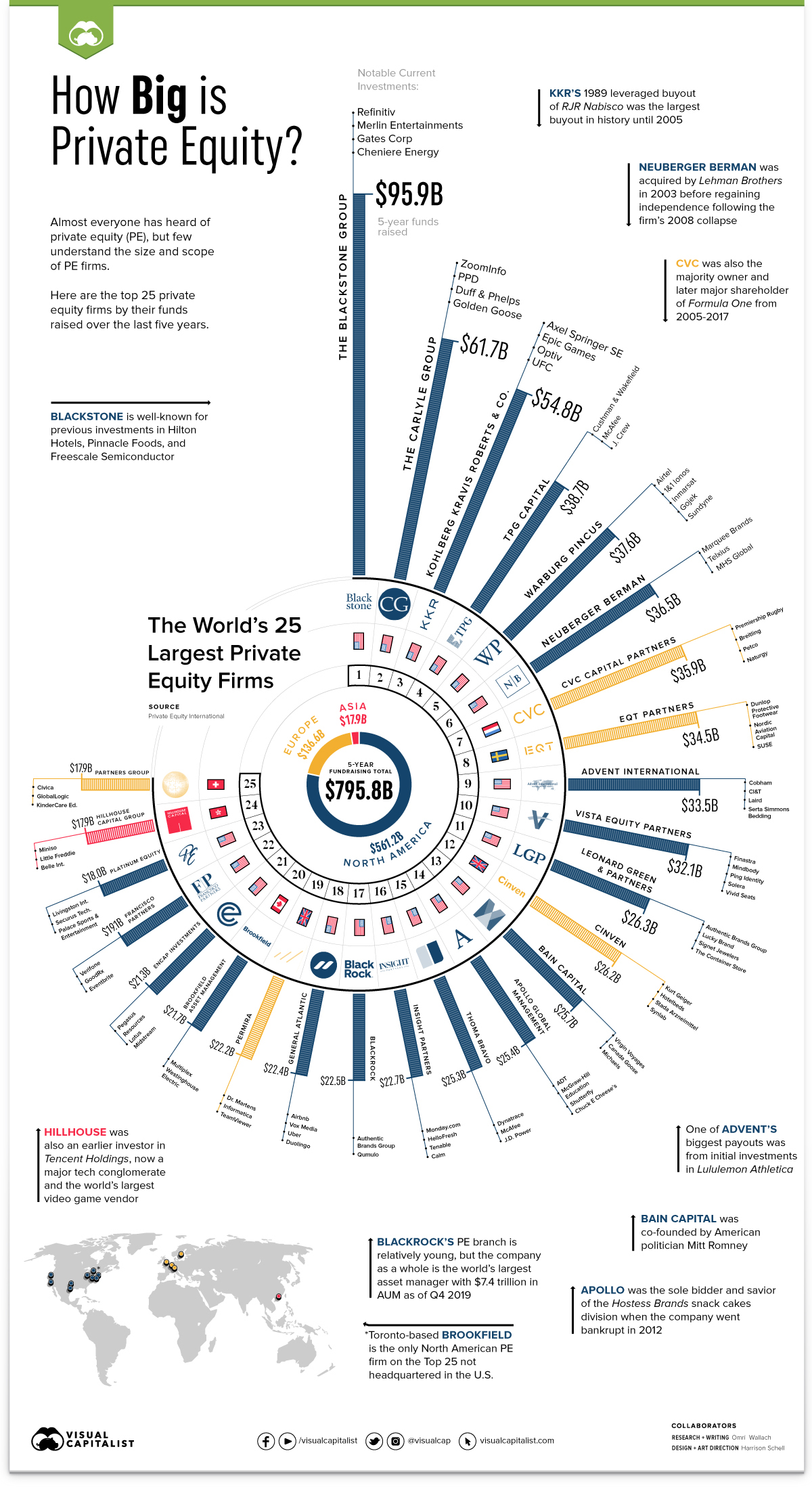

The Top 25 Largest Private Equity Firms in the World

Did you know that about half of all daily newspapers in the country are owned by private equity firms or hedge funds?

You’ve probably heard of private equity (PE) and have no idea what it is and why they’re the lifeblood of funding for private companies. Private equity is the golden ticket that grants access to a world of investment opportunities that are not available to the average investor. This exclusive investment opportunity is the go-to for institutional investors and high-net-worth individuals who are looking to invest in privately held companies or publicly traded companies that are taken private.

Not only does private equity offer the potential for higher returns, but it also allows investors to acquire a controlling stake in private companies or take public companies private, with the aim of enhancing their operations and profitability before selling them for a profit.

However, the road to success in private equity is not an easy one. Extensive due diligence is required to navigate the complexities of private equity investments, which come in different forms such as leveraged buyouts, growth equity, and venture capital.

Since private equity investments are not publicly traded, the companies involved are not required to disclose as much information about their operations and financial performance as publicly traded companies. This means that private equity investors need to be diligent in their research and analysis before making any investment decisions.

So, if you’re ready to join the big leagues and unlock the potential of private equity investments, make sure to do your homework and seek out the expertise that’s needed to succeed in this exclusive world of investing. It’s also important to know some of the big players in the private equity space with a great track record of success. In this piece, we’re going to explore some of the largest global private equity firms, their scale, and their scope using the data from The Capitalist.

How Large is the Private Equity Market?

Over the years, most have heard of private equity, but only a few understand the size and scope of PE firms. Private equity currently has $4.4 trillion in assets under management, including $1 trillion of uninvested capital, according to data from the US Senate website.

In addition, according to data from Preqin, a provider of data and intelligence on alternative assets, the private equity industry has seen significant growth over the past decade, with global private equity assets under management growing from $1.5 trillion in 2010 to $4.5 trillion in 2020.

“The private equity industry has evolved significantly over the past decade, expanding into new markets and sectors, and attracting record levels of capital from institutional investors worldwide. Global private equity assets under management grew from $1.5 trillion in 2010 to $4.5 trillion in 2020.” – Bain & Company

Overall, the private equity market is a large and growing industry that attracts significant amounts of capital from institutional investors. While the exact size of the market can vary depending on the source and methodology, it is clear that private equity is a significant force in the world of finance and investing.

Here are the top 25 global private equity firms by total assets under management (AUM) as of 2021. Please note that the figures provided may have changed since this table was created, and different sources may report slightly different AUM values for the same firms. Also, note that the ranking may vary depending on the source and the methodology used.

The 25 Largest Private Equity Firms

| Rank | Private Equity Firm | Total Assets Under Management (AUM) |

|---|---|---|

| 1 | The Blackstone Group | $684 billion |

| 2 | The Carlyle Group | $260 billion |

| 3 | KKR & Co. | $259 billion |

| 4 | Apollo Global Management | $455 billion |

| 5 | CVC Capital Partners | $129 billion |

| 6 | TPG Capital | $108 billion |

| 7 | Bain Capital | $130 billion |

| 8 | Warburg Pincus | $71 billion |

| 9 | Ardian | $112 billion |

| 10 | Advent International | $75 billion |

| 11 | EQT Partners | $67 billion |

| 12 | Brookfield Asset Management | $600 billion |

| 13 | GIC Private Limited | $440 billion |

| 14 | Bridgepoint | $30 billion |

| 15 | Clayton Dubilier & Rice | $38 billion |

| 16 | Silver Lake Partners | $90 billion |

| 17 | Hellman & Friedman | $75 billion |

| 18 | CD&R | $38 billion |

| 19 | AlpInvest Partners | $60 billion |

| 20 | Ares Management | $197 billion |

| 21 | Onex Corporation | $44 billion |

| 22 | H.I.G. Capital | $44 billion |

| 23 | HarbourVest Partners | $77 billion |

| 24 | Cinven | $23 billion |

| 24 | Permira | $50 billion |

Private Equity: By the Numbers

Below is private equity by the numbers, according to a document from the US Senate website.

The private equity (PE) industry is continuing to grow at a rapid pace.

- PE employs 11.7 million people – nearly 3 million more than just two years ago.

- There are more than 18,000 PE funds – a nearly 60% increase in just the last five years.

- PE currently has $4.4 trillion in assets under management, including $1 trillion of uninvested capital.

- The size of these funds has more than doubled since 2016.

As a result of this growth, PE touches virtually every corner of society…

- PE investments in health care have increased more than 20-fold over the last 20 years, with investments spanning from nursing homes to hospitals, to ambulatory services.

- PE has invested at least $1.1 trillion dollars in the energy sector over the last decade, with 80% of that in fossil fuels.

- About half of all daily newspapers in the country are owned by PE or hedge funds.

- Three PE firms control more than 90% of the prison telecom market, and they’re also big players in prison health care, commissaries, and food service.

You can read the rest of the stats from the document below.

PE Stats Final