Valkyrie’s Bitcoin Strategy ETF certified for listing on the exchange.

Nasdaq’s vice president of listing qualifications, Eun Ah Choi, said shares of Valkyrie’s Bitcoin ETF had been certified for listing on the exchange. The certification for Nasdaq listing is a hint that the U.S. Securities and Exchange Commission (SEC) may soon approve ETF application from Valkyrie.

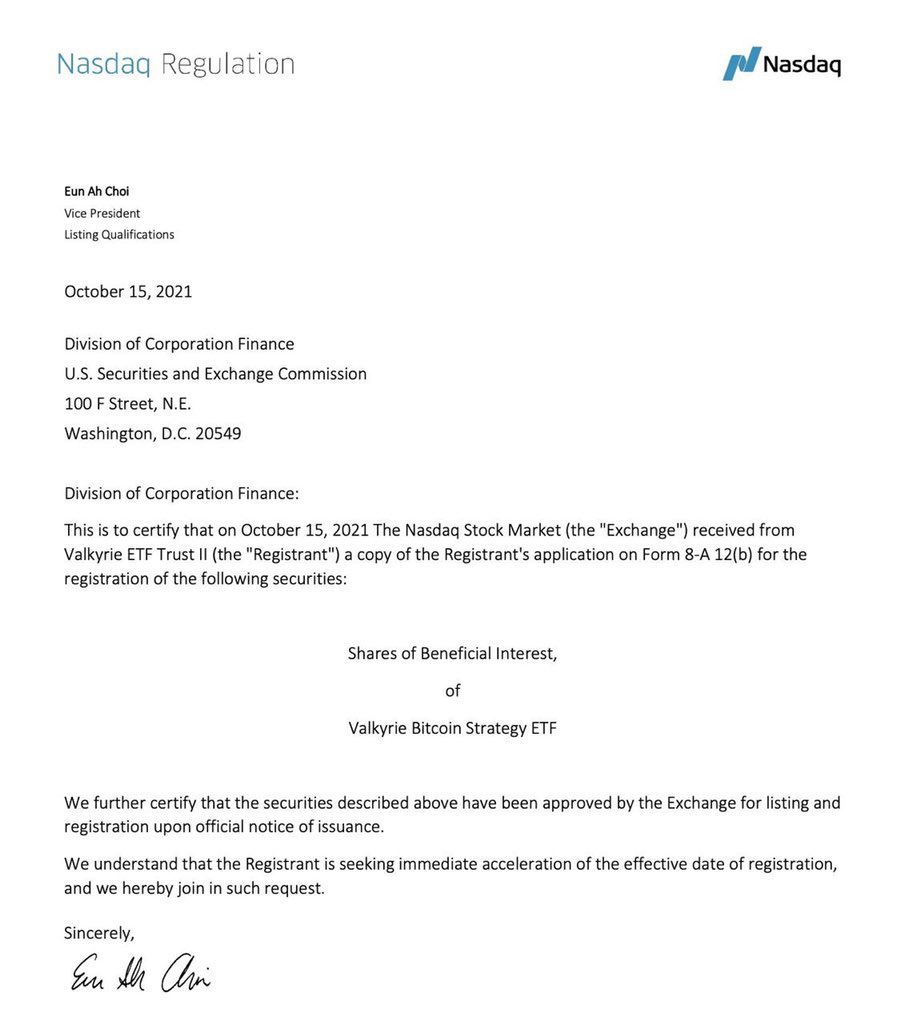

According to October 15 notice from the SEC, the agency said it accepted the registration request for shares of Valkyrie’s Bitcoin Strategy ETF for listing on Nasdaq. Nasdaq’s vice president of listing qualifications, Eun Ah Choi, said in the letter that said shares of Valkyrie’s Bitcoin ETF had been certified for listing on the exchange.

The U.S. Securities and Exchange Commission (SEC) has approved the highly-anticipated Bitcoin Futures ETF in a move likely to open the path to wider investment in digital assets. The approval also makes Valkyrie Bitcoin Futures ETF the first American bitcoin futures ETF.

Bitcoin has been surging since Bloomberg reported that the SEC would not be opposed to the ETF. Bitcoin rose to $61,700.26, its highest level since mid-April, and was last up 4.9% at$60,177. It has risen by more than half since Sept. 20 and is closing in on its record high of $64,895 hit in April.

Below is a copy of the letter from the SEC website.

Clarification and updates: Title and details changed to clarify that Valkyrie’s Bitcoin Strategy ETF has been certified for listing on the exchange and NOT a formal approval.

Old Title: SEC approves Bitcoin Futures ETF from Valkyrie ETF Trust

New Title: Valkyrie’s Bitcoin Strategy ETF certified for listing on the exchange.

This is breaking news. Please check back for updates.