Top 10 Startup and Tech Funding News – July 10, 2025

iCapital Raises $820M for Alternative Investments Platform

iCapital, a New York-based fintech platform that gives wealth managers and investors access to alternative investments, has secured over $820 million in a new funding round at a valuation exceeding $7.5 billion.

This giant capital infusion, co-led by SurgoCap Partners and accounts advised by T. Rowe Price, also saw participation from existing backers like Temasek, UBS, and Bank of New York Mellon. iCapital plans to use the capital to pursue strategic acquisitions, expand its global footprint, and further develop its technology, strengthening its position as a leading marketplace for alternative assets.

Founded in 2013, iCapital has positioned itself as the gateway to alternative investments. The platform helps investment professionals manage complex assets through a mix of admin tools, analytics, and education. That approach seems to be working: iCapital currently services $945 billion in assets, with $257 billion sitting in alternative investments.

Funding Details:

-

Startup: iCapital

-

Investors: SurgoCap Partners (co-lead), T. Rowe Price (co-lead); Temasek, UBS, BNY Mellon

-

Amount Raised: $820 million

-

Total Raised: $1.5 billion

-

Funding Stage: Late-stage (Private round)

-

Funding Date: July 10, 2025

Bilt Raises $250M at $10.75B Valuation for Rent Rewards Platform

Bilt, a New York City-based fintech and rewards network that lets renters earn points toward homeownership, has raised $250 million in new funding at a $10.75 billion valuation. The round was co-led by General Catalyst and real estate investor GID, with additional backing from United Wholesale Mortgage.

Bilt plans to leverage the funds to expand its operations and roll out new offerings – including an upcoming Bilt Card 2.0 and mortgage services – as it continues transforming rent payments into a loyalty and financial wellness program for a network of over 4.5 million rental homes.

Bilt Rewards, founded in 2019 by Ankur Jain, officially rolled out its loyalty program and co-branded credit card in 2021. The fintech platform lets renters earn reward points on monthly rent payments—points that can be redeemed for travel, fitness classes, or even a future home down payment.

Funding Details:

-

Startup: Bilt

-

Investors: General Catalyst (co-lead), GID (co-lead); United Wholesale Mortgage

-

Amount Raised: $250 million

-

Total Raised: Not disclosed

-

Funding Stage: Late-stage Growth

-

Funding Date: July 10, 2025

Airalo Secures $220M to Become First eSIM Unicorn

Airalo, the world’s largest eSIM marketplace, has secured a $220 million investment that values the company at over $1 billion, marking it as the first unicorn in the eSIM industry. The Lewes, Delaware-headquartered startup, which enables travelers to instantly download digital SIM cards for mobile data in over 200 countries, raised this growth round led by global private equity firm CVC (via its Asia Fund VI).

Existing investors Peak XV Partners (formerly Sequoia India & SEA) and Antler Elevate also participated. Airalo will use the funds to scale its platform, enhance customer experience with new products and support, and expand its enterprise offerings, as it continues its rapid growth serving 20 million+ users.

Funding Details:

-

Startup: Airalo

-

Investors: CVC (lead); Peak XV Partners, Antler Elevate

-

Amount Raised: $220 million

-

Total Raised: Not disclosed

-

Funding Stage: Growth Round

-

Funding Date: July 10, 2025

Varda Space Lands $187M Series C to Manufacture Drugs in Space

Varda Space Industries, a California-based startup pioneering pharmaceutical manufacturing in microgravity, has raised $187 million in a Series C round to accelerate its off-world drug production technology. Co-led by venture firms Natural Capital and Shrug Capital, with participation from Lux Capital, Peter Thiel, Founders Fund, and Khosla Ventures, the funding brings Varda’s total capital raised to $329 million.

The El Segundo-based company plans to use the new money to increase the cadence of its space missions and build out its orbital pharmaceutical lab, aiming to produce novel drug formulations that leverage microgravity’s unique advantages. Varda has already completed multiple capsule missions and demonstrated the ability to crystallize drug compounds in space for improved formulations.

Funding Details:

-

Startup: Varda Space Industries

-

Investors: Natural Capital (co-lead), Shrug Capital (co-lead); Lux Capital, Peter Thiel, Founders Fund, Khosla Ventures

-

Amount Raised: $187 million

-

Total Raised: $329 million

-

Funding Stage: Series C

-

Funding Date: July 10, 2025

Harmonic Lands $100M Series B for ‘Mathematical Superintelligence’ AI

Harmonic, a Palo Alto-based artificial intelligence lab co-founded by Robinhood’s Vlad Tenev, has landed $100 million in Series B funding to advance its “Mathematical Superintelligence” platform. The new round, which values Harmonic at nearly $900 million post-money, was led by Kleiner Perkins with participation from Paradigm and Ribbit Capital, as well as existing investors Sequoia Capital, Index Ventures, and angel backer Charlie Cheever.

Harmonic is developing an AI system called Aristotle that autonomously solves complex mathematical problems beyond human capability, using methods to ensure logical consistency and to flag errors transparently. The fresh capital will enable Harmonic to accelerate the development of Aristotle and move toward commercializing this cutting-edge AI for advanced mathematical reasoning.

Funding Details:

-

Startup: Harmonic

-

Investors: Kleiner Perkins (lead); Paradigm, Ribbit Capital; existing backers Sequoia Capital, Index Ventures, Charlie Cheever

-

Amount Raised: $100 million

-

Total Raised: Not disclosed

-

Funding Stage: Series B

-

Funding Date: July 10, 2025

Renasant Bio Launches with $55M Seed to Fight Kidney Disease

Renasant Bio, a newly launched biotechnology company targeting a rare kidney disorder known as ADPKD, has emerged from stealth with $55 million in seed funding from a group of top life sciences investors. 5AM Ventures led the round alongside Atlas Venture, OrbiMed, and Qiming Venture Partners USA.

The South San Francisco-based startup is developing novel “corrector” and “potentiator” therapies inspired by cystic fibrosis drugs, aiming to fix misfolded proteins and open ion channels to treat autosomal dominant polycystic kidney disease at its root cause. With this substantial seed capital, Renasant Bio will advance its lead drug candidate (now in preclinical testing) toward the clinic and build out its team, addressing a condition that affects 12 million people worldwide.

Funding Details:

-

Startup: Renasant Bio

-

Investors: 5AM Ventures (lead), Atlas Venture, OrbiMed, Qiming Venture Partners USA

-

Amount Raised: $55 million

-

Total Raised: $55 million

-

Funding Stage: Seed

-

Funding Date: July 10, 2025

Spacelift Secures $51M Series C for Infra Automation Platform

Spacelift, an infrastructure-as-code management platform, has secured $51 million in a Series C round to advance its AI-powered DevOps automation suite. The Redwood City, CA-based startup’s financing was led by Five Elms Capital, with participation from Endeavor Catalyst and Inovo Venture Partners.

Spacelift’s platform helps engineering teams orchestrate cloud infrastructure by integrating with popular tools like Terraform, Pulumi, and Ansible, enabling them to automate provisioning, enforce policy guardrails, and manage configurations through a single workflow. With the new funding, Spacelift plans to accelerate product innovation, expand enterprise adoption, and further simplify complex infrastructure operations for its customers across the globe.

Funding Details:

-

Startup: Spacelift

-

Investors: Five Elms Capital (lead); Endeavor Catalyst, Inovo Venture Partners

-

Amount Raised: $51 million

-

Total Raised: Not disclosed

-

Funding Stage: Series C

-

Funding Date: July 10, 2025

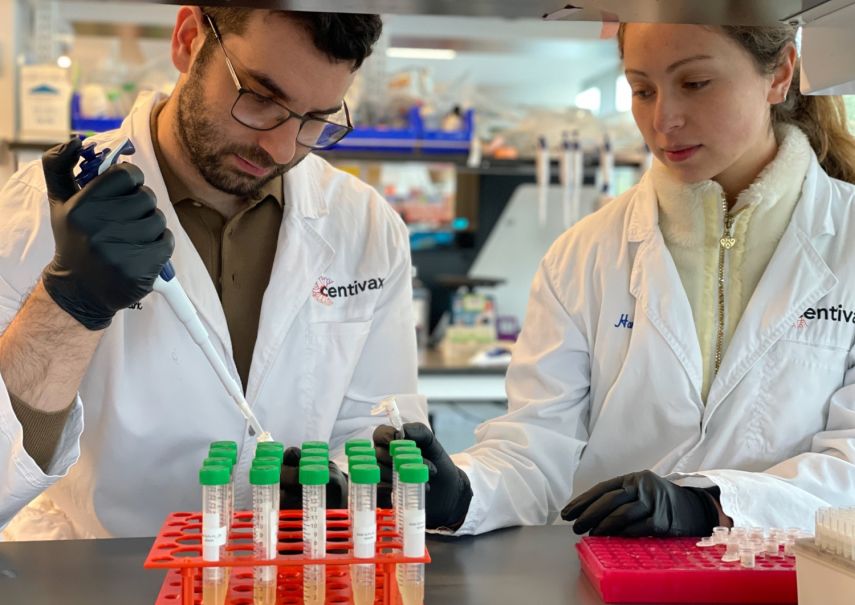

Centivax Snags $45M Series A to Advance Universal Flu Vaccine

Centivax, a South San Francisco-based biotech company, has snagged $45 million in Series A financing to bring its universal flu vaccine candidate into human trials. The round was led by Future Ventures – the firm of noted tech investor Steve Jurvetson – with participation from NFX, BOLD Capital Partners, Base4 Capital, Kendall Capital Partners, and Amplify Partners.

Centivax is developing a broad-spectrum vaccine platform using computationally engineered immunogens to protect entire families of viruses. Its lead program, a next-generation influenza vaccine designed to protect against all flu strains, is on track to begin Phase 1 trials within a year. The new funding will support clinical testing and expansion of Centivax’s pipeline, which includes programs for RSV, herpesviruses, HIV, malaria, and even a universal antivenom.

Funding Details:

-

Startup: Centivax

-

Investors: Future Ventures (lead); NFX, BOLD Capital Partners, Base4 Capital, Kendall Capital Partners, Amplify Partners

-

Amount Raised: $45 million

-

Total Raised: $45 million

-

Funding Stage: Series A

-

Funding Date: July 9, 2025

Ionic Mineral Technologies Closes $29M Series B for Battery Materials

Ionic Mineral Technologies, a Provo, Utah-based producer of advanced battery materials, has closed a $29 million Series B financing to scale its domestic production of key components for next-generation batteries. The oversubscribed round, which exceeded an initial $25 million target, was funded by a group of undisclosed investors, reflecting strong confidence in the startup’s mission.

Ionic Mineral Technologies is ramping up manufacturing of its proprietary nano-silicon anode material (Ionisil) and high-purity alumina (IonAl) for use in electric vehicle batteries and other applications. The company’s vertically integrated approach, backed by its own mineral resources and processing tech, aims to strengthen the U.S. supply chain for critical battery materials. The new capital will support the expansion of Ionic’s production capacity in Utah and ongoing product development.

Funding Details:

-

Startup: Ionic Mineral Technologies

-

Investors: Undisclosed investors (oversubscribed round)

-

Amount Raised: $29 million

-

Total Raised: Not disclosed

-

Funding Stage: Series B

-

Funding Date: July 10, 2025

Foundation EGI Grabs $23M Series A to Bring AI to Engineering

Foundation EGI, a Los Altos, CA-based startup founded by MIT researchers, has raised $23 million in an oversubscribed Series A round to develop what it calls the world’s first “Engineering General Intelligence” platform. The funding was led by Translink Capital with participation from RRE Ventures, McRock Capital, and others, bringing the company’s total funding to roughly $30 million (including a prior seed round).

Foundation EGI’s AI-driven software aims to revolutionize manufacturing and engineering workflows by converting natural-language specifications into structured, “engineering-grade” documentation and code, dramatically speeding up design cycles and preserving institutional knowledge. The new capital will support product development and go-to-market efforts as the company tackles inefficiencies in the $8 trillion global engineering and manufacturing sector.

Funding Details:

-

Startup: Foundation EGI

-

Investors: Translink Capital (lead); RRE Ventures, McRock Capital, among others

-

Amount Raised: $23 million

-

Total Raised: $30 million

-

Funding Stage: Series A

-

Funding Date: July 10, 2025

Vellum Lands $20M Series A to Build Enterprise AI Products

Vellum, a New York-based enterprise AI development platform, has landed $20 million in Series A funding to help companies build, test and deploy mission-critical AI products. The round was led by Leaders Fund, with participation from Socii Capital and returning investors including Y Combinator, Rebel Fund, Pioneer Fund, and Eastlink Capital. Vellum’s end-to-end platform provides a collaborative workspace where technical and non-technical teams can design AI workflows using a visual interface or API, streamlining the process of bringing AI-driven applications from concept to production. The new capital will fuel Vellum’s growth and product enhancements as demand from enterprises for AI solutions continues to rise.

Funding Details:

-

Startup: Vellum

-

Investors: Leaders Fund (lead); Socii Capital; Y Combinator, Rebel Fund, Pioneer Fund, Eastlink Capital

-

Amount Raised: $20 million

-

Total Raised: Not disclosed

-

Funding Stage: Series A

-

Funding Date: July 10, 2025

Cerebrium Raises $8.5M Seed to Simplify AI App Infrastructure

Cerebrium, an AI infrastructure startup originally from South Africa and now headquartered in New York, has raised $8.5 million in seed funding to help developers build and scale AI applications more easily. The round was led by Google’s AI-focused fund Gradient Ventures, with participation from Y Combinator, Authentic Ventures, and several angel investors.

Founded by former e-commerce engineers, Cerebrium offers a platform that lets companies create multimodal AI products, such as voice assistants and AI video generators, without the heavy lifting of managing complex back-end infrastructure. The funding will be used to launch new features and meet growing enterprise demand, as Cerebrium aims to enable more developers to deploy AI models without large infrastructure teams or cloud costs.

Funding Details:

-

Startup: Cerebrium

-

Investors: Gradient Ventures (lead); Y Combinator, Authentic Ventures, angel investors

-

Amount Raised: $8.5 million

-

Total Raised: $8.5 million

-

Funding Stage: Seed

-

Funding Date: July 10, 2025

ALTR Raises $5M Seed to Transform Low-Alcohol Wine Tech

ALTR, a Phoenix-based beverage technology startup, has raised $5 million in seed funding to commercialize its breakthrough “flavor-first” alcohol removal technology for wines and spirits. The round was led by Demeter, with participation from a slate of strategic and venture backers including Suntory Global Spirits, Techmind, AZ Venture Capital, FTW Ventures, Bluestein Ventures, Solvable, and Xinomavro.

ALTR’s nanotechnology platform can selectively remove ethanol from alcoholic beverages while preserving their taste and aroma, allowing producers to create low-alcohol or non-alcoholic drinks that taste virtually identical to the original. The company will use the seed capital to scale up its technology and bring its first de-alcoholized wine products to market, heralding a new era of “better-for-you” wines.

Funding Details:

-

Startup: ALTR

-

Investors: Demeter (lead); Suntory Global Spirits, Techmind, AZ Venture Capital, FTW Ventures, Bluestein Ventures, Solvable, Xinomavro

-

Amount Raised: $5 million

-

Total Raised: $5 million

-

Funding Stage: Seed

-

Funding Date: July 10, 2025

Belong Raises $5M to Build Fintech Platform for NRIs

Belong, a fintech startup focused on the financial needs of non-resident Indians (NRIs), has raised $5 million in a round led by Elevation Capital as it prepares to launch its platform. The funding also saw participation from Relentless Ventures and a group of angel investors, including founders and executives from Urban Company, Zomato, Mamaearth, PayU, and McKinsey.

Founded in 2024, Belong is creating a digital banking and investment platform tailored for NRIs, simplifying cross-border financial products like deposits, investments, and remittances through India’s GIFT City regulatory framework. The startup will use the funds to acquire necessary licenses, build out its product suite, and ramp up marketing, with plans to expand into key NRI markets in the GCC, UK, and North America.

Funding Details:

-

Startup: Belong

-

Investors: Elevation Capital (lead); Relentless Ventures; angel investors including founders of Urban Company, Zomato, Mamaearth, etc.

-

Amount Raised: $5 million

-

Total Raised: $5 million

-

Funding Stage: Seed

-

Funding Date: July 9, 2025

CYNiO Secures €2M Seed for CO₂-Based Specialty Chemicals

CYNiO, a chemical technology startup based in Saxony, Germany, has secured over €2 million (approximately $2.2 million) in seed financing to advance its sustainable approach to specialty chemical production. The investment was jointly made by bmp Ventures (via its IBG Innovation Fund) and Technologiegründerfonds Sachsen (TGFS).

Founded in 2025 as a spin-off from the TU Bergakademie Freiberg, CYNiO has developed a patented process to manufacture isocyanates – key ingredients for pharmaceuticals, adhesives, coatings, and foams – using carbon dioxide instead of highly toxic phosgene. The fresh capital will help establish the company’s first production facility in Bitterfeld-Wolfen and scale up its CO₂-based manufacturing platform to supply rare specialty chemicals to the European market more safely and flexibly.

Funding Details:

-

Startup: CYNiO

-

Investors: bmp Ventures (IBG Innovation Fund), TGFS (Technologiegründerfonds Sachsen)

-

Amount Raised: €2 million (≈ $2.2 million)

-

Total Raised: €2 million

-

Funding Stage: Seed

-

Funding Date: July 9, 2025

Clean Fanatics Cleans Up $2M Seed to Scale Home Services

Clean Fanatics, a Bengaluru-based premium home services marketplace, has raised ₹17 crore (approximately $2 million) in a seed round led by Inflection Point Ventures. The round also saw participation from Blume Founders Fund, LetsVenture, Trica, TiE Angels, and other prominent angel investors.

Founded in 2020, Clean Fanatics connects homeowners with vetted professionals for high-quality home maintenance and cleaning services. The startup plans to deploy the new funds to expand its team, enhance its technology platform, and launch new service categories – including residential construction and home renovation – as it strives to become a one-stop solution for all home service needs in India.

Funding Details:

-

Startup: Clean Fanatics

-

Investors: Inflection Point Ventures (lead); Blume Founders Fund, LetsVenture, Trica, TiE Angels, others

-

Amount Raised: $2 million (₹17 crore)

-

Total Raised: $2 million

-

Funding Stage: Seed

-

Funding Date: July 10, 2025

Funding Summary Table

| Startup | Investors (Lead and notable investors) | Amount Raised | Total Raised | Funding Stage | Funding Date |

|---|---|---|---|---|---|

| iCapital | SurgoCap Partners (co-lead); T. Rowe Price (co-lead); Temasek; UBS; BNY Mellon | $820 million | $1.5 billion | Late-stage (Private) | July 10, 2025 |

| Bilt | General Catalyst (co-lead); GID (co-lead); United Wholesale Mortgage | $250 million | Not disclosed | Growth (Late-stage) | July 10, 2025 |

| Airalo | CVC (lead); Peak XV Partners; Antler Elevate | $220 million | Not disclosed | Growth Round | July 10, 2025 |

| Varda Space | Natural Capital (co-lead); Shrug Capital (co-lead); Lux Capital; Peter Thiel; Founders Fund; Khosla Ventures | $187 million | $329 million | Series C | July 10, 2025 |

| Harmonic | Kleiner Perkins (lead); Paradigm; Ribbit Capital; (prev: Sequoia, Index Ventures, Charlie Cheever) | $100 million | Not disclosed | Series B | July 10, 2025 |

| Renasant Bio | 5AM Ventures (lead); Atlas Venture; OrbiMed; Qiming Venture Partners USA | $55 million | $55 million | Seed | July 10, 2025 |

| Spacelift | Five Elms Capital (lead); Endeavor Catalyst; Inovo Venture Partners | $51 million | Not disclosed | Series C | July 10, 2025 |

| Centivax | Future Ventures (lead); NFX; BOLD Capital; Base4 Capital; Kendall Capital; Amplify Partners | $45 million | $45 million | Series A | July 9, 2025 |

| Ionic Mineral Tech | Undisclosed investors (oversubscribed round) | $29 million | Not disclosed | Series B | July 10, 2025 |

| Foundation EGI | Translink Capital (lead); RRE Ventures; McRock Capital; others | $23 million | $30 million | Series A | July 10, 2025 |

| Vellum | Leaders Fund (lead); Socii Capital; Y Combinator; Rebel Fund; Pioneer Fund; Eastlink Capital | $20 million | Not disclosed | Series A | July 10, 2025 |

| Cerebrium | Gradient Ventures (lead); Y Combinator; Authentic Ventures; angels | $8.5 million | $8.5 million | Seed | July 10, 2025 |

| ALTR | Demeter (lead); Suntory Global Spirits; Techmind; AZ Venture Capital; FTW Ventures; Bluestein; Solvable; Xinomavro | $5 million | $5 million | Seed | July 10, 2025 |

| Belong | Elevation Capital (lead); Relentless Ventures; angels (Urban Co., Zomato, etc.) | $5 million | $5 million | Seed | July 9, 2025 |

| CYNiO | bmp Ventures (IBG Fund); TGFS (Technologiegründerfonds Sachsen) | €2 million (~$2.2M) | €2 million (~$2.2M) | Seed | July 9, 2025 |

| Clean Fanatics | Inflection Point Ventures (lead); Blume Founders Fund; LetsVenture; Trica; TiE Angels; others | $2 million | $2 million | Seed | July 10, 2025 |