Fintech startup Funding Circle surpasses $10 billion lent to small businesses globally as the lending platform; hits a major milestone in less than 10 years

Funding Circle, the leading small business loans platform in the UK, US, Germany and the Netherlands, hits a major milestone that demonstrates global evolution in the way small businesses access finance. Today, Funding Circle announced that its investors have lent more than $10 billion to small businesses globally through its platform, achieving a major milestone in less than 10 years.

When Funding Circle was founded, they could see that businesses weren’t being given the finance to grow, while investors were making poor returns. They had a simple idea — let them support each other. By lending directly to businesses through Funding Circle, investors are able to earn attractive returns to better provide for their future. Businesses get fast, easy access to funding to grow, create jobs, support local communities and drive the economy forward.

Achieving this milestone in less than a decade, Funding Circle has proven that its model has become the preferred option for small business funding that fuels economic growth — with every $1 lent to a small business through Funding Circle in 2018 contributing $2 to GDP, according to Oxford Economics.

Founded in 2010 by Alex Tonelli, Andrew Mullinger, James Meekings, Sam Hodges, and Samir Desai, Funding Circle is a global lending platform for small businesses, connecting businesses who want to borrow with investors who want to lend in the UK, US, Germany and the Netherlands. Since launching in 2010, investors across Funding Circle’s geographies — including more than 90,000 retail investors, banks, asset management companies, insurance companies, government-backed entities and funds — have lent $10.2 billion to 72,000 businesses globally. To date, Funding Circle has raised a total of $422.9M in funding over 9 rounds. Their latest funding was raised on Jan 11, 2017 from a Series F round.

“We are incredibly proud that Funding Circle has become small business’ first choice for loans,” said Bernardo Martinez, Funding Circle US Managing Director. “We look forward to continuing to build on the strong foundations we have put in place to help many more businesses in the years ahead.”

Over the last nine years, Funding Circle has facilitated loans from more than 90,000 investors to 72,000 small businesses. This modern lending approach enables small businesses to access fast, affordable and transparent funding for a variety of business needs; while investors have the opportunity to earn attractive, risk-adjusted returns from a previously inaccessible asset class. Funding Circle’s business lending platform is the largest operating in any of our geographies by total global loan volume, number of investors and loans outstanding1.

Today Funding Circle manages a loan portfolio of $3 billion (£2.5 billion) in the United Kingdom and $1 billion in the United States, plus an additional $175 million (€156 million) and $129 million (€115 million) in Germany and the Netherlands, respectively. Not only was Funding Circle the first lending platform anywhere in the world to have facilitated more than $1 billion across two markets, but within the United States the company holds more US small business loans outstanding than almost 98% of banks2.

In each market that Funding Circle serves, banks continue to focus on loans to larger companies despite smaller businesses’ outsized contributions to the economy. The lack of support from traditional bank lenders has resulted in more small businesses turning to non-bank options such as online lending when seeking finance, driving huge economic growth as a result. Oxford Economics found that in 2018 alone, lending through Funding Circle contributed $8.7 billion (measured in “gross value added”) to the global economy, and created and sustained 115,000 jobs globally.

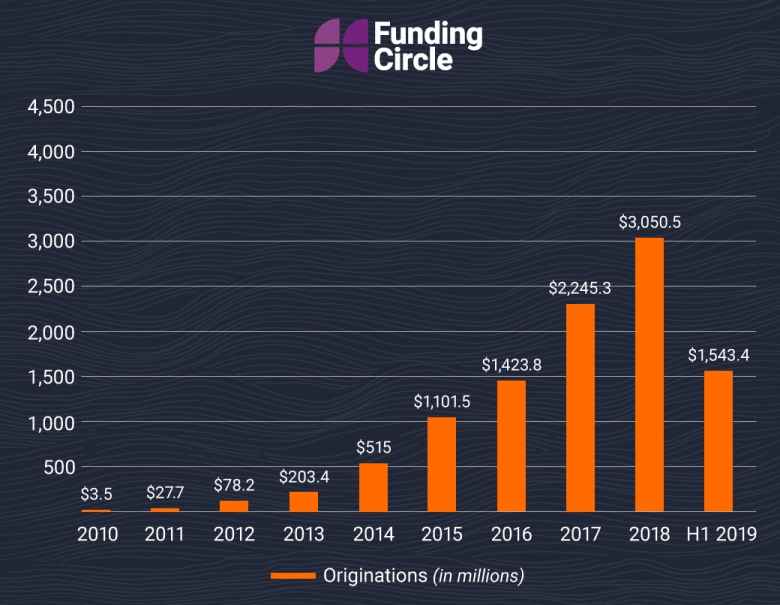

Global Small Business Loan Originations, 2010-2019