) in JSON.

The platform then uses intelligent prompt generation, feedback loops, and model switching to ensure the LLM completes the task accurately and repeatedly. CEO Göran Sandahl and his co-founders, who previously built a successful observability startup, will use the funding to launch Opter’s Task Completion API and attract a developer community. By providing guardrails and an API layer for AI models, Opter aims to eliminate the guesswork in prompt engineering and make AI outputs robust enough for real-world enterprise use cases.

Funding Details:

- Startup: Opter AI (formerly Opper AI)

- Investors: Luminar Ventures, Emblem Venture Capital, Greens Capital, plus angel investors

- Amount Raised: $3 million

- Total Raised: $3 million

- Funding Stage: Pre-Seed

- Funding Date: July 14, 2025

ScienceMachine Raises $3.5M Pre-Seed to Build AI Data Scientist for Biotech

ScienceMachine, a London-based startup creating an AI-powered data analyst for life science R&D, raised $3.5 million in a pre-seed round to accelerate development of its “AI Data Scientist” platform. The funding was co-led by Revent and Nucleus Capital, with participation from Juniper Ventures, Opal Ventures, and several angel investors. ScienceMachine’s product – nicknamed “Sam” – automatically ingests and analyzes complex experimental data for biotechnology researchers, cleaning and visualizing results, and even integrating relevant public datasets.

By structuring research data and surfacing new insights, Sam helps bio R&D teams optimize experiments and identify promising leads faster. CEO Lorenzo Sani says the capital will be used to expand the startup’s operations and refine the AI, which is being tailored to tasks like improving bio-manufacturing processes and drug discovery. ScienceMachine’s vision is to give every scientist a tireless virtual assistant that works 24/7 to drive innovation from lab data, potentially accelerating breakthroughs in medicine and sustainability.

Funding Details:

- Startup: ScienceMachine

- Investors: Revent (lead), Nucleus Capital (lead), Juniper Ventures, Opal Ventures, and angel investors

- Amount Raised: $3.5 million

- Total Raised: $3.5 million

- Funding Stage: Pre-Seed

- Funding Date: July 14, 2025

Inntelo AI Raises £506K Pre-Seed to Enhance Hotel Guest Experiences

Inntelo AI, a London-based hospitality tech startup, raised £506,000 in pre-seed funding to expand its AI-driven guest engagement platform for hotels. The round was led by Haatch (a UK venture fund) and the British Business Bank’s Future Fund, with participation from Look AI Ventures and several angel investors, among them former executives from Trip.com and DocuSign. Inntelo, founded by CEO Asif Alidina, offers hotels an AI concierge that handles guest inquiries via WhatsApp, phone, and other channels, automatically turning requests into tasks for hotel staff.

By leveraging conversational AI and process automation, Inntelo improves guest satisfaction and operational efficiency across departments from housekeeping to spa services. The new funds will be used to accelerate commercial growth, integrate with more property management systems, and scale deployments at hotel properties. This financing follows an earlier £120,000 investment from the Antler accelerator, bringing Inntelo’s total funding to roughly £626,000 to date.

Funding Details:

- Startup: Inntelo AI

- Investors: Haatch (lead), British Business Bank Future Fund (co-lead), Look AI Ventures, and angel investors (ex-Trip.com, DocuSign executives)

- Amount Raised: £506,000 (approx. $660,000)

- Total Raised: £626,000

- Funding Stage: Pre-Seed

- Funding Date: July 14, 2025

Funding Summary Table:

| Startup | Investors (Lead and Notable) | Amount Raised | Total Raised | Funding Stage | Funding Date |

|---|---|---|---|---|---|

| Varda Space Industries | Natural Capital, Shrug Capital (leads); Founders Fund, Peter Thiel, Khosla Ventures, etc. | $187 M | Not disclosed | Series C | July 14, 2025 |

| Moonvalley | General Catalyst (lead); CAA, CoreWeave, Comcast Ventures, Khosla, Y Combinator | $84 M | $154 M | Additional Funding (Series B ext.) | July 14, 2025 |

| Illimis Therapeutics | DSC Investment, Woori VP (co-leads); Korea Dev. Bank, Aju IB, GS Ventures, etc. | $42 M | Not disclosed | Series B | July 14, 2025 |

| NetBox Labs | NGP Capital (lead); Sorenson Capital, Headline; Flybridge, Salesforce, IBM, etc. | $35 M | ~$55 M | Series B | July 14, 2025 |

| TeraWatt Technology | Khosla Ventures, Temasek, JIC, JBIC (major investors) | Not disclosed | Not disclosed | Series C (First Close) | July 14, 2025 |

| EndoQuest Robotics | Crescent Enterprises, Dr. Fred Moll (co-leads); Puma VC, UTHealth | Not disclosed | ~$202 M | Series D-2 | July 14, 2025 |

| MOTOR Ai | Segenia Capital, eCAPITAL (leads); HNWI angels | $20 M | $20 M | Seed | July 14, 2025 |

| Zip Security | Ballistic Ventures (lead); Silver Buckshot, Mantis VC, General Catalyst, etc. | $13.5 M | $21 M | Series A | July 14, 2025 |

| Dextall | L+M Development Partners, Essence Dev., Simpson Strong-Tie | $15 M | Not disclosed | Series A | July 14, 2025 |

| Murphy | Northzone (lead); Lakestar, Seedcamp, ElevenLabs | $15 M | $15 M | Pre-Seed/Seed | July 14, 2025 |

| The GLD Shop (GLD) | MarcyPen Capital (lead); Brand Velocity Group; Founder re-invest | Not disclosed | Not disclosed | Growth Investment | July 14, 2025 |

| Island | J.P. Morgan Growth Equity (new investor in Series E) | Not disclosed | ~$730 M | Series E (Strategic) | July 14, 2025 |

| Independence Hydrogen | Sumitomo Corporation (strategic investor) | Not disclosed | Not disclosed | Strategic Investment | July 14, 2025 |

| Pretzel Therapeutics | Mito Fund (strategic healthcare investor) | Not disclosed | Not disclosed | Strategic Investment | July 14, 2025 |

| BondCliQ | FactSet (strategic investor) | Not disclosed | Not disclosed | Strategic Investment | July 14, 2025 |

| Cobionix | TitletownTech (lead); Lions Investment, Dr. Paul McBeth | $3 M | $3 M | Seed | July 14, 2025 |

| YPlasma | Faber (lead); SOSV (HAX) | $2.5 M | $2.5 M | Seed | July 14, 2025 |

| Abacus | Menlo Ventures (lead); Pear VC, Recall, Original Capital | $6.6 M | $6.6 M | Seed | July 14, 2025 |

| Duranta | Base10, Pear (co-leads); Coalition Operators, Sunshine Lake | $7 M | $7 M | Seed | July 14, 2025 |

| Asepha | Glasswing, Core Innovation (co-leads); Panache, Redbud, Ripple, Front Row | $4 M | $4 M | Seed | July 14, 2025 |

| Circuit | Nyca Partners (lead); Soma, New Form, The Venture Dept, etc. | $4.5 M | $4.5 M | Seed | July 14, 2025 |

| Opter AI (Opper) | Luminar Ventures, Emblem (leads); Greens Capital, angels | $3 M | $3 M | Pre-Seed | July 14, 2025 |

| ScienceMachine | Revent, Nucleus Capital (co-leads); Juniper, Opal Ventures | $3.5 M | $3.5 M | Pre-Seed | July 14, 2025 |

| Inntelo AI | Haatch (lead); British Business Bank, Look AI Ventures, angels | £506K | £626K (incl. prior) | Pre-Seed | July 14, 2025 |