Nvidia soars past $3.7 trillion valuation with Blackwell GPU launch

Just days after Apple briefly surpassed Nvidia in market value, the chipmaker is back on top following the debut of its Blackwell GPU. Nvidia’s stock surged to an all-time high of $153.58 in premarket trading, bringing the company’s valuation to over $3.7 trillion.

Nvidia first crossed the $3.6 trillion mark on November 7, cementing its dominance in the AI-driven market. Last month, the company momentarily overtook Apple with a valuation of $3.53 trillion during trading hours on October 25, though Apple reclaimed the lead by the market close.

Adding to the momentum, Nvidia recently unveiled the $3,000 Project Digits personal computer at CES 2025, a machine roughly 1,000 times more powerful than the average laptop. This powerhouse is built around the Nvidia GB10 Grace Blackwell Superchip, which combines tightly linked components on a single chip to minimize data transfer delays. The device features a Blackwell graphics card, a Grace processor, 128 GB of memory, and 4 TB of SSD storage.

AI’s Impact on Nvidia’s Unstoppable Growth

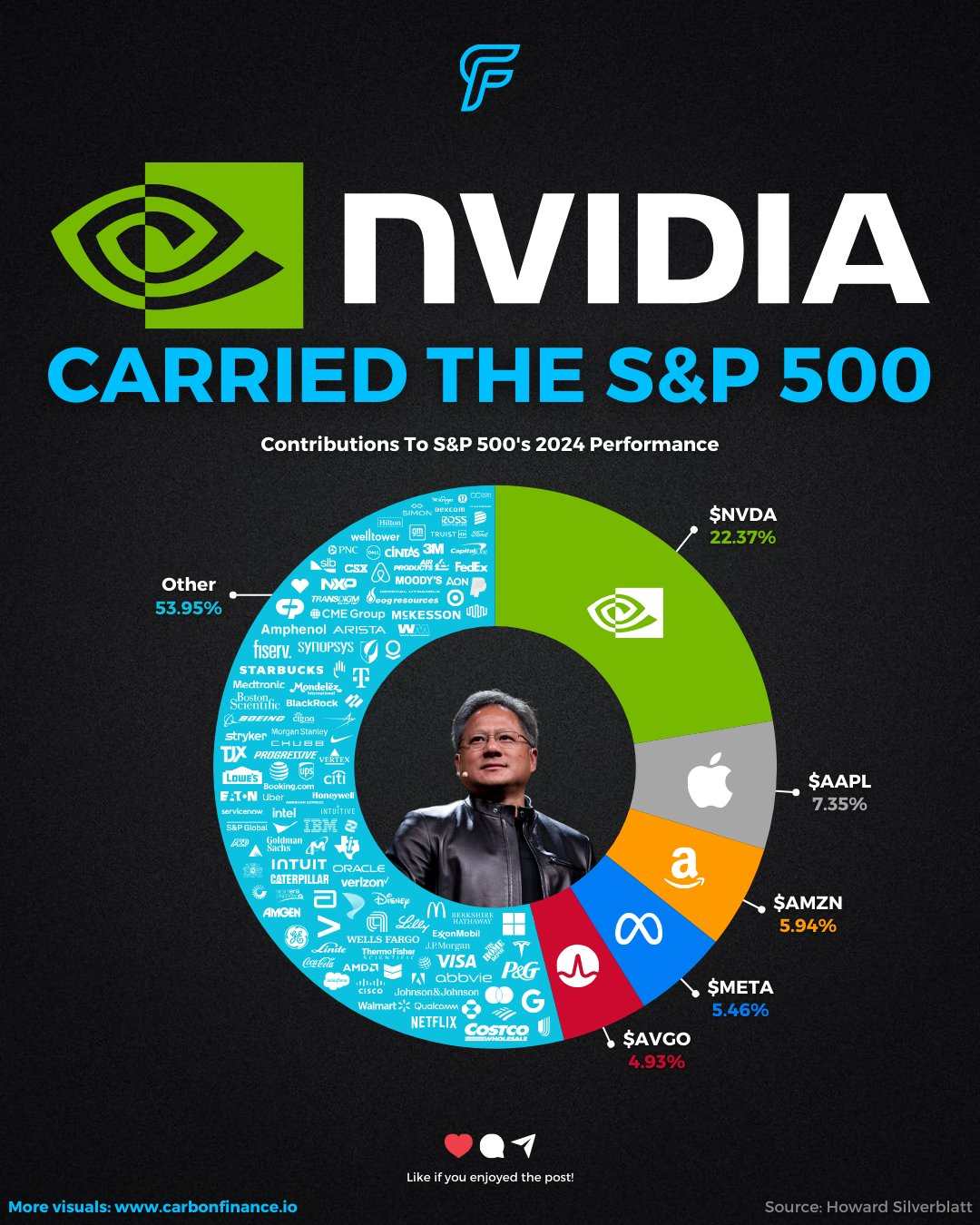

Nvidia has been a significant driver of the S&P 500’s performance, contributing 22% to the index in 2024. Its shares have soared by over 800% in two years, outpacing Apple, which has nearly doubled in the same period. In November alone, Nvidia’s stock climbed 12%, tripling its value this year.

Nvidia’s remarkable rise underscores its pivotal role in powering AI advancements. Tech giants like Microsoft, Alphabet, and others are heavily investing in AI infrastructure, directly boosting demand for Nvidia’s GPUs. Analysts are projecting a staggering 80% increase in Nvidia’s quarterly revenue, reaching $32.9 billion when earnings are reported on November 20.

The company’s trajectory underscores the broader strength in the tech sector. The S&P 500 technology index surged over 4% following Trump’s recent victory, reflecting optimism for tech stocks overall. Nvidia, in particular, has benefited from major investments by Microsoft, Alphabet, and other industry giants to expand AI infrastructure. These efforts have propelled Nvidia’s stock by 12% in November alone, tripling its value this year.

With a valuation exceeding the combined worth of companies like Eli Lilly, Walmart, JPMorgan, Visa, UnitedHealth Group, and Netflix, Nvidia remains a standout in the U.S. market. Analysts forecast a staggering 80% jump in quarterly revenue, reaching $32.9 billion, when Nvidia reports earnings on November 20.

Founded in 1991 by Jensen Huang, Chris Malachowsky, and Curtis Priem, Nvidia has evolved from a gaming GPU innovator into a leader in AI-focused technology. Its ability to capitalize on the AI boom has cemented its place among the world’s most valuable companies.

As Nvidia continues to break records and push boundaries, its role as a key player in the tech industry’s AI-driven future is unmistakable.