Nvidia hits $1 trillion market cap, joining the exclusive club of Alphabet, Amazon, Apple, and Microsoft

After many weeks of expectations, Nvidia finally hit a $1 trillion market cap at the open Tuesday after its stock rose nearly 6% in morning trading at around $409, making it the world’s first $1 trillion chipmaker as the AI boom rages on.

The company joins a small club of mostly tech companies that include Alphabet, Amazon, Apple, and Microsoft. However, Nvidia stocks need to hold above $404.86 to maintain its membership in the elite trillion-dollar club.

Nvidia stunned investors last week after it announced a blowout revenue forecast that surpassed analysts’ expectations by more than 50%, thanks to skyrocketing demand for its AI processors. According to CNBC, Nvidia projected a remarkable $11 billion in sales for the second quarter of fiscal 2024, surpassing market expectations by 50%, as consensus estimates had anticipated sales of $7.15 billion.

According to Wall Street analysts, Nvidia’s forecast has been described as “unfathomable” and “cosmological,” resulting in a significant increase in their price targets. Numerous analysts have raised their estimates, with the highest price target valuing the company at approximately $1.6 trillion, equivalent to the valuation of Google-parent Alphabet.

Almost overnight, the chipmaker experienced a staggering 26% surge in its share value, propelling its market worth to nearly $1 trillion at approximately $950 billion, according to FactSet. This remarkable ascent represents a significant increase from its previous closing market value of $755 billion on Wednesday.

Nvidia’s impressive performance is not limited to its revenue of $7.2 billion in the first quarter alone. The company’s projections for the upcoming quarter indicate an estimated revenue of approximately $11 billion, surpassing Wall Street’s expectations by over 50%. This incredibly optimistic outlook sparked a remarkable 26% surge in Nvidia’s stock when the market opened on Thursday morning, adding a staggering $170 billion to its market value.

According to Bloomberg data, this represents one of the largest single-day gains ever recorded for a US stock. As a result, Nvidia’s market capitalization now exceeds $950 billion. The rally also had a positive impact on other players in the chip industry, such as Taiwan’s TSMC and Japan’s Advantest.

In a note on Thursday, Needham analyst Rajvindra Gill said:

“Back in late 2021, we began publishing work suggesting Nvidia would become the first semiconductor company with a trillion-dollar market cap. While there was some peaks and valleys in the interim years, we believe Nvidia is in a position to achieve that valuation over time.”

Secret to Nvidia Success

You may wonder how Nvidia has achieved such remarkable growth. Thanks to the popularity of ChatGPT and the big demand for new chips to power generative AI tools. Nvidia is also the leader in the development of chip technology that holds the potential to either guide us toward salvation or lead us to eternal peril: artificial intelligence.

Nvidia’s graphics processing units (GPUs) play a crucial role in powering generative AI platforms such as OpenAI’s ChatGPT and Google’s Bard. While the company has been a long-standing leader in the discrete GPU market, traditionally associated with high-performance gaming, it is only recently that consumers have started recognizing the broader applications of GPUs in fields such as artificial intelligence and machine learning.

The remarkable success of OpenAI’s ChatGPT has caught the attention of tech giants like Alphabet and Microsoft. They are now capitalizing on the potential of generative AI, which can engage in conversations that resemble human interactions and create a wide range of content, including jokes and poetry.

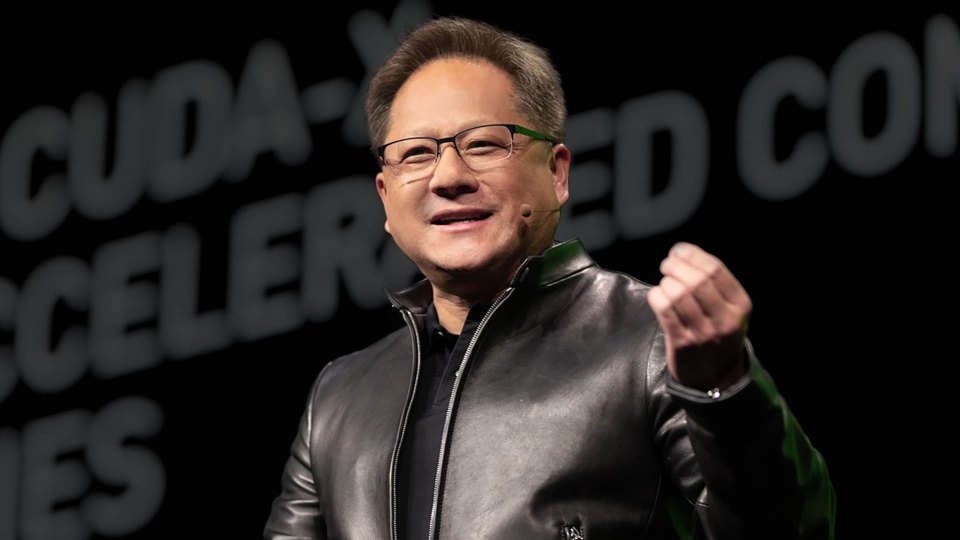

Founded in 1993 by CEO Jensen Huang, Chris Malachowsky, and Curtis Priem, Nvidia specializes in designing and manufacturing graphics processing units (GPUs) for gaming, artificial intelligence, and other applications. It has achieved significant growth and recognition for its advancements in AI and its contributions to the gaming industry.