Verizon acquires Frontier Communications for $20 billion to expand its fiber network

Verizon Communications has announced a $20 billion acquisition of Frontier Communications Parent Inc., the largest fiber internet provider in the US. This news follows a report from The Wall Street Journal earlier this week that indicated Verizon was close to finalizing the deal, which led to a 38% rise in Frontier’s share price in New York.

Frontier’s shares soared to around $38, but have since dropped by 9% to the low $35 range. The Journal’s report on the deal emerged on Wednesday afternoon.

Verizon will pay $38.50 per share in cash to Frontier investors, offering a 43.7% premium over Frontier’s average share price over the past 90 days, as of Tuesday. Both companies’ Boards of Directors have approved the transaction, which is expected to be completed in about 18 months, pending approval from Frontier’s shareholders and regulatory bodies.

Verizon stated that this acquisition will significantly broaden its fiber network across the US, enhancing its ability to deliver high-quality mobility and broadband services. It will also bolster Verizon’s network for digital advancements such as AI and IoT.

“This strategic acquisition of the largest pure-play fiber internet provider in the US will significantly expand Verizon’s fiber footprint across the nation, accelerating the company’s delivery of premium mobility and broadband services to current and new customers. It will also expand Verizon’s intelligent edge network for digital innovations like AI and IoT,” Verizon wrote in a press release.

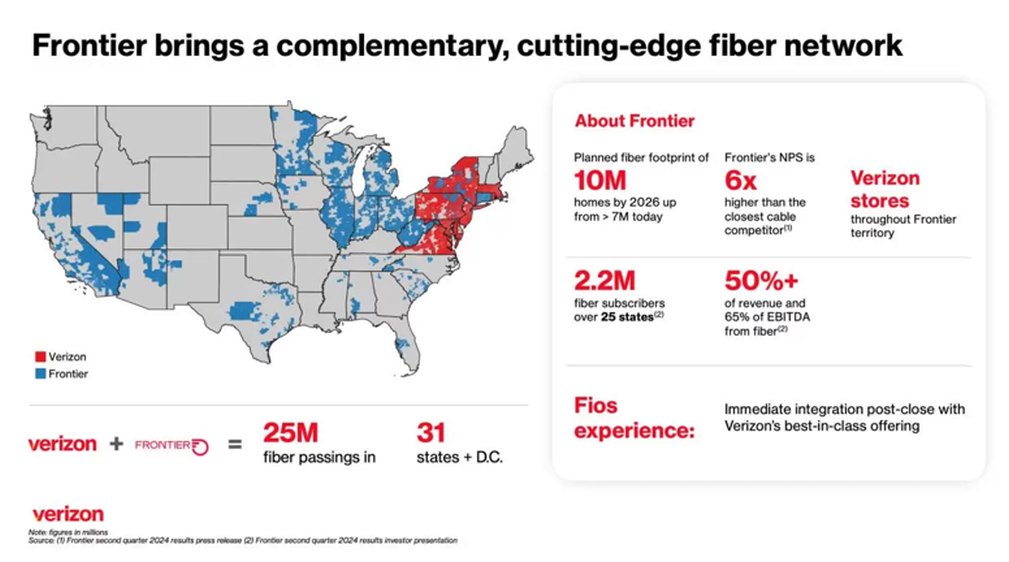

As part of the acquisition agreement, Frontier’s 2.2 million fiber subscribers in 25 states will integrate with Verizon’s existing 7.4 million Fios connections in 9 states and Washington, DC. Additionally, Frontier plans to increase its fiber locations by 2.8 million by the end of 2026.

Nationwide fiber coverage of the combined company

According to WSJ, Verizon is focusing on expanding its home internet services amid slower wireless revenue growth and high dividend costs. With new fiber-optic construction being costly and lengthy, existing broadband providers like Frontier are appealing acquisition targets.

For Frontier, this deal marks a remarkable turnaround from its Chapter 11 bankruptcy in April 2020. It underscores the growing importance of fiber network infrastructure in supporting advancements in AI and data centers.

Verizon has been active in acquisitions in recent years, including its 2020 purchase of BlueJeans Network, a video conferencing platform, for approximately $500 million.

Verizon has been actively acquiring companies in recent years. In 2020, Verizon bought BlueJeans Network, a video conferencing and event platform startup, for about $500 million. BlueJeans Network, which was founded in 2009 by Alagu Periyannan and Krish Ramakrishnan, offers enterprise-grade video solutions.