Trump’s Truth Social files for crypto ETF with SEC in surprise move

In a move that few saw coming, Truth Social, the social media platform owned by Trump Media & Technology Group, is officially stepping into the crypto arena. The company has filed with the U.S. Securities and Exchange Commission to launch the “Truth Social Crypto Blue Chip ETF,” a fund aiming to give investors exposure to major cryptocurrencies like Bitcoin, Ethereum, and Solana.

The SEC has acknowledged the filing, which means it’s now under review, but approval is far from guaranteed. Still, the move signals a new direction for a platform better known for political commentary than financial products.”

It’s a move that has raised eyebrows, not just because of who’s behind it, but also because it signals how deep crypto has now seeped into political and cultural brands trying to stretch into finance.

What’s in Truth Social ETF?

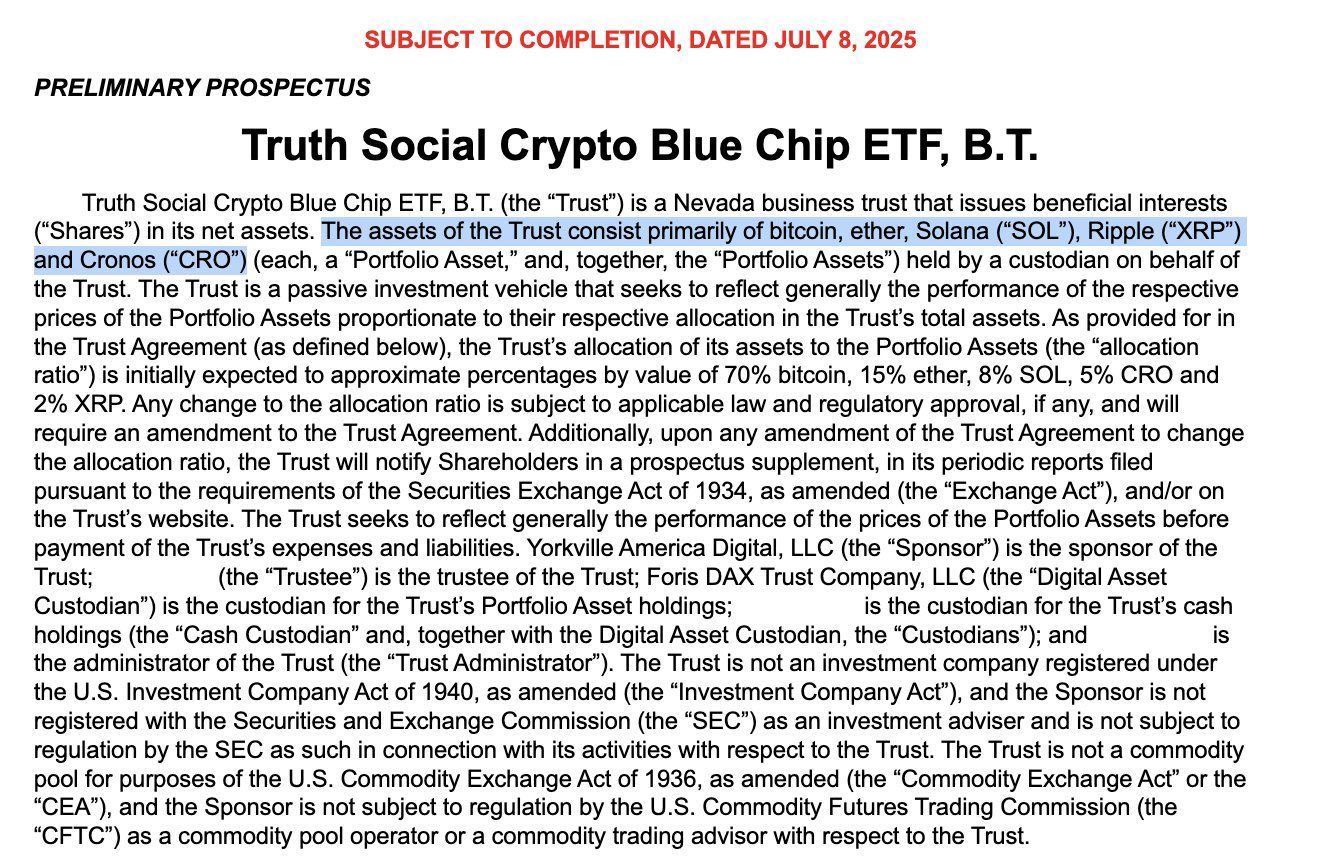

According to the filing and social media posts from those tracking the development, the proposed ETF breaks down like this:

-

Bitcoin (BTC): 70%

-

Ethereum (ETH): 15%

-

Solana (SOL): 8%

-

Cronos (CRO): 5%

-

XRP: 2%

It’s a heavily Bitcoin-weighted mix with a few well-known altcoins sprinkled in—Ethereum, Solana, XRP, and Cronos, the last of which is tied to Crypto.com. While the exact ticker and launch date remain TBD, the application aims for a listing on the New York Stock Exchange.

The pitch is simple: give investors exposure to major cryptocurrencies without having to hold or manage them directly.

Where the SEC Stands

The SEC has officially acknowledged the filing, meaning they’ve received it and will begin the review process. That doesn’t say anything about the likelihood of approval, though.

Historically, the SEC has taken a skeptical stance on crypto ETFs. Market volatility, liquidity gaps, and the potential for manipulation have been sticking points. But over the last year, the agency has greenlit spot Bitcoin and Ethereum ETFs, signaling a shift—albeit a cautious one.

Truth Social’s application arrives during a time of growing institutional interest in digital assets, with more firms trying to package crypto into investment products that feel familiar to traditional investors.

What This Means for Truth Social

For Trump Media, this isn’t just a side hustle—it’s a bet on crypto becoming a mainstream investment vehicle. And it’s a chance to make Truth Social about more than just political content and culture wars.

Launching a crypto ETF—especially one made up of “blue chip” digital currencies—gives the company a new financial angle. It’s a way to tap into a different kind of user: the investor who wants exposure to crypto but isn’t ready to navigate exchanges and wallets.

Still, approval isn’t guaranteed. The SEC could take months to decide or reject the filing outright. And market volatility isn’t going anywhere. Just ask anyone who’s watched Bitcoin swing $10,000 in a matter of days. That kind of movement could make this ETF a hard sell to traditional investors who prefer stability.

Political Baggage Could Weigh It Down

Then there’s the branding. Truth Social is tightly linked to former President Donald Trump, and that connection could cut both ways. It might attract loyal fans, but turns off others who see the platform as too politically charged.

ETFs tend to succeed based on trust, scale, and perception. If the fund ends up being seen more as a political product than a financial one, it could struggle to draw serious capital.

The Bigger Picture

This filing adds to a growing wave of attempts to bring crypto into the investment mainstream. From legacy firms to social platforms, everyone wants a piece of the ETF market. The SEC’s softening stance on digital assets has opened the door, but getting through it still takes convincing.

If Truth Social manages to get approval, the ETF could open a new chapter for the company—and draw more eyes (and dollars) its way. But there’s a long road ahead, and it’s filled with hurdles the SEC has already tripped others over.