Top 10 Startup and Tech Funding News Roundup for the Week Ending July 11, 2025

It’s Friday, July 11, 2025, and we’re back with your top startup and tech funding news roundup for the week ending July 11. This week wrapped up with a strong flurry of venture activity across sectors that continues to reshape the global tech landscape. From AI infrastructure and in-space manufacturing to fintech, fashion logistics, and deep mathematical reasoning, investors aren’t just writing checks—they’re backing companies rewriting the rules of their industries.

iCapital Secures $820 Million to Expand Alternative Investment Platform

iCapital, a fintech platform for alternative investments, has raised an $820 million funding round at a valuation above $7.5 billion to fuel its next phase of growth. The New York-based company’s platform enables wealth managers and investors to access private market and alternative assets through a unified digital interface.

The latest infusion, co-led by SurgoCap Partners and T. Rowe Price, saw participation from existing backers including Temasek, UBS, and BNY Mellon. Founded in 2013, iCapital has grown rapidly (acquiring over 20 companies along the way) and plans to use the new capital for strategic acquisitions, international expansion, and further investment in its technology as demand for “wealthtech” solutions continues to rise.

Funding Details:

- Startup: iCapital

- Investors: SurgoCap Partners and T. Rowe Price (co-leads); Temasek, UBS, BNY Mellon (among others)

- Amount Raised: $820 million

- Total Raised: ~$1.5 billion (to date)

- Funding Stage: Not disclosed (late-stage)

- Funding Date: July 10, 2025

Bilt Rewards Bags $250 Million, Triples Valuation in Housing Fintech Push

Bilt, a fintech loyalty platform that lets renters earn points on housing payments, has raised $250 million in new funding at a $10.75 billion valuation. The round was led by General Catalyst and real estate investment firm GID, with participation from United Wholesale Mortgage, and more than tripled Bilt’s valuation from its previous round in 2024.

Founded in 2021 and based in New York, Bilt offers a co-branded credit card and rewards program enabling users to earn points on rent, which can be redeemed for travel, fitness classes, home décor, and even a future home down payment. With this massive injection of capital, Bilt is expanding its platform beyond rent to encompass condos, homeowner association fees, student housing, and mortgage payments. The company is also rolling out new credit card options (including a no-annual-fee card and premium tiers) as it evolves into a broader housing and neighborhood commerce network.

Funding Details:

- Startup: Bilt Rewards

- Investors: General Catalyst (lead), GID (lead); participation from United Wholesale Mortgage

- Amount Raised: $250 million

- Total Raised: $813 million

- Funding Stage: Series D (late-stage)

- Funding Date: July 10, 2025

XPANCEO Raises $250 Million Series A for AR Contact Lens Interfaces

XPANCEO, a Dubai-based deeptech startup developing AI-powered smart contact lenses, secured $250 million in a Series A round at a $1.35 billion valuation. The funding was led by Opportunity Venture Asia, which had also led XPANCEO’s earlier $40 million seed round, signaling strong continued support. XPANCEO’s vision is to replace smartphones and traditional wearables with seamless augmented-reality contact lenses that overlay digital information directly onto the user’s field of view.

Co-founded by Roman Axelrod and Dr. Valentyn Volkov, the company is building these next-gen wearable interfaces to allow users to interact with digital content hands-free. The new capital will accelerate XPANCEO’s efforts to commercialize its technology — expanding global R&D and manufacturing teams, progressing regulatory approvals, and launching pilot deployments — as the startup moves closer to bringing its futuristic interface to market.

Funding Details:

- Startup: XPANCEO

- Investors: Opportunity Venture Asia (lead); (previous seed backer, with no additional investors disclosed publicly for this round)

- Amount Raised: $250 million

- Total Raised: $290 million (approximate)

- Funding Stage: Series A

- Funding Date: July 2025 (Week of July 7–11, 2025)

Varda Space Industries Lands $187 Million for In‑Space Pharma Labs

Varda Space Industries, a California-based startup pioneering in-space pharmaceutical manufacturing, has raised $187 million in a Series C round to scale its orbital lab capabilities and hypersonic reentry technology. The round was co-led by Natural Capital and Shrug Capital, with notable participation from Founders Fund (co-founded by Peter Thiel), Khosla Ventures, Caffeinated Capital, Lux Capital, Also Capital, and even Thiel himself.

Varda has already completed three capsule launch-and-return missions — including two successful recoveries earlier this year — which tested microgravity drug crystallization processes and demonstrated the startup’s reentry systems. With the new funding, Varda plans to increase the frequency of its spaceflights and build out what could be the world’s first commercial microgravity-enabled drug production facility in orbit. The company is hiring pharmaceutical researchers (such as structural biologists and crystallization scientists) as it aims to deliver the first drug formulations made in space, an uncommon intersection of aerospace and biotech with huge strategic potential.

Funding Details:

- Startup: Varda Space Industries

- Investors: Natural Capital and Shrug Capital (co-leads); Founders Fund, Peter Thiel, Khosla Ventures, Caffeinated Capital, Lux Capital, Also Capital

- Amount Raised: $187 million

- Total Raised: $329 million

- Funding Stage: Series C

- Funding Date: July 11, 2025

MaintainX Gets $150 Million to Double Down on AI for Operations

MaintainX, a San Francisco-based startup offering an AI-driven maintenance and asset management platform, has raised $150 million in a Series D funding round that values the company at $2.5 billion. The round was co-led by Bessemer Venture Partners and Bain Capital Ventures, and brings MaintainX’s total funding to about $254 million to date. MaintainX’s software helps industrial and frontline teams digitize their work orders, track equipment performance, and leverage machine learning to predict and prevent failures, transforming maintenance from a manual, reactive task into a proactive, data-driven function.

The new financing will be used to enhance the platform’s AI and machine health monitoring capabilities (including more IoT sensor integrations), develop predictive maintenance solutions, and expand into additional industries and global markets. MaintainX is positioning itself as a leader in the digital transformation of operations management, aiming to save companies billions by reducing unplanned downtime and improving efficiency.

Funding Details:

- Startup: MaintainX

- Investors: Bessemer Venture Partners (co-lead), Bain Capital Ventures (co-lead); D.E. Shaw, Amity Ventures, August Capital, Founders Circle, Sozo Ventures, and others

- Amount Raised: $150 million

- Total Raised: $254 million

- Funding Stage: Series D

- Funding Date: July 9, 2025

Harmonic AI Snags $100 Million Series B to Build “Math Superintelligence”

Harmonic AI, an artificial intelligence startup co-founded by Robinhood CEO Vlad Tenev, secured $100 million in a Series B round to advance its mission of solving complex mathematical problems with AI. The Palo Alto-based company’s latest funding was led by Kleiner Perkins with participation from Paradigm and Ribbit Capital, alongside continued support from existing investors Sequoia Capital and Index Ventures.

Harmonic’s flagship AI model, dubbed Aristotle, is designed to tackle advanced math, physics, and computer science problems that stump today’s general-purpose AI systems, using formal verification methods to ensure each step of reasoning is logically correct. The new capital values Harmonic at roughly $875 million and will help the company accelerate the development and release of Aristotle to researchers and the public later this year.

By focusing on “math-first” AI and eliminating the hallucination issues of large language models, Harmonic aims to achieve breakthroughs on unsolved equations and create a foundation for more trustworthy AI in high-stakes domains.

Funding Details:

- Startup: Harmonic AI

- Investors: Kleiner Perkins (lead); Paradigm, Ribbit Capital; existing backers Sequoia Capital and Index Ventures

- Amount Raised: $100 million

- Total Raised: $175 million (approximate)

- Funding Stage: Series B

- Funding Date: July 11, 2025

Agora Banks $50 Million to Scale Stablecoin Infrastructure Platform

Agora, a startup building white-label stablecoin infrastructure, has raised $50 million in a Series A funding round to help businesses launch their own digital currencies. The round was led by crypto venture giant Paradigm, with participation from Dragonfly Capital, and boosts Agora’s total financing to roughly $62 million (including its prior seed raise). Agora provides a full-stack platform that allows fintechs, exchanges, and enterprises to issue branded U.S. dollar stablecoins quickly without having to build the complex blockchain, compliance, and liquidity systems from scratch.

The New York-based company, co-founded by Nick van Eck (son of the CEO of asset manager VanEck) and former Coinbase engineers, announced the funding alongside the launch of its enterprise stablecoin solution, which enables companies to spin up their own regulated stablecoins within days. With the new capital, Agora plans to deepen the integration between on-chain digital dollars and traditional banking infrastructure, while offering partners features like shared yield from reserve assets and global on/off-ramps. The investment underscores growing institutional demand for stablecoin tech as the $250+ billion stablecoin market continues to expand toward mainstream finance.

Funding Details:

- Startup: Agora

- Investors: Paradigm (lead); Dragonfly Capital (existing investor continuing participation)

- Amount Raised: $50 million

- Total Raised: $62 million

- Funding Stage: Series A

- Funding Date: July 11, 2025

RealSense Spins Out of Intel with $50 Million for AI Vision Tech

RealSense, a pioneer in AI-powered computer vision previously part of Intel Corp., has completed a spinout as an independent company and raised $50 million in Series A funding to accelerate its growth. The investment was led by an undisclosed semiconductor-focused private equity firm and included strategic participation from Intel Capital and the MediaTek Innovation Fund.

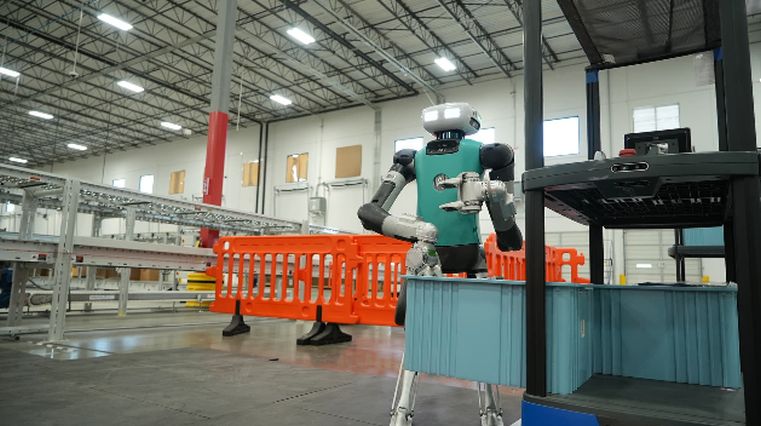

RealSense is well-known for its 3D depth-camera technology, which is embedded in a majority of the world’s autonomous mobile robots and has applications ranging from robotics and industrial automation to biometric security and augmented reality. Under CEO Nadav Orbach, the San Francisco-area company will use the new funding to scale up its manufacturing, sales, and go-to-market globally, and to expand into emerging markets and product lines.

As an independent entity, RealSense plans to move faster in innovating next-generation vision systems for humanoid robots, AI-driven surveillance and access control, and other “physical AI” applications – all while continuing to support its existing customer base and product roadmap inherited from Intel.

Funding Details:

- Startup: RealSense

- Investors: Renowned semiconductor private equity firm (lead, name not disclosed); Intel Capital; MediaTek Innovation Fund

- Amount Raised: $50 million

- Total Raised: $50 million (as a spinout)

- Funding Stage: Series A

- Funding Date: July 11, 2025

Virtru Locks Down $50 Million to Advance Data Security Platform

Virtru, a Washington, D.C.-based data security and privacy startup, has raised $50 million in Series D funding to scale its enterprise data protection platform. The round was led by Iconiq Capital, with participation from existing investors including Bessemer Venture Partners, Foundry Capital, and the Chertoff Group. This latest investment doubles Virtru’s valuation to approximately $500 million and comes as organizations seek better control over sensitive information in the age of AI and cloud collaboration.

Founded in 2012 by brothers John and Will Ackerly (one an ex-NSA engineer), Virtru is known for its Trusted Data Format (TDF) technology, which allows companies and government agencies to encrypt files and emails and maintain control over who can access them, even after sharing. Virtru’s platform integrates with tools like Google Workspace and Microsoft 365 to enable end-to-end encryption, granular permissions, and audit trails for data.

With the new funding, Virtru plans to accelerate development of security solutions for AI/ML data workflows and strengthen its position as a leader in data-centric security standards, catering to both commercial enterprises and defense/government clients that require zero-compromise data sharing.

Funding Details:

- Startup: Virtru

- Investors: Iconiq Capital (lead); Bessemer Venture Partners, Foundry Capital, The Chertoff Group

- Amount Raised: $50 million

- Total Raised: $150 million+

- Funding Stage: Series D

- Funding Date: July 11, 2025

Apolink Raises $4.3 Million Seed to Keep Satellites Connected 24/7

Apolink, a space-tech startup founded by 19-year-old entrepreneur Onkar Singh Batra, has raised $4.3 million in an oversubscribed seed round to develop a real-time connectivity network for low Earth orbit satellites. Backed by Y Combinator, 468 Capital, Unshackled Ventures, Rebel Fund, Maiora Ventures, and other angels, the new funding values Apolink at $45 million post-money.

The Y Combinator-backed startup — formerly known as Bifrost Orbital — is tackling the problem of intermittent “dead zones” in satellite communications. Today, satellites often lose contact when they don’t have line-of-sight to a ground station, but Apolink is building a constellation of relay satellites equipped with a hybrid RF and optical laser communications system to provide continuous 24/7 coverage.

By ensuring that each satellite in orbit can always link to the network, Apolink aims to enable constant data flow for Earth observation, telecom, and defense satellites. With the seed funding, the team will accelerate development of its relay technology and prepare for in-space demonstrations, bringing the industry closer to uninterrupted global satellite connectivity as agencies like NASA move toward relying on commercial networks for space communications.

Funding Details:

- Startup: Apolink

- Investors: Y Combinator, 468 Capital, Unshackled Ventures, Rebel Fund, Maiora Ventures; notable angels including Laura Crabtree (Epsilon3 CEO), Benjamin Bryant (Pebble co-founder), Kanav Kariya (Jump Crypto President)

- Amount Raised: $4.3 million

- Total Raised: $4.3 million

- Funding Stage: Seed Round

- Funding Date: July 11, 2025

Funding Summary Table:

| Startup | Investors (Lead and notable investors) | Amount Raised | Total Raised | Funding Stage | Funding Date |

|---|---|---|---|---|---|

| iCapital | SurgoCap Partners, T. Rowe Price (co-leads); Temasek, UBS, BNY Mellon | $820 million | ~$1.5 billion | Not disclosed (Late-stage) | July 10, 2025 |

| Bilt Rewards | General Catalyst (lead), GID (lead); United Wholesale Mortgage | $250 million | $813 million | Series D | July 10, 2025 |

| XPANCEO | Opportunity Venture Asia (lead) | $250 million | ~$290 million | Series A | July 2025 (Week 28) |

| Varda Space | Natural Capital, Shrug Capital (co-leads); Founders Fund, Peter Thiel, Khosla, Lux, etc. | $187 million | $329 million | Series C | July 11, 2025 |

| MaintainX | Bessemer Venture Partners (co-lead), Bain Capital Ventures (co-lead); D.E. Shaw, etc. | $150 million | $254 million | Series D | July 9, 2025 |

| Harmonic AI | Kleiner Perkins (lead); Paradigm, Ribbit; Sequoia, Index (existing) | $100 million | ~$175 million | Series B | July 11, 2025 |

| Agora | Paradigm (lead); Dragonfly Capital | $50 million | $62 million | Series A | July 11, 2025 |

| RealSense | [Undisclosed Semiconductor PE] (lead); Intel Capital; MediaTek Innovation Fund | $50 million | $50 million | Series A | July 11, 2025 |

| Virtru | Iconiq Capital (lead); Bessemer, Foundry, Chertoff Group | $50 million | $150 million+ | Series D | July 11, 2025 |

| Apolink | Y Combinator, 468 Capital, Unshackled Ventures, Rebel Fund, Maiora (seed backers) | $4.3 million | $4.3 million | Seed Round | July 11, 2025 |