CoinMarketCap Releases “According to CMC” Q3 2023 Report on the Crypto Market

Key takeaways from the Q3 report include:

- A significant drop in trading volume, reaching historic lows. The combined spot trade volume on the top 15 centralized exchanges decreased by 30.59% in Q3.

- Memes, a sector that dominated in Q2 2023, retained its popularity. However, meme coins saw a 53% decrease in dominance as the initial hype subsided.

- ChainGPT (CGPT) has emerged in the Top 10 Most Added To Watchlist in Q3 2023, replacing PEPE. CGPT offers AI capabilities such as blockchain analytics and smart contract generation.

- The Telegram bots sector gained momentum in Q3, driven primarily by trading-focused platforms like Unibot (UNIBOT).

- Germany has surpassed Turkey to become one of the top three countries in terms of users on CMC. The United States and India maintained their leading positions.

CoinMarketCap, by far the world’s most-referenced price-tracking website for crypto assets, has unveiled its latest “According to CMC” report. The 5-chapter report offers deeper insights into the overall cryptocurrency market, key events, future themes, trends, and much more.

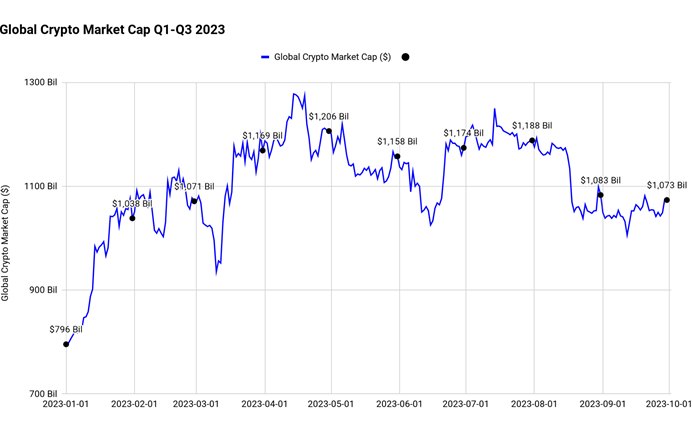

Total Crypto Market Cap

According to the report, by the close of Q3, the total cryptocurrency market capitalization stood at $1.07 trillion USD, marking an 8.56% decrease during the quarter while maintaining a 34.95% year-to-date increase. Several factors contributed to this quarter’s market growth:

Q3 of 2023 witnessed substantial growth narratives compared to the previous quarter (Q2). These included the rise of onchain Real World Assets (RWAs), the successful integration of Base and other leading Layer 2 solutions, and increased adoption of SocialFi platforms. A common thread throughout the quarter has been the focus on bringing more Web2 users into the Web3 ecosystem.

Notably, traditional finance (TradFi) has made its presence felt in the crypto space. In the United States, applications for BTC Spot ETFs and ETH Futures & Spot ETFs have been filed, indicating a clear interest from traditional financial institutions in investing in cryptocurrencies through regulated instruments. Furthermore, prominent banks and trading firms have announced plans to establish their crypto desks, underscoring the growing interest and participation of institutional players in the crypto market.

Here’s a brief summary of the additional insights from the report:

- In comparison to Q2, Q3 has seen strong growth narratives in the crypto market, including the rise of real-world assets (RWAs), the success of Base and other leading Layer 2 solutions, and more robust implementations of SocialFi platforms.

- Trading volume has reached an all-time low, and market liquidity is currently limited.

- Sectors such as Real World Assets (RWA), Generative AI, Oracles, Media, and Lending/Borrowing have experienced significant market cap growth in Q3. Additionally, sectors like Telegram Bots and the Base Ecosystem have seen substantial expansion.

- Meme, DeFi, and Smart Contracts continue to be the top three most popular sectors on CoinMarketCap. Pageviews indicate active community engagement with the leading coins in these sectors.

- Notable gainers in Q3 revolve around oracles, real-world assets, the Telegram ecosystem, interoperability, cross-chain liquidity, and decentralized stablecoins.

You can read and download a copy of the entire report below.

According to CMC Q3