AI startup funding more than doubles in Q2, surges to $24 billion

Posted On July 9, 2024

0

2.2K Views

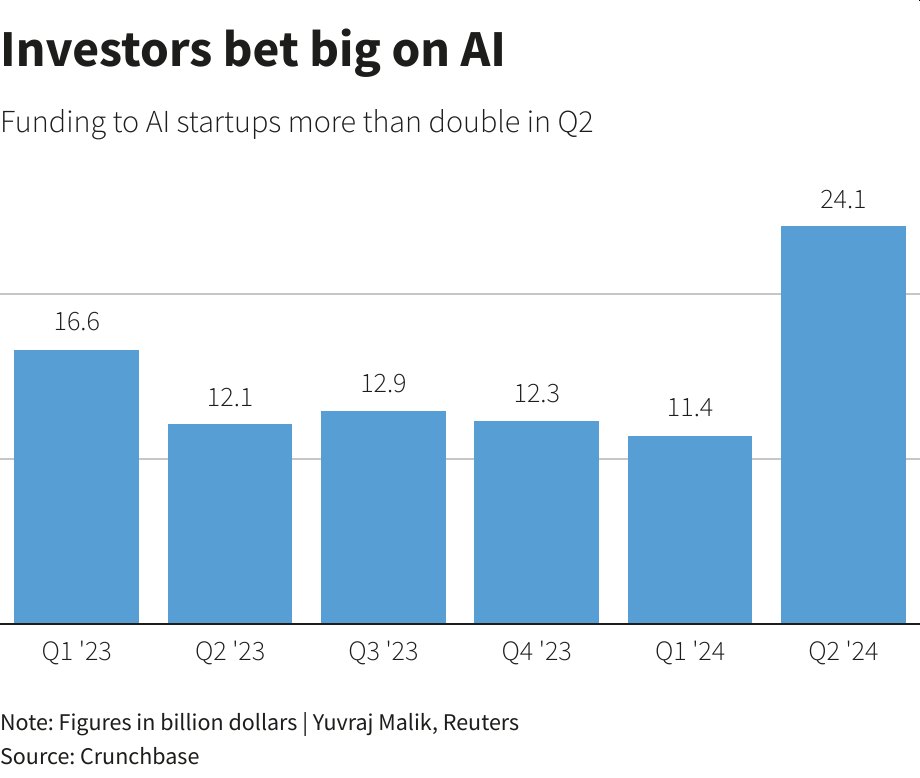

The artificial intelligence boom, ignited by the success of ChatGPT two years ago, shows no signs of slowing down as investors continue to funnel billions into generative AI startups. According to the latest data from Crunchbase, investments in AI startups skyrocketed to $24 billion from April to June, more than doubling from the previous quarter.

This staggering influx of capital underscores the growing appetite for new AI technologies. Overall, startup funding increased by 16% sequentially, reaching $79 billion last quarter. AI investments drove this growth, marking the first time AI became the largest sector, surpassing healthcare and biotech.

The success of OpenAI’s ChatGPT has spurred a race to adopt the latest AI technologies across business productivity, healthcare, and manufacturing. Despite the massive investments, investors and Big Tech firms anticipate that significant gains from AI will only materialize over the next few years. Analysts cautioned that generative AI startups will need to generate billions in annual revenue to justify their current levels of spending.

Source:/Credit: Reuters

Five out of six billion-dollar funding rounds last quarter were directed toward AI companies. Notable deals included Elon Musk’s xAI raising $6 billion and AI infrastructure provider CoreWeave securing $1.1 billion. Other significant funding rounds featured automated driving company Wayve and data preparation firm Scale AI. Outside the AI sector, cybersecurity company Wiz raised $1 billion, Reuters reported, citing Crunchbase data.

Despite the uptick in the last quarter, overall startup funding remains low compared to the past three years. Global funding declined by 5% to $147 billion in the first half of the year, remaining flat compared to the second half of 2023, according to Crunchbase.

A tight monetary policy in the U.S. has slowed the revival of initial public offerings (IPOs), hampering one of the primary sources of returns for institutional private market investors who typically invest in startups and sell shares during IPOs.

As investment in AI surges, so does the demand for chips powering the large language models (LLMs) that many generative AI startups rely on. This demand has propelled Nvidia to become the world’s most valuable company, with a market capitalization exceeding $3 trillion. However, analysts warn that Big Tech needs to generate $600 billion in annual revenue to justify the substantial AI hardware expenditure.