Fintech startup Stackin’ raises $4 million in funding led by Experian Ventures, and others, to help millennials save and invest

Stackin‘, a fintech startup and text-message based financial platform, has raised a $4 million Series A funding round to to launch banking and investing features for its messaging platform, user acquisition, and to expand its operations. The round was led by Experian Ventures, Dig Ventures, and Cherry Tree Investments, along with participation from new and existing investors including Social Leverage, Wavemaker Partners, and Mucker Capital. part of the fundraising, Stackin’ also announced that Ross Mason, founder of Dig Ventures and former founder and CEO of MuleSoft, will join its Board of Directors.

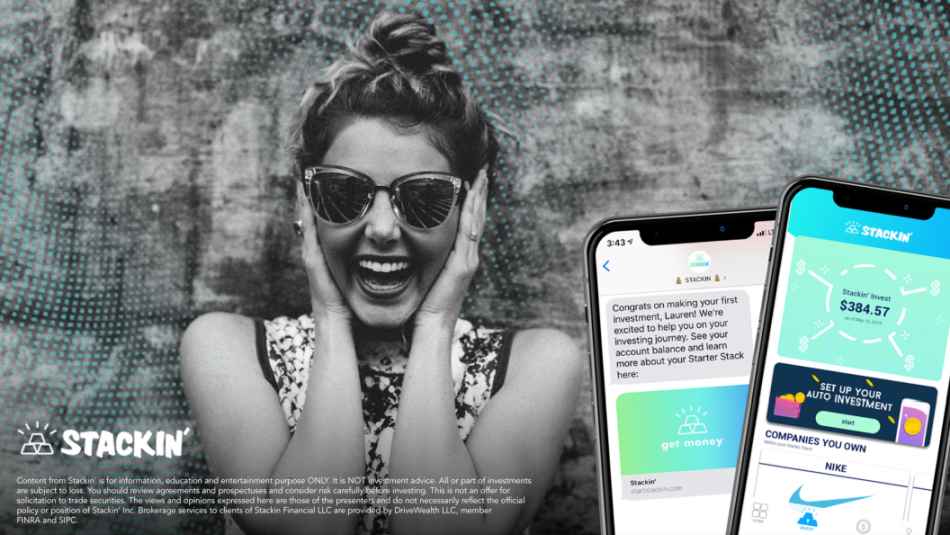

Stackin’ was founded in 2017 and is led by Scott Grimes, CEO, and Kyle Arbaugh, President. Grimes previously founded UPROXX Media, which was acquired by Warner Music Grou. The Los Angeles, California-based Stackin’ helps members improve their finances, start investing and save money all via text. Stackin’ is democratizing finance and investment by making it easier, friendlier and fun.

Since its launch in 2017, the startup has achieved rapid growth in a notoriously difficult industry and helped over 250,000 underserved Americans do better financially. Delivered via text, mobile applications and social platforms, our financial guidance is trusted by a generation of consumers who want to do better but just need someone to help them navigate these tough decisions. It uses intelligent personalized messaging to help millennials find ways to improve their finances and grow their hard-earned money. The company has more than 500,000 users who use the service to receive guidance so they can start taking steps to save and invest.

Only one in three millennials have money invested in the stock market according to Bankrate.com and a recent study from PWC found that among the overall population, millennials are the age group with the lowest level of financial literacy.

Stackin’ serves this growing generation of young consumers and helps them start investing, automate their savings and eliminate bank fees. By engaging members over text message, Stackin’ makes it easy for members to start a financial conversation and gain access to helpful products.

“Stackin’ has a unique and highly effective approach to connect and communicate with an entire generation of younger consumers around finance,” said Ty Taylor, Group President of Global Consumer Services at Experian. “We’re excited to support the company’s next phase of growth.”

Stackin’ was founded in 2017 and is led by Scott Grimes, CEO, and Kyle Arbaugh, President. Grimes previously founded UPROXX Media, which was acquired by Warner Music Group.

“Stackin’ is fundamentally changing the shape and context of what a financial relationship means by creating a fun, inclusive and judgement free environment that empowers our users to learn and take action through messaging,” said Scott Grimes, CEO and co-founder of Stackin’. “This funding allows us to build out new features around banking and investing that will enhance the relationship with our customers.”

“With Stackin’s distinctive model and considerable early scale, I think there are many impactful ways to deepen the relationship with their consumers, as well as help elevate financial literacy for everyone. I’m excited to join the Stackin’ team,” said Ross Mason.

“Consumers now have the ability to choose their financial services products based on what best serves their individual needs and the brand they want to identify with,” said Kyle Arbaugh, President of Stackin’. “Stackin’ is a brand for those underserved young consumers that want a simpler, more personal way to reach their financial goals.”

Stackin’ recently introduced Stackin’ Cash, a free personal high-interest checking account. With Stackin’ Cash, consumers enjoy a 1.00% APY on the entire deposit balance, free ATMs worldwide, and no monthly maintenance fees. Stackin’ Cash is powered by Radius Bank, an industry-leading virtual bank.

Experian is the world’s leading global information services company. During life’s big moments — from buying a home or a car, to sending a child to college, to growing a business by connecting with new customers — we empower consumers and our clients to manage their data with confidence.