Echelon raises $3.5 million in seed funding to advance DeFi lending on Move-based blockchains

Echelon, a decentralized lending protocol, has raised $3.5 million in seed funding to advance DeFi lending on Move-based blockchains. The funding round was led by Amber Group, with participation from Laser Digital, Saison Capital, Selini Capital, Interop Ventures, and Re7.

With this new capital, Echelon plans to broaden its services by developing strategies backed by treasury and real-world assets (RWAs), creating vaults for cross-chain deposits, and expanding its team by hiring full-stack and smart contract engineers, as well as boosting its marketing efforts. The protocol aims to deliver high-performance markets that integrate seamlessly with other DeFi platforms and RWAs.

Move-Based Blockchains

Move-based blockchains are powered using the Move programming language, which was originally developed by Facebook for smart contracts and decentralized applications (dApps). Designed to offer enhanced security, flexibility, and efficiency in blockchain development, Move was initially created for Facebook’s blockchain project, Libra (later rebranded as Diem), and has since then been adopted by various blockchain platforms.

Unlike the traditional blockchain platforms, Echelon’s features include increased borrowing capacity on correlated assets, isolated pools for niche asset markets, direct in-wallet integration for simplified yield strategies, and future support for investing in and borrowing against illiquid RWAs.

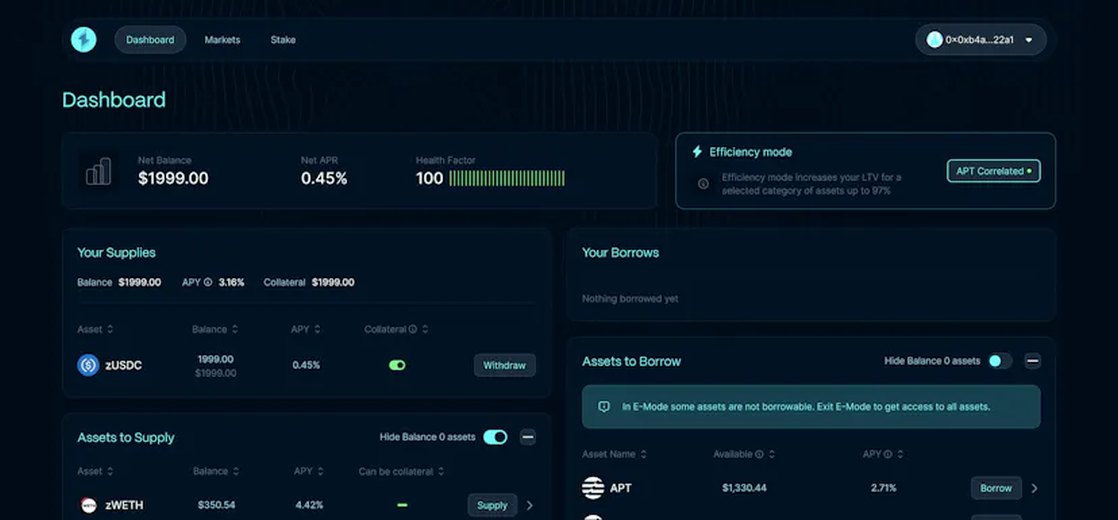

Echelon Market Dashboard

Built using the Move language, Echelon Protocol is designed for institutional-grade markets on platforms like Movement and Aptos. It focuses on capital efficiency, affordable borrowing rates, and innovative yield opportunities for a global user base. The protocol has already gained significant traction, with notable user engagement and substantial amounts of assets supplied and borrowed.

Rushi Manche, Co-Founder of Movement Labs, highlighted Echelon’s focus on capital efficiency and user-friendly design, positioning it as a potential leader in the next generation of DeFi protocols on the Movement Network.

“Their focus on capital efficiency and user-friendly design positions them to become a leader in the next generation of DeFi protocols on the Movement Network,” Manche said.

Echelon aims to optimize capital efficiency and provide accessible borrowing rates in the DeFi space. By leveraging advanced risk management and integrating with various assets, the protocol seeks to create new opportunities for yield generation and financial access.

Founded in 2023, Echelon is a high-efficiency money market that supports the borrowing and lending of assets through non-custodial pools, enabling users to earn interest and leverage their buying power. Positions are overcollateralized to protect lenders while maximizing capital efficiency for borrowers. The protocol includes isolated pools for niche assets and one-click strategies for leverage staking and RWA-backed vaults, such as leveraged treasuries.

Movement Labs is the driving force behind the Movement Network, an ecosystem of modular Move-based blockchains that allows developers to create secure, high-performance, and interoperable blockchain applications, bridging the gap between Move and EVM ecosystems.