Nvidia’s market value soars $2 trillion in 2024 amid AI boom, emerging as the top global market cap gainer

2024 will go down as a landmark year for Nvidia. The chipmaking powerhouse saw its market capitalization skyrocket, fueled by unprecedented demand for its GPUs and the surging interest in artificial intelligence technologies.

On November 7, Nvidia’s shares reached a record high, cementing its position as the first company to hit $3.6 trillion in market value. The company’s extraordinary climb was buoyed by investor optimism following Donald Trump’s election win, with expectations of tax breaks and reduced regulations driving confidence in tech stocks.

However, the race for market supremacy took another turn on December 23, when Apple reclaimed the top spot, reaching a valuation of around $3.85 trillion. This surge came on the back of excitement around Apple’s AI-focused initiatives and a rebound in iPhone sales.

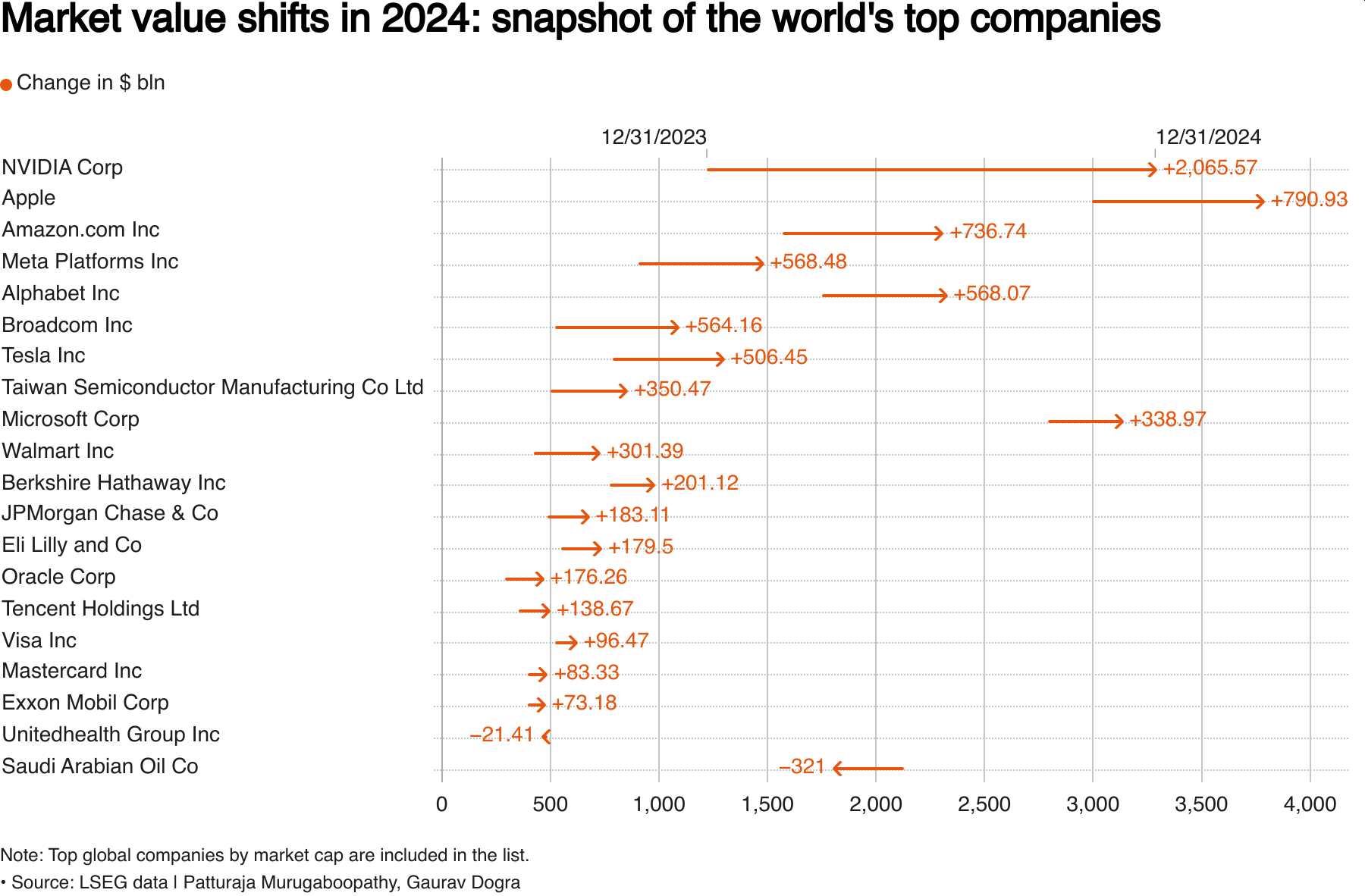

By the end of the year, Nvidia’s market value stood at $3.28 trillion, up from $1.2 trillion at the close of 2023. This remarkable $2 trillion gain secured its position as the second-most valuable publicly traded company globally, just behind Apple.

Tech Giants Dominate the Rankings

Nvidia is not alone. Other tech heavyweights also saw significant gains. Microsoft closed 2024 with a market value of $3.1 trillion, placing it third. Alphabet Inc. and Amazon followed, each valued at roughly $2.3 trillion.

Credit: Reuters (Click here to see a larger image)

The collective performance of these companies played a pivotal role in lifting global market indexes. The S&P 500 climbed 23.3% over the year, while the Nasdaq posted an even stronger gain of 28.6%.

Looking ahead, analysts remain optimistic about the tech sector’s momentum despite potential headwinds, such as U.S.-China trade tensions and uncertainty around interest rate cuts.

Daniel Ives of Wedbush is particularly bullish, forecasting a 25% uptick in tech stocks for 2025. His outlook is rooted in expectations of reduced regulatory pressure under Donald Trump, major advancements in AI, and a stable growth trajectory for Big Tech and Tesla, Reuters reported.

“We believe tech stocks will be robust in 2025 on the shoulders of the AI Revolution and $2 trillion+ of incremental AI cap-ex over the next 3 years,” Ives said.

Nvidia’s groundbreaking year underscores the transformative impact of AI across industries and its ability to reshape the hierarchy of the world’s most valuable companies. The stage is set for even greater competition and innovation in the years to come.

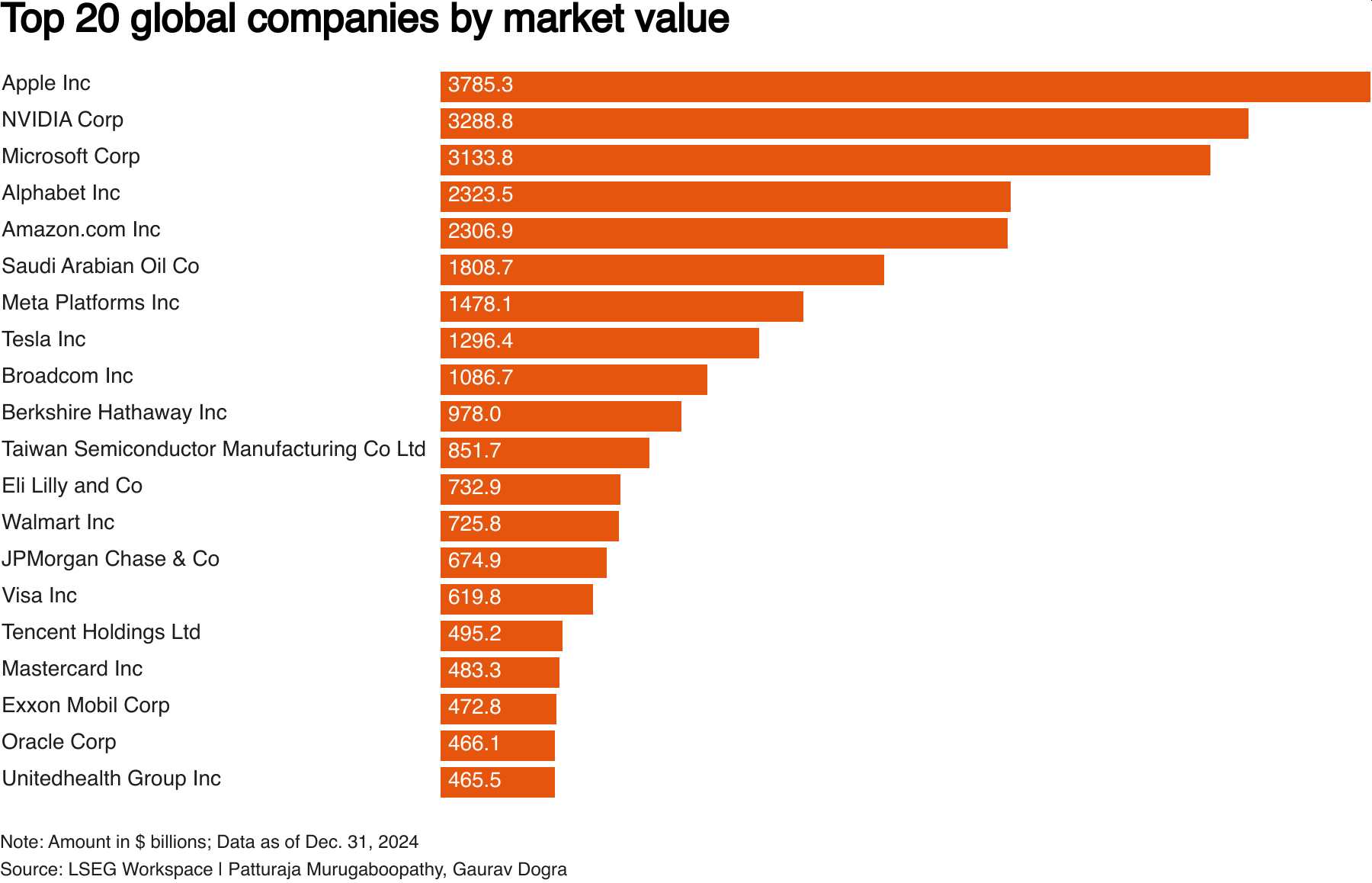

Top 20 Global Companies by Market Value

The 2024 market capitalization boost wasn’t limited to tech giants like Nvidia, Apple, and Microsoft. Several other global companies experienced significant growth in their valuations, reflecting a broader wave of investor confidence across industries. Amazon and Alphabet each surpassed $2.3 trillion in market value, maintaining their positions among the top five most valuable companies. Saudi Aramco, buoyed by steady energy demand, reached $1.8 trillion, while Meta Platforms and Tesla continued to climb, achieving valuations of $1.48 trillion and $1.3 trillion, respectively.

Even outside the tech and energy sectors, companies like Eli Lilly and Walmart made notable strides, with market caps of $732.9 billion and $725.8 billion, showcasing the resilience of healthcare and retail. These gains collectively propelled global stock indexes higher, with the S&P 500 rising 23.3% and the Nasdaq surging 28.6% for the year. As analysts look to 2025, the momentum built by companies across industries in 2024 sets the stage for another year of strong market performance, with technology expected to remain a key driver of growth. Here’s a list of the top 20 global companies that experienced significant valuation growth in 2024.

- Apple Inc: $3,785.3 billion

- NVIDIA Corp: $3,288.8 billion

- Microsoft Corp: $3,133.8 billion

- Alphabet Inc: $2,323.5 billion

- Amazon.com Inc: $2,306.9 billion

- Saudi Arabian Oil Co: $1,808.7 billion

- Meta Platforms Inc: $1,478.1 billion

- Tesla Inc: $1,296.4 billion

- Broadcom Inc: $1,086.7 billion

- Berkshire Hathaway Inc: $978.0 billion

- Taiwan Semiconductor Manufacturing Co Ltd: $851.7 billion

- Eli Lilly and Co: $732.9 billion

- Walmart Inc: $725.8 billion

- JPMorgan Chase & Co: $674.9 billion

- Visa Inc: $619.8 billion

- Tencent Holdings Ltd: $495.2 billion

- Mastercard Inc: $483.3 billion

- Exxon Mobil Corp: $472.8 billion

- Oracle Corp: $466.1 billion

- UnitedHealth Group Inc: $465.5 billion

Note: Amount in $ billions; Data as of Dec. 31, 2024

Source: LSEG Workspace | Patturaja Murugaboopathy, Gaurav Dogra