Duolingo jumps on online learning boom and AI push, set to add $1.68 billion to its market value

Duolingo, fueled by the AI boom started by ChatGPT, is poised for a remarkable resurgence following the disclosure of a data breach compromising the private information of over 2.6 million users last August.

In a premarket surge on Thursday, Duolingo’s shares soared by more than 20%, as the company unveiled its bullish 2024 revenue projections fueled by a seismic shift towards online education and AI integration within its platform. If these gains hold, Duolingo is set to swell its market value by a staggering $1.68 billion.

Projections unveiled by Duolingo for its 2024 revenue, ranging between $717.5 million and $729.5 million, have significantly outstripped analysts’ forecasts, averaging $699.3 million, Reuters reported, citing data from LSEG.

Observers note a pronounced tilt towards online language learning, with Duolingo emerging as the undisputed frontrunner, thanks to its innovative “freemium” model, as highlighted in a briefing from Seaport Global.

Furthermore, analysts laud Duolingo’s adept utilization of generative artificial intelligence (GenAI) across its offerings. The introduction of Duolingo Max, a subscription tier integrating GenAI features, in March of the preceding year, has garnered substantial traction, evidenced by heightened demand at premium price points, as articulated by CFO Matt Skaruppa during a post-earnings call.

“We saw a lot of demand at higher prices for our Max offering,” Skaruppa said.

While Duolingo remains accessible at no cost, its premium subscription offerings and in-app purchases have bolstered the company’s financials, with total bookings soaring to a record $191 million for the final quarter of the previous year, marking a remarkable 51% surge. Concurrently, paid subscribers witnessed a formidable uptick of nearly 60%, surging to a record 6.6 million in the fourth quarter. In premarket trading, shares soared above $235, representing a more than 6% discount relative to the median price target of $251.50, as indicated by thirteen analysts.

The company’s robust performance in the fourth quarter is underscored by a 65% spike in daily active users and a year-on-year surge of 46% in monthly active users, underscoring its steadfast growth trajectory.

Dan Coatsworth, an investment analyst at AJ Bell, lauded Duolingo’s impressive metrics, attributing the positive share price reaction to substantial revenue growth, user expansion, and burgeoning subscriber numbers.

From its humble origins in 2009 as a free language-learning app, Duolingo has undergone a meteoric evolution. According to filings with the SEC on Monday, the company experienced a staggering 97% revenue surge year-over-year, albeit accompanied by a six-fold expansion in net losses, totaling $13.5 million for the quarter ending March 31st.

Back in 2019 when we first covered the company, the language-learning app had 300 million registered users worldwide. Today, Duolingo is the most popular language-learning platform with over 500 million registered users and 42 million are active once a month. Duolingo is also the most downloaded education app worldwide.

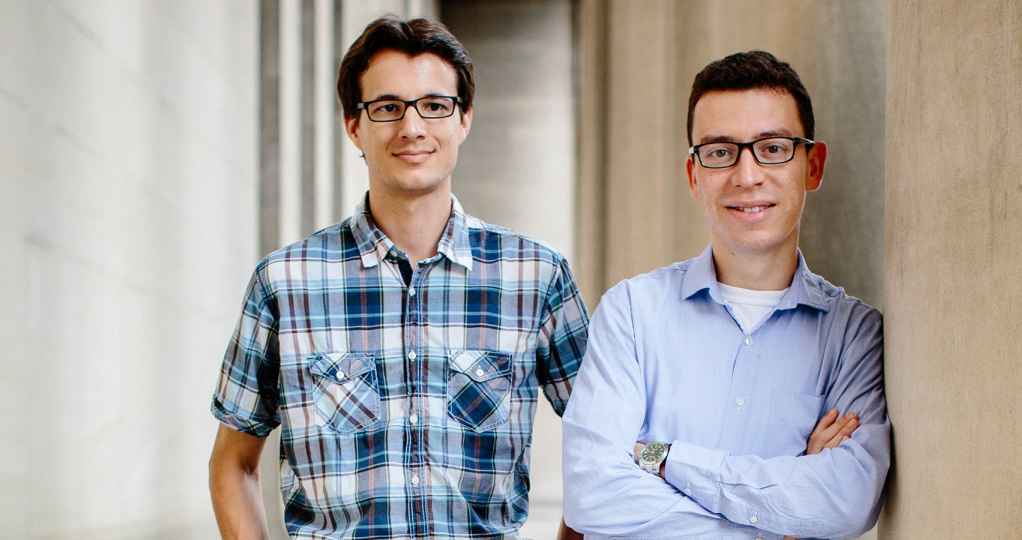

Rooted in the visionary pursuits of Carnegie Mellon computer science professor Luis von Ahn and his Ph.D. student, Severin Hacker, Duolingo’s genesis traces back to a quest for innovation following von Ahn’s successful ventures, including the sale of two businesses, reCAPTCHA, to Google in his early twenties. Recognizing an opportunity to revolutionize the language-learning paradigm, Duolingo was conceived and has since reshaped the educational landscape with its pioneering approach.

Duolingo Founders