America-First Strategic Reserve: President-Elect Trump Backs ‘America-First’ Crypto Reserve

After four years of regulatory hurdles under the Biden administration, the cryptocurrency community is embracing Donald Trump’s return to the White House. Industry insiders are optimistic about a shift in tone, anticipating executive orders that could legitimize the sector, expand access to banking, and establish the U.S. as a global crypto powerhouse.

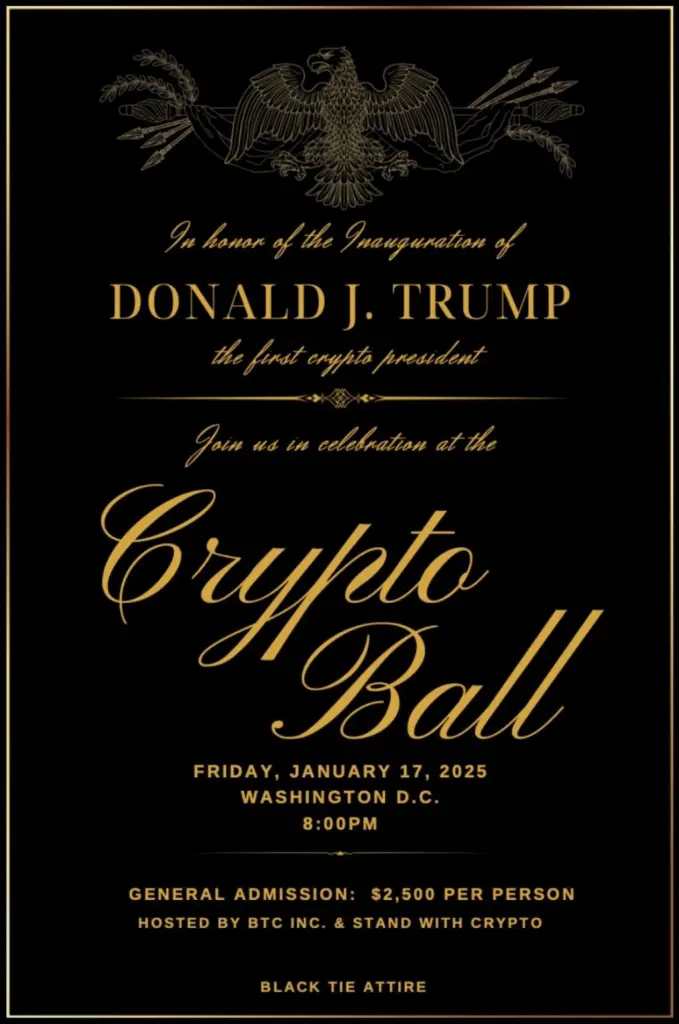

On Friday, newly appointed White House A.I. & Crypto Czar David Sacks is set to host the inaugural Crypto Ball in Washington, D.C., launching a weekend of festivities leading up to Trump’s January 20 inauguration, according to The New York Post.

The exclusive black-tie event, featuring sponsorships from Coinbase, Solana, MicroStrategy, Kraken, and Galaxy Digital, has already sold out its tickets, priced between $2,500 and $1 million. Top-tier attendees paying $1 million will also enjoy a private dinner with the president-elect.

America-First Strategic Reserve

Central to Trump’s crypto agenda is the proposed creation of an “America-First” strategic reserve for U.S.-based cryptocurrencies. The initiative prioritizes assets like USDC, Solana (SOL), and XRP, reflecting the administration’s commitment to bolstering national security and fostering homegrown innovation.

While proponents argue this move strengthens the nation’s control over digital assets and reduces reliance on foreign-dominated platforms, critics caution that it risks sidelining Bitcoin and fracturing the industry’s unity.

“While many in the cryptocurrency community have been cheering on the pro-crypto executive orders Trump is expected to issue, one idea is causing more controversy: the idea of an America-first strategic reserve that would prioritize digital coins founded in the US, like Solana, USD Coin and Ripple’s XRP,” The NY Post reported.

A New Direction for Crypto Policy

Trump’s administration is signaling its crypto-friendly approach with key appointments, including David Sacks as the AI and Crypto Czar and Paul Atkins as the nominee for SEC Chair. Early actions include promises to build a Bitcoin reserve and end the debanking practices that hindered the industry for years.

Frank Chaparro, a Bitcoin investor and director at The Block, expressed relief over the policy changes:

“This is a seismic shift. Banks are finally in a position to work with crypto without fear of reprisal. It’s a monumental change from what we’ve seen over the last four years.”

Crypto Ball and Industry Momentum

The shift in policy is being celebrated with events like the Crypto Ball, which symbolizes the growing synergy between the crypto sector and the new administration. Hosted by David Sacks and supported by industry giants like Coinbase, Solana, and MicroStrategy, the event underscores the rising influence of cryptocurrency in Washington. Beyond the glitz and exclusivity, this gathering reflects a broader effort to integrate digital assets into the U.S. financial framework under the Trump administration.

Crypto Ball

A Broader Crypto Agenda

Beyond the strategic reserve, Trump’s administration is laying the groundwork for what some are calling a “crypto golden age.” Key initiatives include:

- Replacing SEC Chair Gary Gensler: This move is expected to open the door for banks to engage with crypto without restrictive oversight.

- Commuting Ross Ulbricht’s Sentence: Advocates believe this could improve perceptions of the crypto community.

- Creating a Presidential Advisory Council for Crypto: This body would guide policy decisions while encouraging innovation.

- Rolling Back SAB 121 and Operation Choke Point 2.0: Removing these policies could enable financial institutions to support crypto projects, driving growth.

- Boosting U.S. Bitcoin Mining: Plans to position the U.S. as a leader in sustainable mining could further establish dominance in the digital currency space.

Challenges and Opportunities

While the proposed policies have sparked excitement, they also raise questions about long-term industry impact. Favoring U.S.-based assets could alienate global stakeholders or create fractures within the community. Short-term market volatility is also likely as investors respond to these sweeping changes.

The Road Ahead

The Trump administration’s policies mark a pivotal moment for cryptocurrency. With bold initiatives and a focus on U.S. innovation, these actions have the potential to reshape global crypto dynamics. The coming months will determine whether this agenda ushers in a period of unprecedented growth or exacerbates tensions within the industry.

As the crypto market adjusts to this new direction, all eyes will be on Washington to see how these policies play out and what they mean for the future of digital finance.