PayPal, Venmo increasing transaction fees on digital payments as early as next month

While you would think that increased competition in the FinTech space would drive down transaction costs for digital payments, PayPal thinks it’s big enough to jack up its fees without regard to how the decision might affect its customers.

Last week, the payment giant announced it’s increasing the transaction fees for digital payments effective next month. The rate increase will also affect millions of Venmo users, a peer-to-peer payment app acquired by PayPal in 2013. According to the announcement, PayPal and Venmo users will see an increase in instant transfers beginning August 2.

For Venmo users, the pricing fee for instant transfers would increase from 1% to 1.5%. In addition, Venmo said that it’s also increasing its maximum fee from $10 to $15. For PayPal users, the rate will increase to 3.49% plus 49 cents on August 2 for businesses that previously paid a 2.9% fee (plus 30 cents) per digital payments transaction.

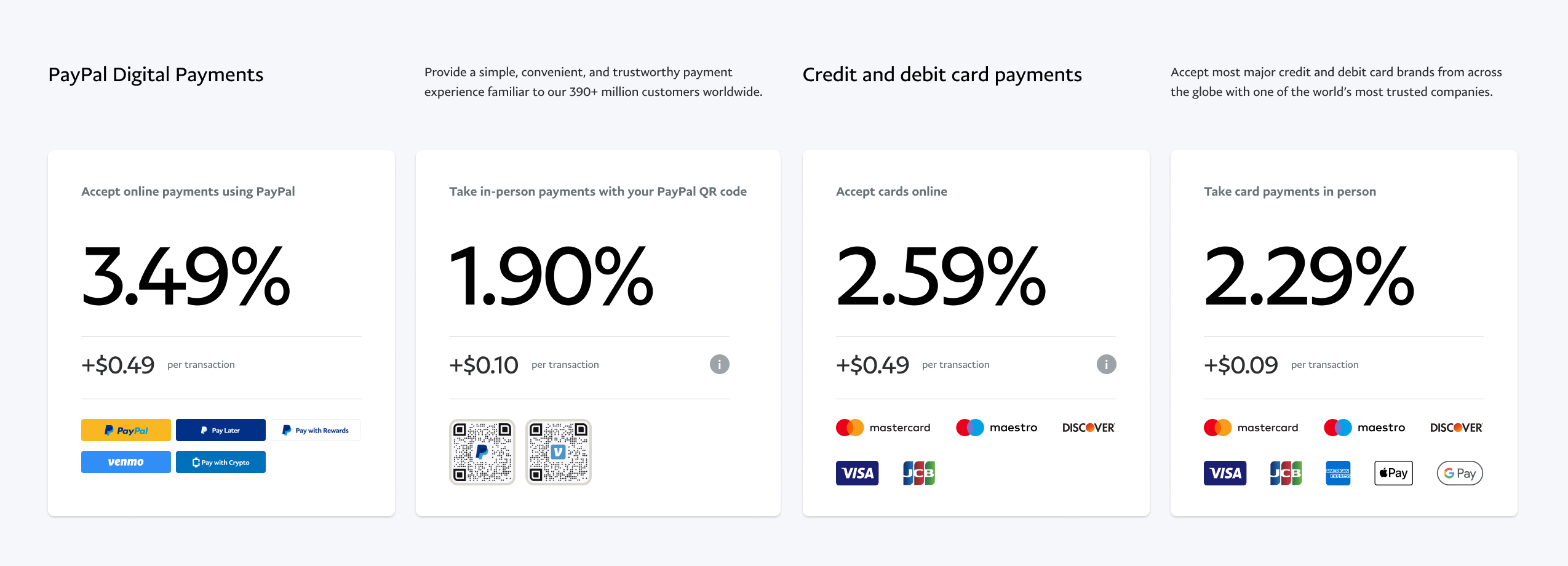

Below are the details of the changes according to the June 18 announcement from the PayPal website.

- PayPal Digital Payments: For PayPal payment products (such as PayPal Checkout, Pay with Venmo, PayPal Credit, Pay in 4, PayPal Pay with Rewards, Checkout with crypto), which include Seller Protection on eligible transactions, the rate for online transactions will be 3.49% + $0.491 per transaction.

- In-person Payments: For PayPal and Venmo QR code transactions over $10, the rate will be 1.90% + $0.10, and for such transactions, $10 and under, the rate will be 2.40% + $0.05. For certain in-person debit and credit transactions, the rate will be 2.29% + $0.09.

- Credit and Debit Card payments: Online credit and debit card transactions will be 2.59% + $0.491 per transaction without Chargeback Protection, or 2.99% + $0.49 with Chargeback Protection.

- Charity Transactions: Fees for charity transactions will be 1.99% + $0.49 for confirmed charities (subject to application and pre-approval).

- Non-standard Pricing: For U.S. merchants who have custom, non-standard pricing, rates will remain unchanged for those services as agreed.

PayPal also added: “We are continuing to innovate at record pace and empower businesses to never miss a transaction no matter where they do business. By investing in our data analytics capabilities, the improvement of our fraud tools, and the new consumer experiences we are delivering with products like Buy Now and Pay Later, Pay with Rewards Points, and Checkout with crypto – we remain at the cutting edge of payments.”

We hope this rate increase will create an opportunity for new and innovative tech startups to provide competitive, better payment processing solutions to customers at affordable prices.