Top 10 Startup and Tech Funding News – July 8, 2025

Sundial Raises $16M Series A for AI-Powered Decision Analytics

Sundial, a San Francisco-based AI analytics startup, has raised a $16 million Series A round to unify and simplify enterprise decision-making. The funding – part of a total $23 million raised to date – was led by DJ Patil of GreatPoint Ventures, with heavyweights like Sequoia Capital, Sunflower Capital, Slow Ventures, Unusual Ventures, Tribe Capital, and Electric Capital also participating alongside prominent tech founders and executives.

Sundial’s platform integrates dashboards, data notebooks, and pipelines into one AI-driven environment, helping everyone from Fortune 500 teams to startups make faster, smarter decisions by automating analytics workflows. The new capital will be used to expand Sundial’s engineering and product teams, enhance its core AI capabilities, and accelerate the adoption of its decision intelligence platform.

Funding Details:

-

Startup: Sundial

-

Investors: GreatPoint Ventures (DJ Patil) – lead, with Sequoia Capital, Sunflower Capital, Slow Ventures, Unusual Ventures, Tribe Capital, Electric Capital, and notable angels including Fidji Simo, Tobi Lütke, Drew Houston, Amjad Masad, Shishir Mehrotra, Deb Liu, Howie Liu, Anil Varanasi, Ruchi Sanghvi, Brian Hale, and Jay Parikh.

-

Amount Raised: $16 million

-

Total Raised: $23 million

-

Funding Stage: Series A

-

Funding Date: July 8, 2025

Huspy Secures $59M Series B for PropTech Expansion

Huspy, a Dubai-based PropTech startup modernizing home buying, closed a $59 million Series B round to fuel its expansion across Europe and the Middle East. The round was led by returning investor Balderton Capital and joined by Peak XV Partners (formerly Sequoia India & SEA), ExBorder Partners, Turmeric Capital, BY Ventures, Dara Management, COTU Ventures, and KE Partners.

Huspy’s digital platform connects real estate agents, mortgage brokers, and buyers online, streamlining everything from property listings to mortgage pre-approvals. Already facilitating over $7 billion in annual real estate transactions across the UAE and Spain, Huspy plans to launch in six new Spanish cities and enter Saudi Arabia by year’s end. The fresh funding will accelerate technology development, strategic hiring, and the company’s push into new markets as it aims to become a dominant digital real estate player in EMEA.

Funding Details:

-

Startup: Huspy

-

Investors: Balderton Capital (lead), Peak XV Partners, ExBorder Partners, Turmeric Capital, BY Ventures, Dara Management, COTU Ventures, and KE Partners.

-

Amount Raised: $59 million

-

Total Raised: Over $100 million (including a $37 million Series A in 2022)

-

Funding Stage: Series B

-

Funding Date: July 8, 2025

Flexi Software Gets Strategic Investment to Advance Accounting Platform

Flexi Software, a Shelton, Connecticut-based enterprise accounting software provider, received a strategic investment of an undisclosed amount from Quality Standard. The deal is aimed at accelerating product innovation and bolstering customer service for Flexi’s financial accounting platform, which serves industries with complex regulatory requirements such as insurance, banking, and credit unions.

Founded in 1992, Flexi has built a reputation for automating multi-entity accounting processes with flexibility and robust compliance features. Alongside the investment, Flexi announced a leadership transition: co-founder Stefan Bothe retired as CEO after 32 years, and Jason Gilliland, co-founder of Quality Standard, has stepped in as the new Chief Executive. The partnership signals a deepened commitment to evolving Flexi’s software suite for its Fortune 500 clients and technology partners worldwide.

Funding Details:

-

Startup: Flexi Software

-

Investors: Quality Standard (strategic investors)

-

Amount Raised: Not disclosed

-

Total Raised: Not disclosed

-

Funding Stage: Strategic investment (private equity)

-

Funding Date: July 8, 2025

Parspec Lands $20M Series A to Streamline Construction Procurement

Parspec, a San Mateo, CA-based startup modernizing construction procurement, has landed $20 million in Series A funding to expand its AI-powered marketplace for building materials. Threshold Ventures (formerly DFJ) led the round, joined by Innovation Endeavors, Building Ventures, Heartland Ventures, and Hometeam Ventures. Parspec’s platform helps wholesale distributors, manufacturers, and contractors efficiently bid and supply products like electrical and plumbing components, using AI to instantly match complex project specifications with available materials.

Founded in 2021 by Forest Flager and Pratyush Havelia, Parspec has seen rapid uptake – quadrupling its revenue in the past year – and is already used by several of the largest electrical distributors in the U.S. With the new capital, Parspec will extend its platform to cover the full project order lifecycle and build out collaboration tools, accelerating the digital transformation of the $70 billion construction supply chain.

Funding Details:

-

Startup: Parspec

-

Investors: Threshold Ventures (lead), Innovation Endeavors, Building Ventures, Heartland Ventures, Hometeam Ventures.

-

Amount Raised: $20 million

-

Total Raised: $31.5 million

-

Funding Stage: Series A

-

Funding Date: July 8, 2025

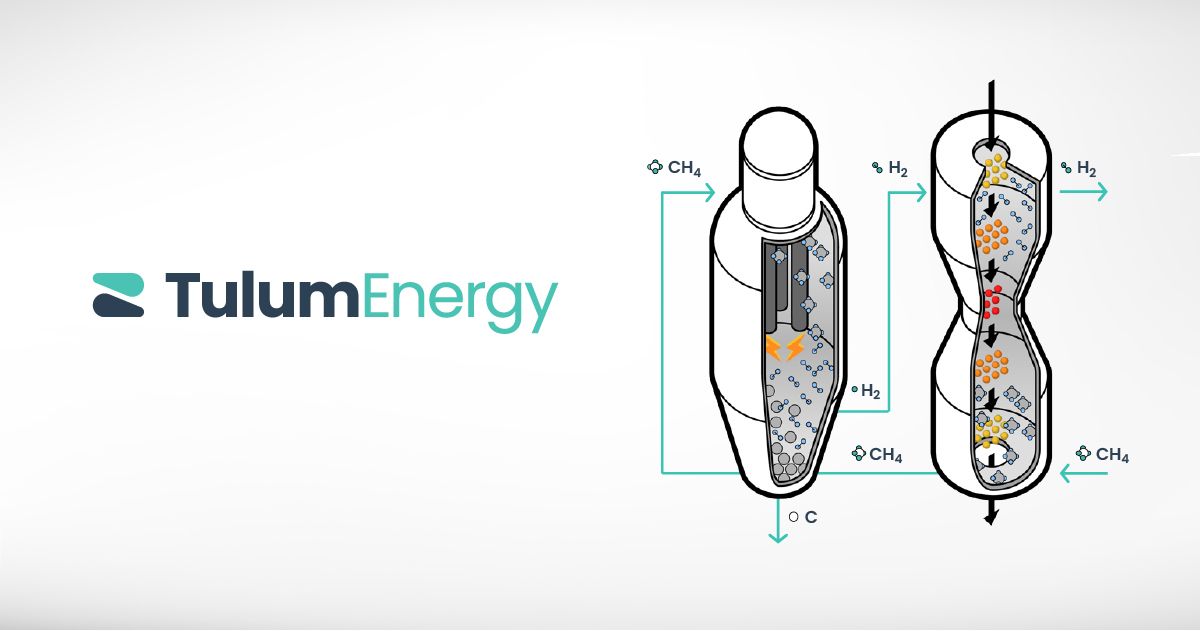

Tulum Energy Bags $27M Seed Round to Scale Clean Hydrogen Tech

Tulum Energy, a Milan, Italy-based cleantech startup, secured $27 million in seed funding to commercialize its breakthrough methane pyrolysis technology. The round was co-led by CDP Venture Capital’s Green Transition Fund and TDK Ventures, with participation from TechEnergy Ventures (Tulum’s founding investor under the Techint Group), Italy’s MITO Tech Ventures, and Doral Energy-Tech Ventures.

Tulum’s process produces “turquoise” hydrogen – clean hydrogen plus solid carbon – from natural gas without emitting CO₂, using a novel electric-arc furnace method originally discovered by Techint engineers. The fresh funds will go toward building Tulum’s first pilot plant at a steel facility in Mexico and establishing an R&D hub in Milan to drive further developments. Led by CEO Massimiliano Pieri, Tulum aims to deliver hydrogen at costs comparable to conventional methods but with up to 95% fewer emissions, providing heavy industry with a scalable decarbonization solution.

Funding Details:

-

Startup: Tulum Energy

-

Investors: CDP Venture Capital (Green Transition Fund) and TDK Ventures (co-leads); TechEnergy Ventures (Techint Group), MITO Tech Ventures, Doral Energy-Tech Ventures.

-

Amount Raised: $27 million

-

Total Raised: $27 million (seed round)

-

Funding Stage: Seed (Venture Financing)

-

Funding Date: July 8, 2025

Galaxy Education Nets Nearly $10M in Funding for EdTech ESL Push in Vietnam

Galaxy Education (GE), a Ho Chi Minh City, Vietnam-based edtech company, has secured nearly $10 million in new funding to scale its English-language learning programs nationwide. The round was led by East Ventures, a prominent Southeast Asian VC, with participation from other undisclosed investors. Galaxy Education, part of the Galaxy Entertainment & Education Group, operates an ecosystem of online learning platforms – including HOCMAI (K-12 e-learning), ICAN (language and coding for kids), and FUNiX (online university) – serving over 8 million learners in Vietnam and 34 countries.

Profitable since early 2025, GE will use the capital to expand its English as a Second Language (ESL) programs in public schools and underserved communities, addressing teacher shortages through an Online-Merge-Offline model that blends AI-driven lessons with human instruction. The investment underscores confidence in Galaxy’s mission to uplift education quality and access in Vietnam via technology and AI.

Funding Details:

-

Startup: Galaxy Education (GE)

-

Investors: East Ventures (lead) and other undisclosed investors.

-

Amount Raised: ~$10 million

-

Total Raised: Not disclosed

-

Funding Stage: Venture funding (Undisclosed round)

-

Funding Date: July 8, 2025

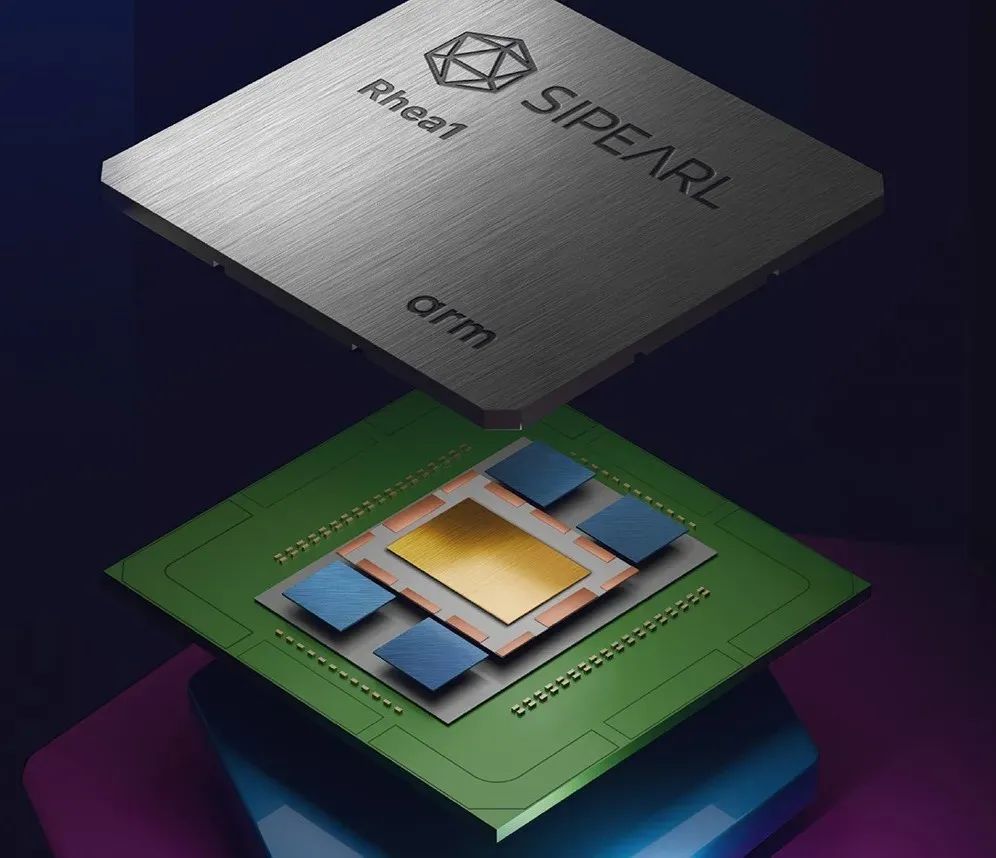

SiPearl Closes €130M Series A to Power European Supercomputing

SiPearl, a French semiconductor startup, has completed a €130 million Series A round – Europe’s largest-ever Series A in the fabless chip sector – to advance its high-performance processors for supercomputers and AI systems. This final tranche of €32 million was backed by the European Innovation Council (EIC) Fund and the French government (via the France 2030 tech sovereignty program), and Taiwan’s Cathay Venture as a new investor.

Launched in 2020 under the EU’s Processor Initiative, SiPearl has developed “Rhea1”, an 80-core Arm-based CPU with 61 billion transistors, now being manufactured by TSMC. Rhea1 is slated to power JUPITER, Europe’s first exascale supercomputer in Germany, bolstering the continent’s technological autonomy. The Series A funding will support SiPearl through Rhea1’s industrialization and accelerate R&D on next-generation chips, as the company gears up for a planned Series B and scale-up to supply Europe’s data centers and cloud providers.

Funding Details:

-

Startup: SiPearl

-

Investors: EIC Fund (EU), French Tech Souveraineté (France 2030 program), Cathay Venture (lead new investor), with prior participation from Arm and Atos (strategic partners).

-

Amount Raised: €130 million (Series A total; €32 million in final tranche)

-

Total Raised: €130 million (excluding EU seed grants)

-

Funding Stage: Series A

-

Funding Date: July 8, 2025

Blues Wireless Adds $8M Follow-on Funding for IoT Connectivity

Blues Wireless, a Boston-based IoT connectivity startup, has raised an additional $8 million in a follow-on round to accelerate product innovation in its wireless data platform. The infusion, led by existing backer XYZ Venture Capital, comes on the heels of a $25 million raise in May led by Sequoia Capital. Blues provides secure cellular modules and cloud services that help companies easily connect any physical device to the internet, enabling real-time data and new services across transportation, healthcare, energy, logistics and more.

Led by CEO Ian Small (former Evernote chief) and founded by tech veteran Ray Ozzie, Blues addresses the hardest parts of IoT connectivity – security, provisioning, and scaling – allowing organizations of any size to gather data from their products in the field. With a total of $99 million raised to date, Blues is poised to expand its Notecard hardware and Notehub cloud services to power the next generation of smart, connected products.

Funding Details:

-

Startup: Blues Wireless (Blues)

-

Investors: XYZ Venture Capital (lead), existing investor (follow-on); prior round led by Sequoia Capital.

-

Amount Raised: $8 million

-

Total Raised: $99 million

-

Funding Stage: Follow-on funding (extension round)

-

Funding Date: July 8, 2025

Levelpath Pulls In $55M Series B in Funding to Transform Enterprise Procurement with AI

Levelpath, a San Francisco-based startup reinventing corporate procurement with AI, has closed in $55 million in Series B financing to accelerate its growth. The round was led by Battery Ventures, with strong follow-on participation from existing backers Redpoint Ventures, Benchmark, 01A, New View Capital, and World Innovation Lab. Founded by the team behind Scout RFP, Levelpath provides an AI-native procurement platform that helps large enterprises manage indirect spending more efficiently.

Levelpath’s software automates workflows and offers a user-friendly interface powered by a proprietary AI “Hyperbridge” engine, giving procurement teams real-time visibility into purchases and compliance. With Fortune 500 clients like Ace Hardware, Western Union, and Amgen already onboard, Levelpath will use the new funding to deepen product development, expand its go-to-market team, and forge more partnerships, continuing its mission to modernize procurement operations. This Series B brings Levelpath’s total funding to about $100 million to date.

Funding Details:

-

Startup: Levelpath

-

Investors: Battery Ventures (lead), Redpoint Ventures, Benchmark, 01A, New View Capital, World Innovation Lab

-

Amount Raised: $55 million

-

Total Raised: $100 million

-

Funding Stage: Series B

-

Funding Date: July 8, 2025

Castellum.AI Closes $8.5M Series A for AI-Driven FinCrime Compliance

Castellum.AI, a New York-based fintech startup, announced an $8.5 million Series A round to advance its AI-driven financial crime compliance platform. The oversubscribed financing was led by Curql, a credit-union-backed venture fund, joined by BTech Consortium (a fund backed by community banks, including Customers Bank) and Framework Venture Partners (backed by major Canadian banks). Several existing investors – Spider Capital, Remarkable Ventures, and Cameron Ventures – also participated.

Castellum.AI’s platform uniquely integrates proprietary risk data, automated AML/KYC screening, and AI agents in one system, allowing banks, credit unions, fintechs, and crypto exchanges to drastically cut false-positive alerts and compliance costs while catching illicit activity more effectively. The fresh capital validates Castellum’s approach, coming directly from financial institutions that rely on next-gen compliance tools. The funds will help Castellum.AI scale its operations and continue enhancing its “explainable AI” compliance agents, which have already demonstrated the ability to pass professional financial crime certification exams and adapt to rigorous regulatory standards.

Funding Details:

-

Startup: Castellum.AI

-

Investors: Curql (lead), BTech Consortium, Framework Venture Partners; with participation from existing backers Spider Capital, Remarkable Ventures, and Cameron Ventures.

-

Amount Raised: $8.5 million

-

Total Raised: Not disclosed

-

Funding Stage: Series A

-

Funding Date: July 8, 2025

Bumo Raises $10M Seed Round for On-Demand Child Care Marketplace

Bumo, a Los Angeles-based startup transforming child care with an on-demand marketplace, has raised $10 million in seed funding to expand its platform connecting parents with vetted caregivers and programs. The round was co-led by True Ventures and Offline Ventures and joined by Goodwater Capital and Marketplace Capital. It also attracted high-profile angel investors, including educator Jennifer Carolan, social media influencer Rachel Barnes, actress Jamie Chung, restaurateur Ellen Chen (Mendocino Farms), Karina Kruse (Kinderzimmer), and Vanessa Dew (Health-Ade).

Founded by two working mothers, Bumo’s app and website let parents find and book trusted childcare services, from daycare spots and babysitters to day camps and “micro-school” sessions, while helping childcare providers fill open slots. Through partnerships with employers and community organizations, Bumo aims to make quality child care more accessible and flexible for modern families. The seed funding will support Bumo’s growth into new regions and further development of its technology as it tackles the childcare challenges faced by working parents.

Funding Details:

-

Startup: Bumo

-

Investors: True Ventures (co-lead), Offline Ventures (co-lead), Goodwater Capital, Marketplace Capital; notable angels Jennifer Carolan, Rachel Barnes, Jamie Chung, Ellen Chen, Karina Kruse, Vanessa Dew.

-

Amount Raised: $10 million

-

Total Raised: $10 million

-

Funding Stage: Seed

-

Funding Date: July 8, 2025

Funding Summary Table:

| Startup | Investors (Lead and notable) | Amount Raised | Total Raised | Funding Stage | Funding Date |

|---|---|---|---|---|---|

| Sundial | GreatPoint Ventures (DJ Patil), Sequoia Capital, Sunflower, Slow, Unusual, Tribe, Electric, etc. | $16 M | $23 M | Series A | Jul 8, 2025 |

| Huspy | Balderton Capital, Peak XV Partners, ExBorder, Turmeric, BY Ventures, COTU, etc. | $59 M | > $100 M | Series B | Jul 8, 2025 |

| Flexi Software | Quality Standard (strategic investor) | Not disclosed | Not disclosed | Strategic Investment | Jul 8, 2025 |

| Parspec | Threshold Ventures, Innovation Endeavors, Building Ventures, Heartland, Hometeam | $20 M | $31.5 M | Series A | Jul 8, 2025 |

| Tulum Energy | CDP Venture Capital (Green Transition), TDK Ventures, TechEnergy, MITO, Doral | $27 M | $27 M | Seed Round | Jul 8, 2025 |

| Galaxy Education | East Ventures (lead), others undisclosed | ~$10 M | Not disclosed | Venture Funding | Jul 8, 2025 |

| SiPearl | EIC Fund (EU), French Tech Souveraineté, Cathay Venture (Taiwan), (plus Arm, Atos) | €130 M | €130 M | Series A | Jul 8, 2025 |

| Blues Wireless | XYZ Venture Capital (lead), (Sequoia Capital led prior round) | $8 M | $99 M | Follow-on Round | Jul 8, 2025 |

| Levelpath | Battery Ventures (lead), Redpoint, Benchmark, 01A, New View, World Innovation Lab | $55 M | $100 M | Series B | Jul 8, 2025 |

| Castellum.AI | Curql (lead), BTech Consortium, Framework VP, Spider, Remarkable, Cameron | $8.5 M | Not disclosed | Series A | Jul 8, 2025 |

| Bumo | True Ventures (co-lead), Offline Ventures (co-lead), Goodwater, Marketplace, J. Chung, etc. | $10 M | $10 M | Seed Round | Jul 8, 2025 |