Insurtech startup CoverWallet launches the first API commercial insurance market

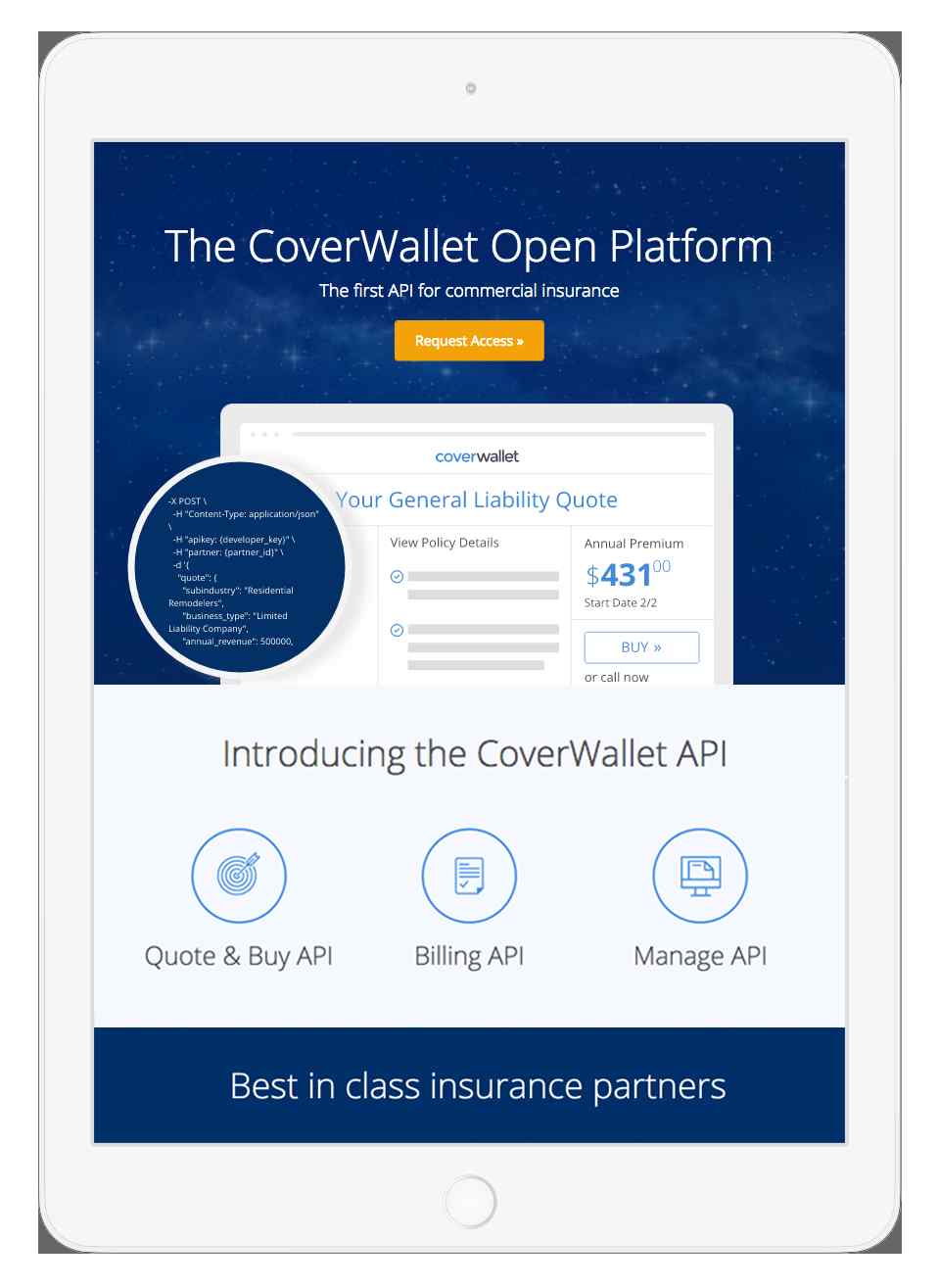

CoverWallet, an online platform that makes it easy for small businesses to understand, buy, and manage insurance onlin, today launched the first API for commercial insurance. With the new easy-to-integrate CoverWallet API, developers and businesses are now able to easily integrate insurance services and solutions directly into their apps and websites in a matter of minutes. Developers and businesses will also be able to offer insurance estimates, policies from leading carriers, and management tools directly through their apps and websites.

Founded in 2015 by Inaki Berenguer and Rashmi Melgiri, the New York-based CoverWallet offers range of insurance include general liability, workers’ compensation, commercial property, BOP, professional liability, E&O, medical malpractice, umbrella insurance, D&O, cyber liability, inland marine, EPLI, commercial auto, disability, health, and product and pollution liability. Its services are provided to firms in the administrative, agricultural, construction, consulting, contractor, education, finance, food, healthcare, management, manufacturing, mining, non-profit, scientific, and real estate industries.

CoverWallet is the leading tech company reinventing the $100 billion U.S. commercial insurance market for small businesses. Based in New York and launched in 2016, it has received more than $35 million in funding from renowned investors including Union Square Ventures, Index Ventures, Two Sigma, and Foundation Capital. Powered by deep analytics, thoughtful design, and state-of-the-art technology, the company is the easiest way for small businesses to understand, buy, and manage insurance online.

The CoverWallet API includes three key services covering the full lifecycle of small business insurance: (1) insurance estimates, (2) quotes and policies from leading carriers, and (3) insurance management services for items such as managing policies, certificates, and claims. The three functions can be used independently, as pairs, or all together, providing flexibility to fit a number of different scenarios.

“We are providing Insurtech as a Service. With our API, anyone can offer business insurance tools and policies so that users don’t need to navigate away from the site or app they are on for their insurance needs,” said Pablo Molina, CTO at CoverWallet. “Opening our platform is an important step for CoverWallet, as we carry out our mission to help small businesses get insurance through a seamless, fast, and convenient user experience.”

Additionally, rather than having to build their own complex integrations with dozens of companies, developers, and businesses benefit from access to CoverWallet’s partnerships with leading insurance carriers.

Integrating the CoverWallet API is quick and simple, and there are a number of different scenarios where the API could be leveraged. For example, it could be integrated with commercial real estate companies, financial institutions, payroll service providers, lenders, accounting software providers, and agency management systems. CoverWallet will provide engineering support throughout the full lifecycle of the integration.